The property tax protest process in Texas comprises both administrative and post-administrative stages. Administrative appeals encompass the informal hearing and the appraisal review board hearing. Post-administrative appeals involve binding arbitration, judicial appeals, and recourse to the State Office of Administrative Hearings. This post provides an overview of binding arbitration, property tax lawsuits, and SOAH filings in Dallas County compared to the broader Texas context.

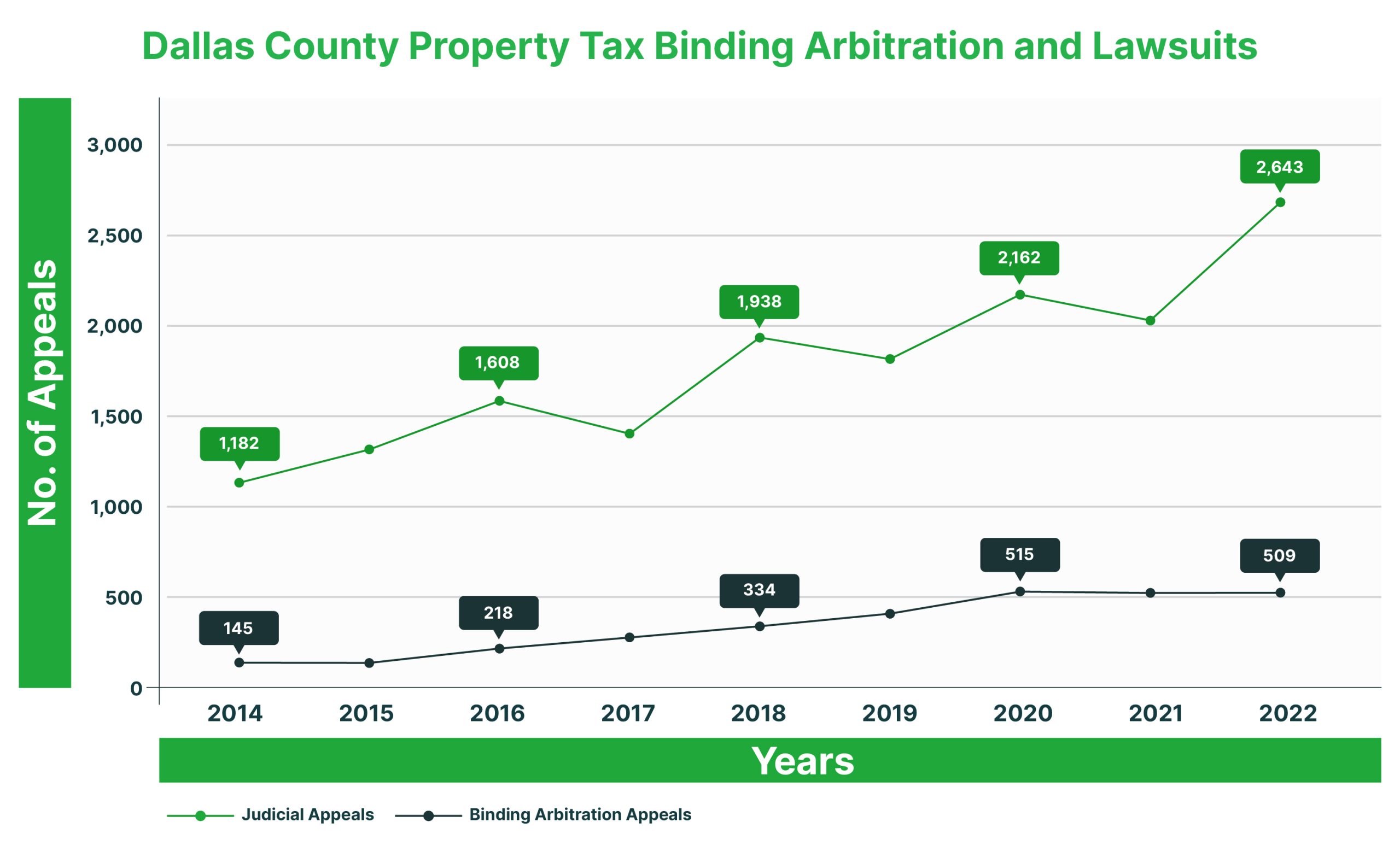

Recent 2022 data highlights Dallas County’s significant position, placing seventh in the state for number of binding arbitration cases and second for number of property tax lawsuits (judicial appeals) among Texas’s 253 counties. Over the last ten years, Dallas has experienced a notable surge in both categories. Binding arbitration cases have surged by an impressive 251%, totaling 509 cases by 2022. Similarly, property tax lawsuits filed with the Dallas Central Appraisal District have seen a remarkable 211% increase, reaching 2,643 cases in 2022, up from 848 cases in 2012.

