The 2022 budget for the Dallas Central Appraisal District amounted to $31.2 million, which incorporates $1.24 million designated for the Dallas County Appraisal Review Board (ARB).

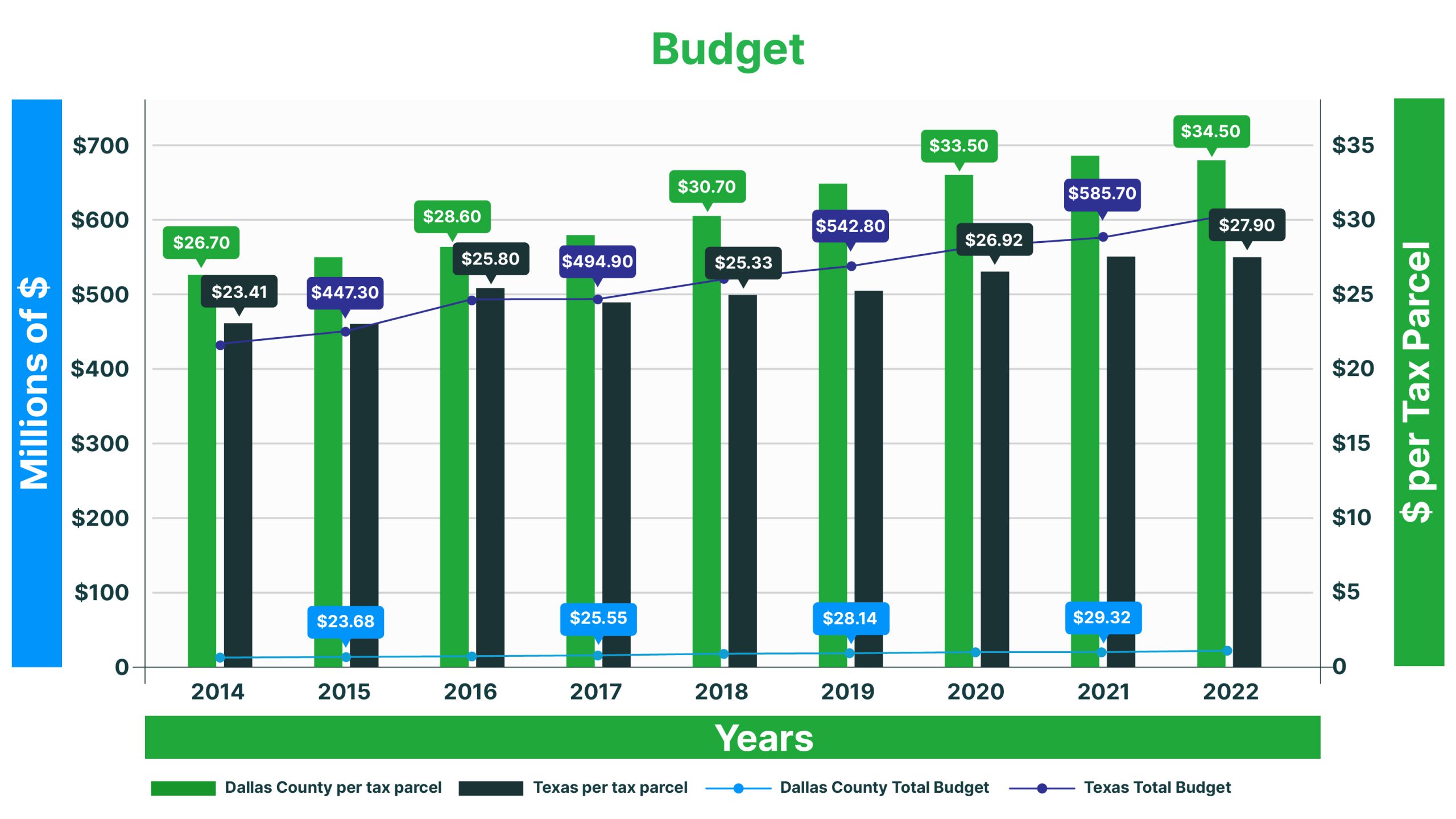

Having over 800,000 tax parcels in 2022, the Dallas Central Appraisal District (DCAD) allocated a budget of $31.2 million, equating to $34.5 per tax parcel. This figure represents a 19% increase over the statewide average of $27.9. Texas-wide Appraisal District Budgets in 2022 totaled $618.5 million, with DCAD comprising 5% of the total.

