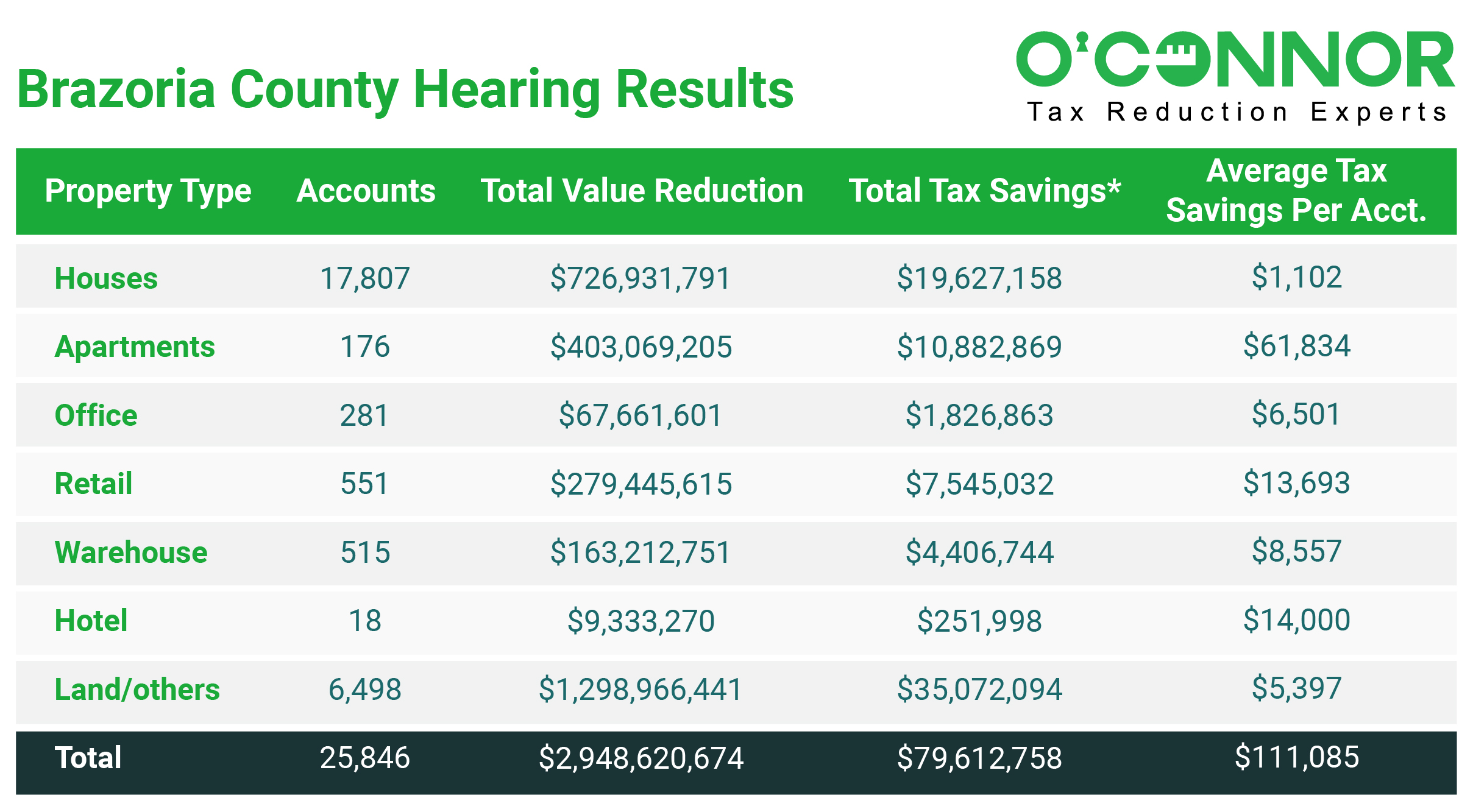

Property owners in Brazoria County have profited from property tax appeals that have been successfully resolved as of the end of September 2023, saving them roughly $79 million.

Each year, the market value of both real estate and personal property is estimated using the Brazoria Central Appraisal District’s estimate. Property owners are asked to object to the statistics every year, regardless of a rise or decline in value. O’Connor assembled this information using the preliminary and most recent tax information provided by the Brazoria Central Appraisal District.