Dallas County Binding Arbitration Filings

Dallas County holds the seventh-highest number of binding arbitration cases among Texas appraisal districts. The count surged from 145 in 2014 to 509 in 2022, marking a remarkable 251% increase.

Statewide, the number of binding arbitration cases surged from 1,705 in 2014 to 17,041 in 2022, reflecting an astounding 899% increase.

In 2022, Harris County led with the highest number of binding arbitration cases, totaling 8,427. Following closely behind were Travis County with 1,474 cases, Fort Bend County with 1,181 cases, Montgomery with 666 cases, Williamson with 536 cases, Bexar County with 523 cases, Dallas County with 509 cases, Galveston County with 338 cases, El Paso with 334 cases, and finally, Tarrant County with 322 cases.

Dallas County Judicial Appeal Filings

Dallas Central Appraisal District initiated property valuations in 2022, assessing a portfolio totaling $459 million. Throughout the year, Dallas County property owners pursued judicial appeals amounting to $70.3 million, constituting 15.3% of the county’s overall property value. This percentage stands out notably against the statewide average of 8.1% for properties undergoing judicial appeal. Across the state, judicial appeals in Texas accounted for properties valued at $430 billion out of a total statewide property value of $5.296 trillion.

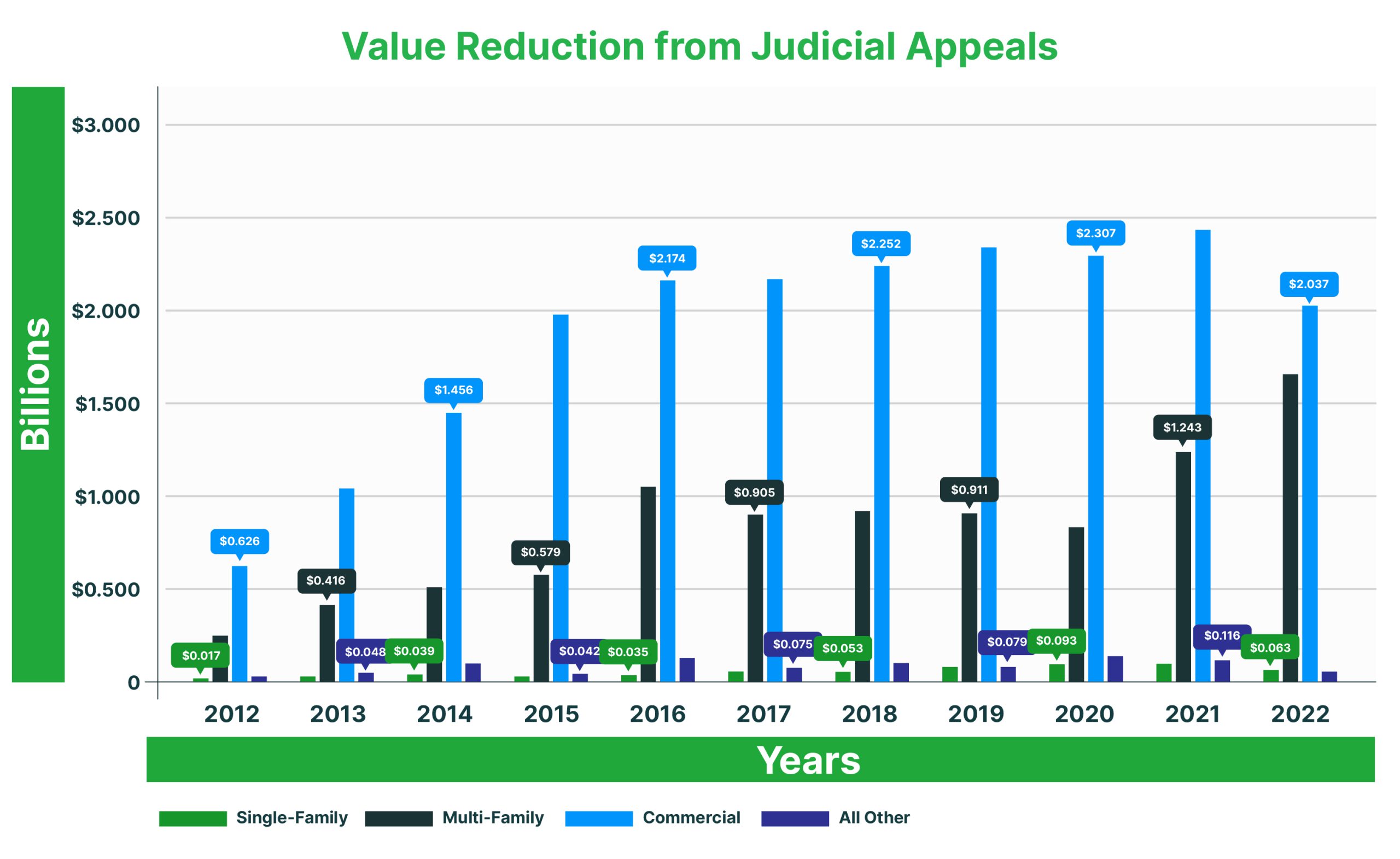

Dallas County Judicial Appeal Tax Savings

Property tax savings through judicial appeals have surged in Dallas County from 2012 to 2022. The savings realized from judicial appeals ranged from $24.8 million to $103.1 million over this period. This indicates a remarkable 315% increase since 2012 for Dallas County property owners who utilized judicial appeals to lower their property taxes.

Texas Property Tax Savings via Judicial Appeal

Texas-wide property tax savings through judicial appeals have increased significantly from $215.9 million in 2012 to $929.1 million in 2022, marking a remarkable 330.3% surge. This demonstrates that Texas property owners are effectively utilizing judicial appeals as an integral part of their property tax management strategy.

Counties with Highest Number of Judicial Appeals in Texas

Let’s examine the top ten counties in Texas with the highest number of judicial appeals for 2022. Leading the pack is Harris County with the highest number of judicial appeal cases, totaling 7,602. Following closely behind is Dallas County with 3,643 cases, Travis County with 1,747 cases, Tarrant County with 1,506 cases, Bexar County with 1,259 cases, Fort Bend County with 719 cases, Montgomery County with 603 cases, El Paso County with 581 cases, Collin County with 538 cases, and finally, Denton County with 527 cases.