Appraisal District Budgets

Examining the top five counties with the highest budgets for 2022, Harris County leads with a budget of $94,872,473, followed by Dallas County at $31,205,055. Tarrant County ranks third with $26,790,117, followed by Collin County at $25,394,900. In fifth place is Travis County, with a 2022 budget of $22,786,110.

Between 2011 and 2022, the budget of the Dallas Central Appraisal District increased by an impressive 45% per year. The DCAD budget surged from $21.52 million in 2011 to $31.21 million in 2022.

In 2022, the budget for the Dallas County Appraisal Review Board amounted to $1.24 million, ranking second among all counties in Texas.

For the tax year 2022, the ARB budgets of the leading counties stand as follows: Harris County leads with $3,582,392, followed by Travis County with $1,630,425. Fort Bend County secures the third spot with a budget of $1,351,226. Dallas County secures the fourth-largest allocation among all counties, totaling $1,242,609, while Tarrant County ranks fifth with $1,203,930.

The Dallas Central Appraisal District has experienced a steady increase in its workforce over the years. Staffing levels have risen from 232 employees in 2011 to 242 in 2022. Moreover, the number of appraisers employed by the district has significantly decreased , going from 125 appraisers in 2011 to only 102 by 2022. Notably, the district maintains full staffing levels compared to statewide averages for similar districts.

Tax Parcels per Employee – Dallas Central Appraisal District versus Texas

In 2022, the Dallas Central Appraisal District handles 3,511 tax parcels per employee, whereas the statewide average is 4,578 tax parcels per appraiser.

