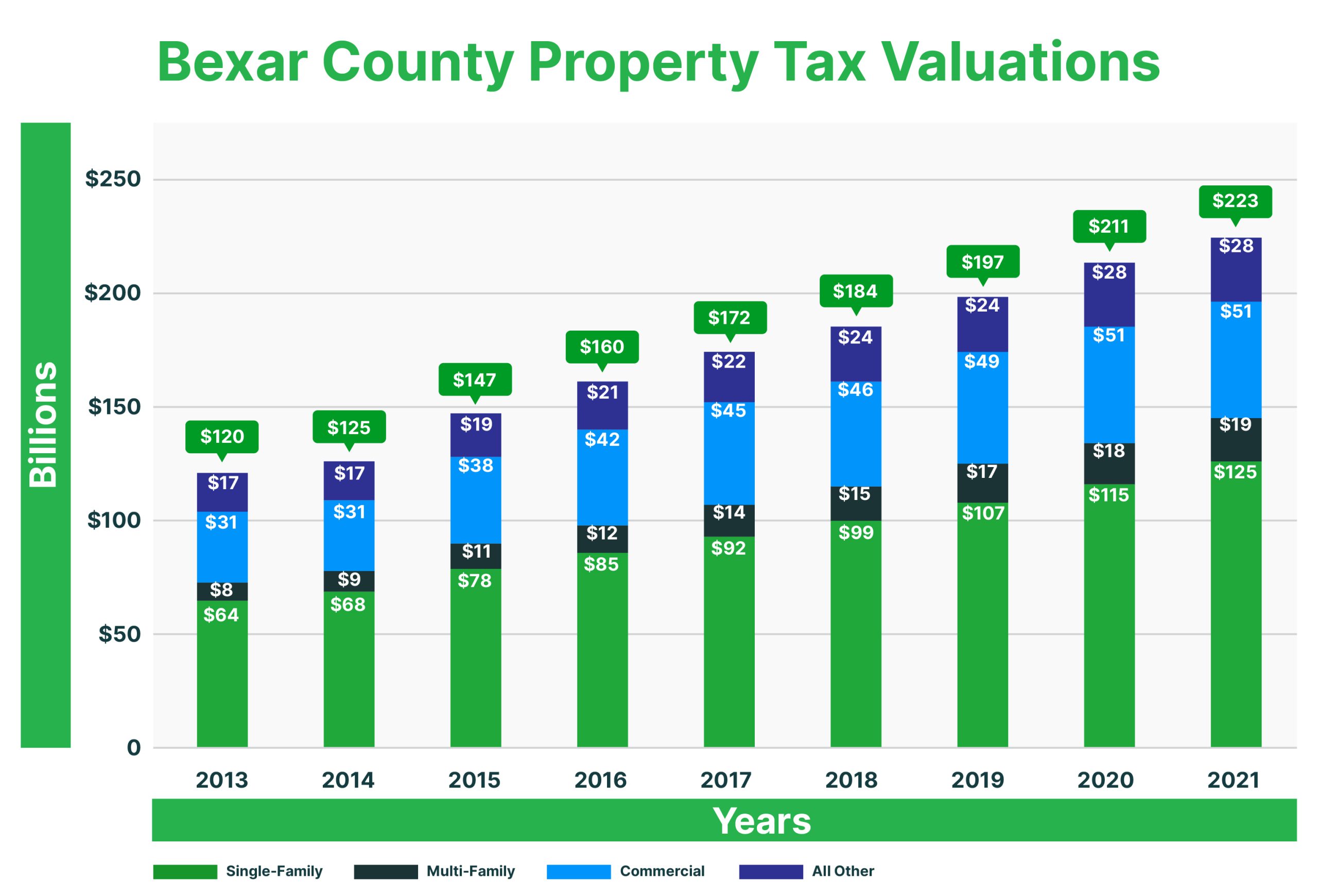

The assessed value of properties in Bexar County, as determined by the Bexar Appraisal District, saw a notable 85% increase from 2014 to 2021, based on the latest available data. During this period, the aggregate value of properties in the county surged from $120 billion in 2013 to $223 billion in 2021. Despite this substantial rise, it’s important to note that this growth rate in property assessments is comparatively lower than the statewide increase of 92% over the same period, spanning from 2013 to 2021. Statewide, the total value of properties assessed by Texas appraisal districts climbed from $2.253 trillion in 2013 to $4.335 trillion in 2021.

Bexar Appraisal District

The Bexar Appraisal District is a governmental entity tasked with assessing the value of all properties within Bexar County at least once every three years. Its governance structure is established through a board of directors, responsible for appointing the chief appraiser. The district’s core functions include determining property values for taxation purposes, conducting protest hearings, managing exemptions and special valuations, and disseminating the final tax roll to various tax entities within Bexar County.