Binding Arbitration versus Judicial Appeals

Binding arbitration applies to properties valued under $5 million, except for homestead residences not subject to a cap. Engaging in binding arbitration necessitates a deposit of $450 or more, with the possibility of a $50 refund if the filing is settled or the property owner prevails. Unlike judicial appeals, binding arbitration generally avoids the discovery process, a significant advantage, especially in cases where appraisal districts heavily rely on paperwork. Judicial appeals incur additional costs such as filing and service fees (~$375), legal fees for attorneys, and expenses for expert reports. Typically, binding arbitration cases are resolved within 6 to 9 months, whereas judicial appeals can drag on for 12 to 36 months.

Value of Accounts in Judicial Appeal

The costs associated with judicial appeals often discourage property tax consultants and owners from pursuing cases valued below $20 million. In Dallas County, the value of single-family accounts involved in lawsuits increased by approximately 192% from 2014 to 2022, while the statewide increase in Texas was 366% over the same period. Multifamily properties in judicial appeal accounts experienced even more substantial growth, with their assessed value rising by 501% in Dallas County and 425% statewide. Commercial properties involved in judicial appeals in Dallas County saw a 125% increase in value, while the statewide increase was 381% from 2014 to 2022.

O’Connor Aggressively Coordinates Judicial Appeals – Provides Turnkey Service

In tandem, O’Connor collaborates with property tax attorneys specializing in handling judicial appeals, overseeing client relationships, preparing expert witness reports on market value and unequal appraisal, and facilitating negotiation settlements. Distinguishing itself from competitors, O’Connor covers all costs associated with judicial appeals, a true rarity within the industry. While many competitors limit their focus to accounts valued between $10 to $15 million for judicial appeals, O’Connor extends its services to commercial accounts valued over $750,000 and residential properties over $1,500,000. Additionally, O’Connor offers binding arbitration services for properties valued well below $1,500,000, ensuring comprehensive assistance tailored to various property tax needs.

O’Connor operates distinctively from a law firm. Rather than solely offering legal services, O’Connor takes a comprehensive approach by coordinating and covering expenses for attorneys, filing fees, tax consultants, expert witnesses, and dedicated staff to facilitate the process.

Are Property Tax Savings from Judicial Appeals Successful?