Tax Parcels per Appraiser – DCAD versus Texas

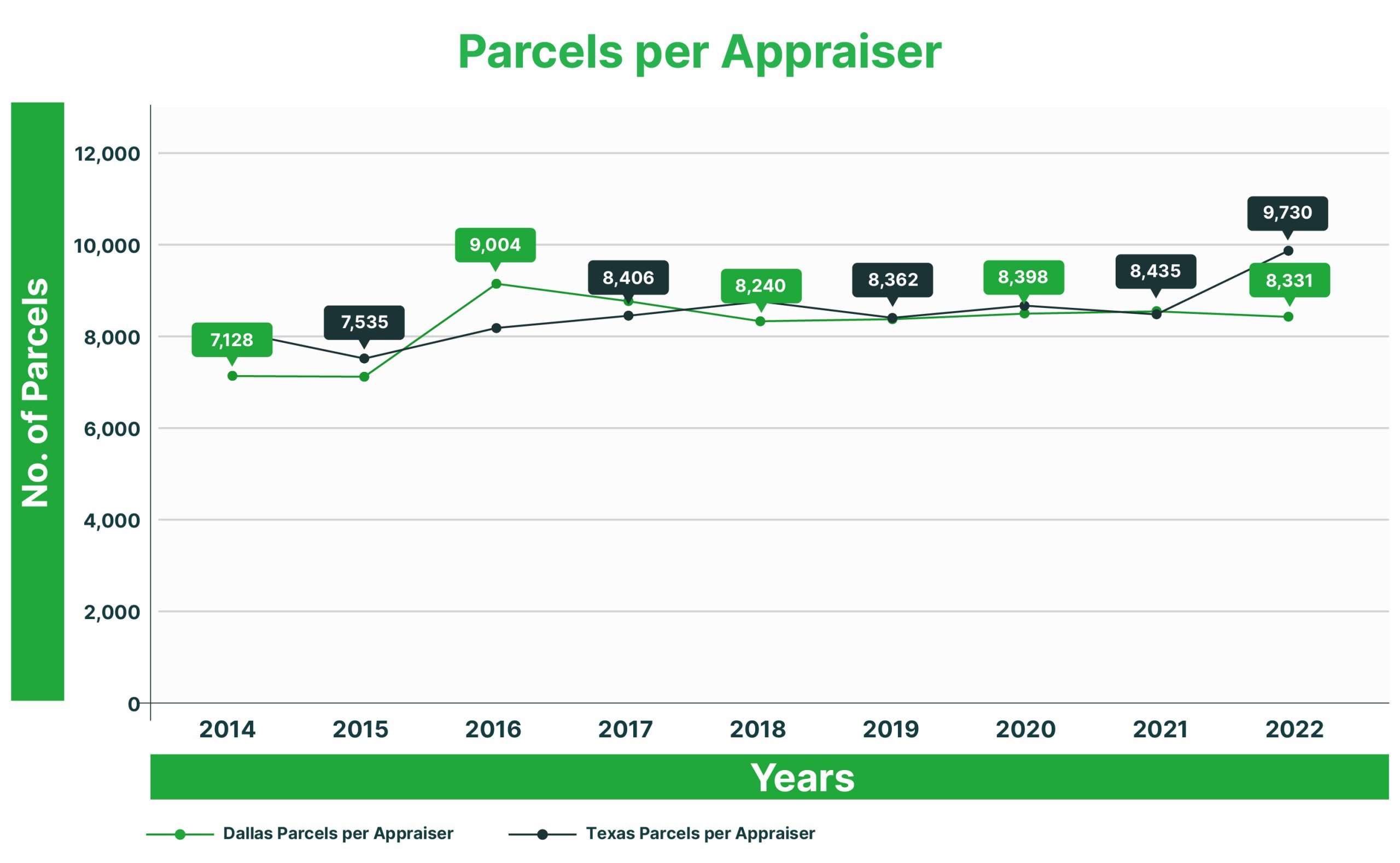

In Dallas Central Appraisal District, there is 1 appraiser for every 8,331 accounts, compared to 1 appraiser for every 9,730 accounts statewide.

Dallas Central Appraisal District appraiser allocation follows:

Within the Dallas Central Appraisal District, 46 appraisers specialize in residential properties, 21 are exclusively focused on commercial properties, and 35 are tasked with assessing all other property types. The total number of Full-Time Employee (FTE) appraisers amounts to 102.

Appraisal District Employee Allocation – DCAD versus Texas

Statewide appraisal districts allocated their appraisers as follows:

In the Statewide Appraisal District, the 2,278 appraisers serve varied roles: 67% specialize in residential appraisals (1,527 appraisers), 22% focus on commercial appraisals (498 appraisers), and 11% handle a range of other appraisal types (253 appraisers). Together, these roles make up the total number of Full-Time Employees (FTE) dedicated to appraisals.

Appraiser versus Administrative Staff at Dallas Central Appraisal District

In comparison to statewide data compiled by the Texas Comptroller, the Dallas Central Appraisal District (DCAD) allocates a higher proportion of its staff to administrative and operations roles relative to appraisers. Specifically, DCAD staff distribution comprises approximately 45% appraisers and 55% administrative staff. In contrast, the statewide average for staff allocation at appraisal districts is 52% appraisers and 48% administrative staff.

Appraisal District Appraiser Allocation

In Dallas County, the allocation of appraisal resources leans more towards residential properties compared to commercial and industrial/business personal properties. Specifically, while 45% of Dallas County’s appraisers focus on valuing houses, a higher percentage, 67%, of statewide appraisers concentrate on residential properties. The emphasis on commercial properties is relatively similar, with 22% of appraisers statewide specializing in commercial properties, slightly higher than the 21% of Dallas County appraisers dedicated to commercial valuations. However, the allocation differs significantly when it comes to industrial and business personal property assessments. In Dallas County, a substantial 34% of appraisers handle valuations in this sector, whereas only 11% of statewide appraisers are engaged in similar assessments.

Revaluation Cycle

Dallas County has consistently revalued every parcel annually from 2014 to 2022. In contrast, statewide appraisal districts revalued approximately 80 to 90% of parcels during the same period. This frequent reassessment sets Texas apart from most states, where revaluation typically occurs every 3 to 6 years.