Bexar County Property Value per Acre

Bexar County spans 1,256 square miles or 803,840 acres, equating to 640 acres per square mile, exceeding the average county size of 1,058 square miles. The Bexar Appraisal District forecasts a total value of $223 billion for 2021, with an estimated value of $277,418 per acre, surpassing the statewide average of $25,218 per acre.

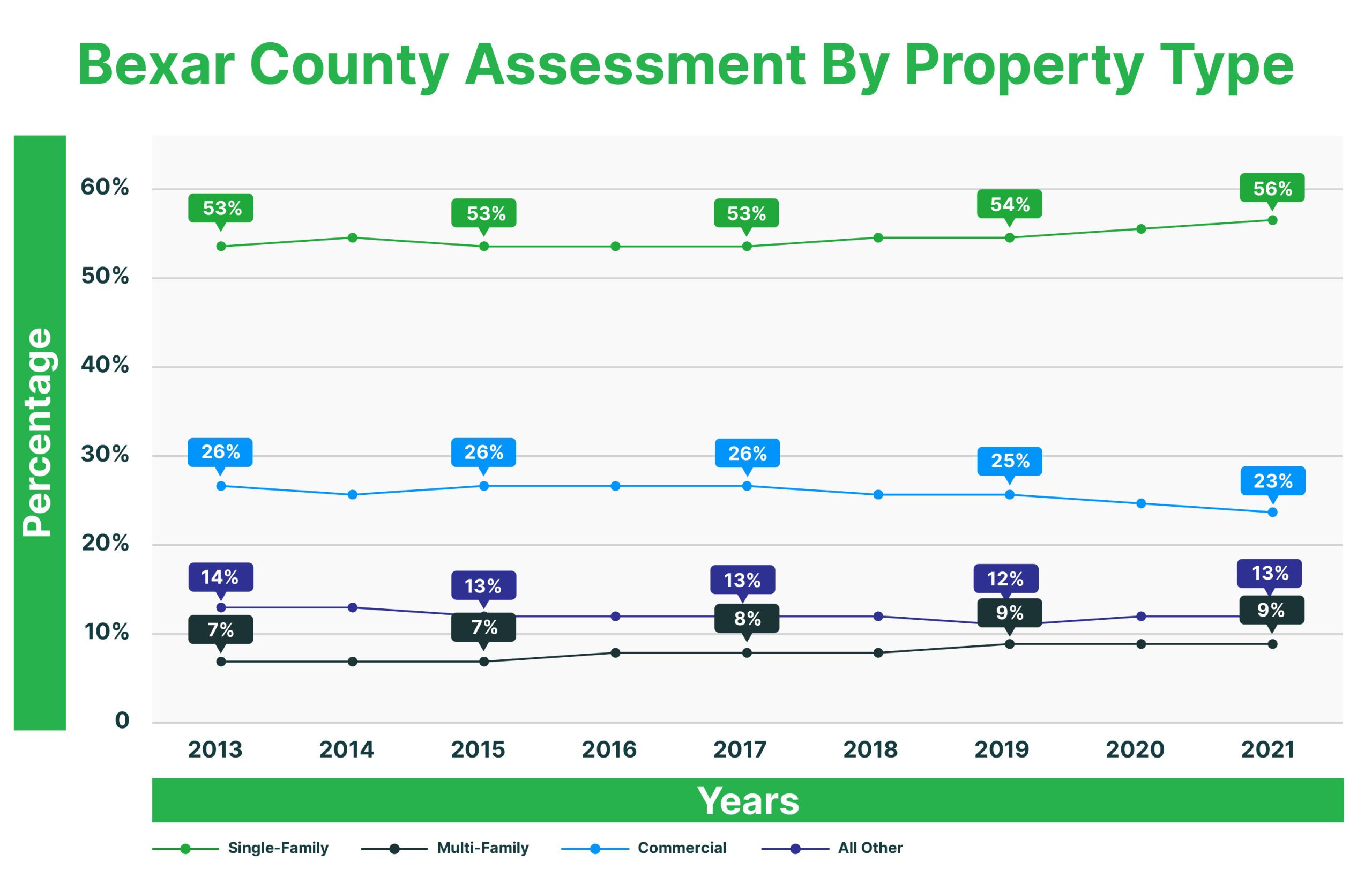

Bexar County Houses 53% of Total Value

.

According to the Bexar Appraisal District, single-family homes represent 56% of Bexar County’s market value, notably higher than the Texas average of approximately 44%. This reflects a rising trend in recent years. Statewide, the average has increased from 41% to 44%, while in Bexar County, it has consistently ranged between 54% and 56%.

Apartments, Commercial, Business Personal Property and Industrial / Other ~ 44%

The Bexar Appraisal District identifies the property tax breakdown for Bexar County in 2021 as follows: single-family houses at 56%, apartments at 9%, commercial buildings at 23%, and industrial and other assets at 13%.