Annually, Dallas County judicial appeals yield considerable property tax savings, ranging between $2.5 million and $4.3 million. However, it’s disheartening that a significant number of Dallas County property owners who could potentially benefit from a judicial appeal choose to discontinue the process after the appraisal review board (ARB) stage.

Practice Tip – Owners of commercial properties valued at $750,000 or above in Dallas are advised to consider pursuing a judicial appeal or binding arbitration, as it can yield favorable outcomes and significant benefits.

O’Connor Handles Binding Arbitration

O’Connor assumes responsibility for all facets of binding arbitration cases, including covering the arbitration deposit and bearing the risk of potential deposit loss (ranging from $450 to $1,500). Unlike most property tax consultants, O’Connor covers the binding arbitration deposit on behalf of the property owner. We handle the entire process, from filing the binding arbitration, negotiating settlements, and attending the arbitration hearings. Additionally, O’Connor prepares expert reports on market value and unequal appraisal. Clients do not incur any costs associated with pursuing binding arbitration unless we successfully reduce their property taxes, in which case our fee is calculated as a percentage of the tax savings. Importantly, our fee is never greater than the property tax savings achieved.

Additional Reduction to Support Binding Arbitration

For a dispute involving just $20,000 to $30,000 in assessed value, O’Connor is ready to step in and represent you in binding arbitration. We cover all associated costs, and you only pay if we successfully lower your property taxes even further below the appraisal review board level. There are no flat fees or upfront costs; payment is contingent upon achieving tangible results.

What is SOAH?

The State Office of Administrative Hearings (SOAH) offers quasi-judicial recourse as an alternative to binding arbitration or judicial appeals. SOAH judges adjudicate disputes involving various licensees in Texas, including brokers, appraisers, and barbers. Unlike binding arbitration, there is no maximum value restriction. However, there exists a minimum appraisal review board value of $1 million and a mandatory $1,500 deposit. This deposit is reimbursed upon case settlement and can be utilized to cover expenses if the case proceeds to trial before an SOAH judge.

Statewide SOAH filings have remained below 100 but are showing signs of increasing. SOAH proves particularly advantageous in certain cases, providing minimal discovery and allowing for a concentrated focus on market value and unequal appraisal arguments. Conversely, in some judicial appeals, appraisal district attorneys prioritize extensive discovery, often with limited relevance to resolving the value dispute.

Should You File a Judicial Appeal or Use Binding Arbitration?

The quantity of appeals after the appraisal review board (ARB) remains relatively minimal in comparison to initial protests. Annually, roughly 10,000 binding arbitration cases and 17,000 judicial appeals are initiated, totaling approximately 27,000 when aggregated. This figure contrasts significantly with the total of 2,190,000 initial protests recorded in 2022, with only 1.2% advancing beyond the ARB. Many property owners who conclude their appeals at the ARB stage may be foregoing potential savings. In practice, a significant proportion of binding arbitration and judicial appeals results in property taxes being reduced below the ARB level. Appraisal districts typically exhibit flexibility when reviewing binding arbitration cases submitted in earnest.

Practice tip: When the disputed value exceeds $20,000 to $30,000 and the case is robust, pursuing binding arbitration is often advisable at many appraisal districts. Appraisal districts generally show a propensity to settle cases backed by well-documented evidence.

For a complimentary analysis of your options following your ARB appearance, please reach out to 713-290-9700.

Dallas County Appeals after ARB Fall Below Statewide Average

In 2022, Dallas County observed a total of 3,152 appeals through binding arbitration or judicial processes, alongside 159,490 property tax protests. This translates to appeals made after the ARB accounting for 1.97% of all property tax protests in Dallas County, a figure considerably lower than the statewide average of 16.2% for appealed accounts extending beyond the appraisal review board (ARB).

Do You Have Questions about Binding Arbitration? Whether It Makes Sense For YOU?

Dial 713-290-9700 to explore the potential advantages of pursuing the appeal beyond the ARB stage. O’Connor specializes in orchestrating a myriad of judicial appeals and binding arbitration cases, alongside handling a limited portfolio of State Office of Administrative Hearings (SOAH) cases, ensuring comprehensive representation tailored to your needs.

Try this – Source: Appraisal district assessment and protest data from Texas Comptroller. Tax savings are estimated based on a 2.7% tax rate and no exemptions or homestead caps. O’Connor is a private company specializing in tax reduction and is not affiliated with the Texas Comptroller or any government entity or appraisal district.