Tax Levy – Dallas County versus Texas

The total Dallas County property tax levy surged from $4 million in 2013 to $8.6 million in 2022, marking a substantial 115% increase. Notably, the per capita property tax levy outpaced population growth, signaling a rapid rise in property taxes. This led to the implementation of Senate Bill 2, capping property tax levy growth at 3.5% (including new construction) for cities and counties, and at 2.5% (including new construction) for schools.

Texas Levy Growth

The statewide tax levy in Texas surged from $43 billion in 2013 to $92 billion in 2022, reflecting a significant 113% increase. This growth far outpaced both population growth and inflation. Consequently, the tax level per person experienced a remarkable surge from 2013 to 2022.

Dallas County versus Texas Per Capita Property Tax Growth

From 2013 to 2022, Dallas County experienced a 78% increase in per capita property taxes, compared to 89% for Texas as a whole. Per capita property tax in Dallas County rose from $1,862 in 2013 to $3,320 in 2022. While the statewide per capita tax levy started lower, its rapid growth resulted in a level similar to that of Dallas County. Statewide, the property tax levy per person was $1,619 in 2013, reaching $3,076 in 2021.

ARB Staffing – Dallas County versus Texas

In comparison to the statewide average, Dallas County maintains a higher level of staffing for its appraisal review board members. Specifically, the Dallas County Appraisal Review Board assigns 9,138 tax parcels per appraisal review board (ARB) member, while the statewide average stands at 11,771. This discrepancy is understandable given DCAD’s frequent utilization of the appraisal review board.

ARB Compensation – Dallas County and Texas-wide

COVID Impact on Appraisal Review Board Staffing

The majority of ARB members are retirees, putting them at increased risk of severe health complications if they contract COVID-19. Over the period from 2019 to 2022, the Dallas County Appraisal Review Board experienced a reduction from 105 members to approximately 93, representing an 11% decrease.

ARB Days of Hearings

Appraisal Review Boards (ARBs) in Texas counties compensate members to oversee tax protests unresolved at informal hearings. In major counties like Harris and Hays, ARBs convene 5-6 days a week for months. In 2021, Harris and Hays tied with 158 ARB hearing days. Other top counties included Comal (100 days), El Paso (97), Tarrant (90), Johnson (86), Montgomery (82), Victoria (80), Travis (71), and Galveston (73). These figures highlight the substantial commitment to resolving tax protests in Texas’ largest counties.

Why More ARB Hearings in Some Counties

The appraisal review board is the second step in a three-step process, following the informal hearing. Together, these are referred to as “administrative hearings.” Following these, property owners have several options: 1) binding arbitration, 2) judicial appeal, 3) State Office of Administrative Hearings (SOAH), or they can choose to take no further action. Interestingly, about 98% of owners opt for no further action after the appraisal review board.

Practice Tip: consider continuing after the appraisal review board annually.

On average, appraisal districts experience tax protests for approximately 10% to 25% of tax parcels, representing 38% of the statewide value. However, in Dallas County, property owners contest property tax assessments for around 24% of tax parcels, which collectively account for 58% of the total value. Notably, properties of a higher value are more prone to being protested. Additionally, protests are a common occurrence for commercial, industrial, and business personal properties on an annual basis.

Owners Who Don’t Protest

Entry-level and mid-range homeowners often don’t engage in property tax appeals, while large commercial property owners believe annual protests are vital for managing taxes. However, many commercial owners only participate in the administrative process, missing out on potential benefits.

Owners of Commercial Valued over $750,000

For most owners of commercial property, it’s advisable to persist with the appeal process beyond the administrative hearings (informal and appraisal review board). Statistical data compiled by the Texas Comptroller from the appraisal district suggests a likelihood of around 90% for an additional reduction of approximately 10%. It’s important to note that these findings are not specific to our accounts but represent statewide aggregate judicial appeal outcomes.

Who is Watching Your Interests?