Bexar County Property Value $109.3 BB per 1 Million Population

Property values have escalated from $66 billion per million people in 2013 to $109.3 billion per million population by 2021, indicating a notably swifter rise compared to population and CPI growth, achieving a 65% increase in just 8 years. Statewide, the market value per million people stands at $145 billion.

Bexar County Population Growth and Density

The population of Bexar County increased by 12% between 2013 and 2021. In the same time frame, Texas’s population is growing at a quicker rate of 13%. Bexar County’s population density is 2.5 people per acre versus the Texas-wide average of 0.17 people per acre. Stated differently, there are 5.88 acres of land for each resident of Texas, men, women, and children.

Property Value Grows Faster Than Population

The difference between Bexar Appraisal District’s property value increase (86%) and the population growth (12%) is significant. Over the period from 2013 to 2022, the value of real estate in the United States rose considerably. However, since early 2022, the real estate market has been unstable. Increased borrowing rates have made homes less affordable and commercial properties less valuable.

Transition Period to Slower Property Value Growth

As of October 2023, house prices in San Antonio and Texas have fluctuated. Year-end prices are expected to be similar to 2022, with variations across markets. Though sales have dipped slightly, average prices remain steady. However, with current mortgage rates below 3.5%, there are fewer sellers. Obtaining a new mortgage would likely mean higher rates, around 7%.

Erratic Reassessment in 2024

Once again, Texas appraisal districts may significantly raise home values in 2024. However, statistics on both the volume and price of house sales offer limited assistance. In reality, in metro regions where sales prices typically remain flat, the situation is mixed. While some areas experience increased costs, others see lower prices or maintain stability. The reassessments for 2024 appear to be a mixed bag, with some assessments expected to rise while others are likely to be reduced.

Bexar County Home Price Sale Trends

A year ago, home values experienced significant fluctuations compared to their current levels. In October, the median home price in the Bexar County area decreased by 1.6% to $295,000, while the average price of homes in September was $300,000.

Commercial Property Values Down Due to Higher Interest Rates

Commercial property values hinge on interest rates, especially the 10-Year Treasury rate. Rising rates increase capitalization rates, lowering market values. Pre-COVID and during COVID until 2021’s end, rates were low. However, in 2022 and 2023, commercial mortgage rates surged, slashing sales and mortgages for these properties.

This rate hike has stalled commercial property markets. Buyers demand higher capitalization rates for better returns, pushing prices down. Owners, unwilling to accept lower prices, wait for rates and markets to stabilize before selling.

Bexar County Property Value in Comparison

In 2021, the Bexar Appraisal District assessed Bexar County properties at a total value of $223 billion, placing it fourth among the top counties. Bexar County leads the lineup among counties with high property values, ranking third after Harris ($687 billion) and Dallas ($392 billion), followed by Tarrant ($283 billion) and then Bexar ($223 billion).

Are Bexar Appraisal District (BAD) Property Values Reliable?

The Bexar Appraisal District (BAD) faces a significant challenge, much like other appraisal districts in Texas. In 2021, BAD had 77 appraisers tasked with evaluating the value of 721,063 property tax parcels. Normally, BAD conducts a thorough reassessment of all properties annually. Among the 77 appraisers, the majority focus on on-site data collection for newly constructed properties. Consequently, each of the 77 appraisers dedicated to assessing property value is responsible for approximately 9,364 tax parcels.

Bexar County Owners Actively Protest Property Taxes

Property owners in Bexar County are more inclined to file protests compared to property owners across Texas. In 2021, protests in Bexar County resulted in a reduction of property taxes by $179.19 million. Additionally, Bexar County tax protests led to a decrease in the value of property within the county by $6.63 billion, which includes informal, ARB, and judicial appeals. Texas contributes a significant share of property tax savings from protests and judicial appeals, with the statewide total value reduction amounting to $162 billion in 2021.

Homeowner Tips

Homeowners are advised to ensure that their primary residence qualifies for the homestead exemption. In Bexar County, homeowners who protest their property taxes stand a good chance of receiving reductions during the informal appeal process. Details regarding the number of protests, outcomes, comparisons to statewide trends, and other relevant aspects will be discussed in the upcoming second blog post on property taxes in Bexar County. For complimentary advice on homestead exemptions, feel free to reach out to us at 713-290-9700. Assistance with homestead support is provided at no cost.

Free Enrollment in Property Tax Protection Program™

Sign up for the Property Tax Protection Program™ today and eliminate upfront fees or flat fees. Enroll online in just 3 minutes with no initial costs, or contact us at 713-290-9700 or visit one of our 9 locations. With O’Connor, your property taxes will be actively appealed every year, and you’ll only pay if your taxes are decreased for that year.

Our source for this information is Texas Comptroller statistics on appraisal district assessments and protests. Tax savings are calculated based on a 2.7% tax rate with no exemptions or homestead limits.