Crosby County Appraisal District

Local Appraisal District

O’Connor is the leading company representative for the Crosby Central Appraisal District property owners because:

- Established in 1974, O’Connor has grown into one of the nation’s largest property tax consulting firms, backed by a team of over 1,000 dedicated professionals. We specialize in residential property tax reduction in Texas, Illinois, Georgia, and New York, while our commercial property tax services extend to 45 states nationwide.

- Leveraging one of the most comprehensive proprietary property data systems in the country, O’Connor delivers powerful, data-driven appeals. Our insights give us a strategic edge in reducing assessed property values for our clients.

- With our contingency-based pricing structure, clients owe nothing unless we achieve a reduction in their property taxes. There are no upfront payments, sign-up fees, or surprise charges. This model ensures our success is directly tied to the results we deliver for our clients.

- Thanks to decades of experience, we’ve built a robust database of sales and unequal appraisal evidence formatted to align precisely with the standards of the Crosby CAD and its ARB, strengthening our ability to advocate effectively on behalf of our clients.

Crosby County Appraisal District

Local Appraisal District

Crosby Appraisal District’s (CAD) formal and informal hearing results are displayed below:

- The tax savings from informal protests in Crosby County amounted to $10 thousand in 2023. That same year Crosby County property owners protested the taxable value of 150 accounts.

- In Crosby County, 1.3% of property tax appeals submitted to the Appraisal Review Board (ARB) and 5% of informal protests were successful in achieving a reduction.

- The percentage of parcels protested reached 2% in 2023 in Crosby County.

- By 2023, 1.3% of Crosby County homeowners protested and received a reduction, up from less than 1% in 2021.

Save With O’Connor

1,148

Average HCAD Tax Savings

Average Property Tax Savings from Protesting (Informal + Formal)

Residential Property

343

Commercial Property

1,966

Disclaimer: O’Connor is a property tax consultant and is not affiliated with any appraisal district. Data for graphs provided by Texas comptroller.

Single Family

Commercial / Other

Total

Disclaimer: O’Connor is a property tax consultant and is not affiliated with any appraisal district. Data for graphs provided by Texas comptroller.

Single Family

Commercial / Other

Total

2024 County Appraisal District Statistics

Select

Year

-

County:

Crosby -

Street Address:

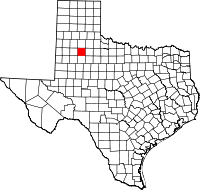

109 W. Aspen St. Crosbyton, TX 79322-2501 -

Mailing Address:

P.O. Box 505 Crosbyton, TX 79322-0505 -

Phone:

806-675-2356

Major Cities:

Crosbyton, Ralls, Cone, Lorenzo

Anderson County Texas totals 8 square miles, with a 2020 population of about 7,076. Adjacent counties include Henderson, Houston, Freestone, Cherokee, and Leon County. The total market value of real property and personal property in Anderson County in 2020 was $4,900,000,000. Anderson County 2020 property taxes are estimated to total $58,600,000 million based on an effective tax rate of 2.4% including homestead exemptions. Anderson County property owners protested the noticed value for 214 houses and 1,100 commercial and BPP properties. Anderson County Appraisal Review Board appeals were successful for 17.05% of the owners. Property owner property tax protests in Anderson County results in savings of $16,062,679 million in 2020, or $12,355 per account protested. The 2020 budget for Anderson was $1,200,000 including 13 employees.

Crosby Property Tax Values