With a budget exceeding $31 million and an additional $1.24 million allocated for the Appraisal Review Board (ARB), the Dallas Central Appraisal District (DCAD) endeavors to accurately assess the 800,000 tax parcels in Dallas County. Despite employing 242 staff members in 2022, the task remains challenging: achieving precise and consistent valuations for both real and personal property throughout the county. While DCAD aims to ensure properties are assessed at 100% of their market value, what are the repercussions when they overshoot this target?

Can You Afford An Ally to Look Out for Your Interests?

What Leads to Property Overvaluation by the Dallas Central Appraisal District (DCAD)?

The Dallas Central Appraisal District (DCAD) assesses 800,000 tax parcels yearly through mass appraisal methods. Regular aerial photography inspections are conducted on each property at least every three years, although this approach may yield limited information. DCAD relies on “mass appraisal models” incorporating incomplete property data for valuation. Notably, while some properties are valued below 100% (still eligible for appeal on unequal appraisal grounds), others are appraised at more than 100% of their market value.

Are You Undervalued or Overvalued?

Identifying whether your property is over or undervalued necessitates taking specific steps:

- Submit a protest before the May 15th deadline each year.

- Request the hearing evidence from the appraisal district, which also limits the information they can utilize.

- Prepare for and attend the informal hearing (usually resolving 70 to 90% of cases with a reduction).

- Proceed to the appraisal review board and beyond if necessary.

Practice tip: Practice tip: Your property tax assessment cannot be raised during either an informal or appraisal review board hearing.

What does DCAD Valuation at 100% Mean?

When Dallas Central Appraisal District values properties with a median level of assessment of 100% (relative to market value), it means:

- Half of all properties possess a market value exceeding their DCAD value. When visualized in a graph depicting the correlation between DCAD value and market value, the data forms a bell curve. While some properties are slightly undervalued, others exceed double the market value and beyond.

- Approximately half of the properties valued below market value remain excellent candidates for protest, addressing both market value and unequal appraisal concerns. When filing your protest, request the hearing evidence package from the appraisal district. In many instances, the DCAD comparable sales data will include several relevant comparables. Should you find these insufficient, explore your street and neighborhood for an assessment comparable that bolster your case for a reduction.

- You have the option to protest based on either market value (if your property is assessed above its true market value) or unequal appraisal. Unequal appraisal contends that a reasonable number of comparable properties, properly adjusted, indicate a lower value. Regardless of the protest’s basis, securing a lower tax assessment ultimately results in reduced property taxes.

What if You Don’t Have Time or the Temperament to Protest?

Consider hiring O’Connor or a competitor. Research shows that individuals who consistently challenge property taxes often experience lower rates. This reduction in one year can significantly influence negotiations for subsequent years by lowering the property’s assessed value.

Benefits of O’Connor:

- Quick and easy online enrollment in just 3 minutes, with no fees or credit card required. Alternatively, you can contact us by phone.

- No flat fees, upfront costs, or filing fees ever. You only pay a percentage of the savings achieved.

- Access to live support from knowledgeable property tax experts.

- O’Connor leads in tax appeals in Texas, covering approximately 180 counties. We employ assertive strategies such as binding arbitration, coordinating judicial appeals, and leveraging the State Office of Administrative Appeals.

At O’Connor, we’re dedicated to transforming the landscape of property ownership by providing innovative and cost-effective solutions for tax reduction. In 2023, our efforts resulted in saving property owners a staggering $195 million in property taxes (as of September 2023) and enabling them to realize $400 million in federal income tax savings. Through our specialized cost segregation reports, we enhance property owners’ depreciation, leading to significant reductions in both federal and state income taxes.

Take control of your property taxes today! Enroll now and pay later with no upfront fees, no flat fees ever! Just a portion of your savings when we reduce your property taxes. Act now and start saving!

Source: Data obtained from the Texas Comptroller, including assessment and protest data from various appraisal districts. Tax savings estimates are calculated using a 2.7% tax rate and do not account for exemptions or homestead caps. It’s important to note that O’Connor is an independent private company specializing in tax reduction and is not affiliated with the Texas Comptroller, any government entity, or appraisal district.