According to O’Connor’s predictions, the property tax protests in Brazoria County are expected to lead to a collective reduction of $62 million in property taxes by 2023, before the final determination of tax values. This projection is based on an examination of data from the Brazoria County Property Tax Trends report, specifically analyzing the decline in property taxes compared to the previous year.

In Brazoria County, this year, property tax savings for homeowners reached $19.6 million, making it the second-highest amount saved among property types. According to the Brazoria County Appraisal District, as of September 2023, a total of 17,807 residential assessments have been reduced due to tax hearings. On average, the assessments have dropped by $40,823, leading to an average property tax savings of $1,102 per household. This calculation is based on a tax rate of 2.7%, with homestead exemptions subtracted.

The initial $2.3 billion worth of the tax complaints filed by the owners of commercial multi-family complexes was lowered to $1.9 billion, saving $403 million in tax assessments. With a tax rate of 2.7%, apartment owners stand to save a total of $2.2 million in property taxes this year. The second-highest number of tax protests in Brazoria County as of September 2023 involved final valuations for apartment buildings, with an average reduction of 17.1% and a projected property tax savings of $61,834 per apartment tax protest. This covers the 176 apartment hearing results that have been officially completed for 2023.

The commercial property type land/others in Brazoria County saw the highest reduction in value savings and property tax savings, according to the hearing-adjusted values for the 2023 property tax year. Tax savings of $35 million and a decreased value of $1.2 billion were achieved. Brazoria County had the least overall percentage reduction in assessment for land and other real estate, at only 5.1%. The corrected valuation was lowered from $25 billion to $24 billion. At a tax rate of 2.7%, the total savings for each tax parcel in 2023 amount to $5,397.

The finished 2023 estimated value of hotels that received protests was drastically decreased for hotel owners, going from $34 million to $25 million. With a 2.7% tax rate, this resulted in a $9.3 million tax assessment reduction and a $251,998 tax savings. This comprises the conclusions of the property tax hearings for a total of 18 hotels, with an average decrease in property taxes of $14,000 for finished cases ending in 2023. The highest percentage decline in demonstrations against hotel taxes and property taxes occurred by September 2023, at 36.3%.

As of September 2023 in Brazoria County, 281 office building tax issues have been settled, saving owners from paying $1.8 million in property taxes. The initial $386 million valuation was decreased to $318 million, which resulted in a $67 million tax assessment reduction. The average decrease in property taxes was $6,501 with a 2.7% tax rate. When office tax complaints are settled with a decrease, the percentage assessment reduction for office buildings is 17.5%.

In 2023, Brazoria County resolved tax complaints for a total of 25,846 properties, resulting in a decrease in assessed value from $36.1 billion to $33.1 billion. This represents an average drop of 8.16%. As a result, property owners were able to save an average of $2,999 in taxes for each challenged property.

Apartments with the largest 2023 property tax assessment reduction include the following:

- The Reserve at Tranquility Lake, located at 2850 Oak Rd in Pearland, Texas, had its property tax assessment reduced from $62 million to $40 million by $22 million. This tax assessment decrease lowers their property taxes by $611,331 based on a 2.7% tax rate.

- The 2800 Tranquility apartments, which is located at 2800 Tranquility Lk in Pearland, Texas, had its completed initial property tax assessment reduced from $41.8 million to $29.9 million, a drop of $11.9 million. The owner of the 2800 Tranquility units will save $323,500 by September 2023. This 2001-built apartment complex’s property taxes were reduced by 28%.

- The owner of The Retreat at Shadow Creek Ranch Apartments received a tax reduction of $284,155. The initial assessment of the property’s 2023 taxes, which was originally $58 million, was lowered by $10.5 million to $48 million. This reduction reflects the revised assessment of the property’s completed 2023 taxes. The building is located at 2500 Business Center Drive in Pearland, Texas, and was constructed in 2013.

Over 65 experts work for the Brazoria County Appraisal District, whose responsibility it is to appraise properties for the county. The examples shown above highlight the significant results for the completed property tax reductions resulting from the property tax appeal process as of September 2023.

By contrasting the Brazoria County Appraisal District’s baseline values with the present 2023 tax assessments, it is possible to determine the decrease for the finished 2023 property tax assessment. The data eliminates properties that were objected to but did not obtain a reduction, which increases the average reduction.

In a given year, there is a high likelihood that many property tax protests in Brazoria County will be successful. It is recommended that property owners carefully evaluate their annual property tax assessments and lodge protests each year.