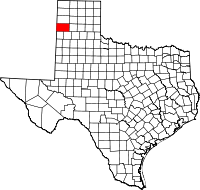

Deaf Smith County Appraisal District

Local Appraisal District

More property owners choose O’Connor than any other tax consultant in Texas because:

- At O’Connor, we explore every avenue to reduce your property taxes — including binding arbitration, where we cover the deposit regardless of the outcome.

- With over 30 years of experience and millions of appeals statewide, we’ve built strong working relationships with appraisal district teams throughout Texas.

- While those connections matter, it’s the strength of our evidence that truly sets us apart. Using proprietary tools and a database of over 50 million sales, we craft appeals tailored to what appraisal districts expect.

- Our deep expertise allows us to develop compelling sales and unequal appraisal data that meet the standards of Deaf Smith CAD and the ARB.

Deaf Smith County Appraisal District

Local Appraisal District

Deaf Smith County Appraisal District’s (CAD) formal and informal 2024 hearing results are displayed below:

- In 2024, Deaf Smith County property owners saved $40,000 in property taxes through informal hearings.

- There were 210 accounts in 2024 of taxable values in Deaf Smith County that were disputed by property owners.

- Of the appeals filed, 69% of informal protests led to reductions, with commercial owners receiving $30,000 through informal protests.

- The percentage of protested parcels grew in 2024 by 2%

Save With O’Connor

1,148

Average HCAD Tax Savings

Average Property Tax Savings from Protesting (Informal + Formal)

Residential Property

343

Commercial Property

1,966

Disclaimer: O’Connor is a property tax consultant and is not affiliated with any appraisal district. Data for graphs provided by Texas comptroller.

Single Family

Commercial / Other

Total

Disclaimer: O’Connor is a property tax consultant and is not affiliated with any appraisal district. Data for graphs provided by Texas comptroller.

Single Family

Commercial / Other

Total

2024 County Appraisal District Statistics

Select

Year

-

County:

Deaf Smith -

Street Address:

140 E. 3rd St. Hereford, TX 79045-5597 -

Mailing Address:

P.O. Box 2298 Hereford, TX 79045-2298 -

Phone:

806-364-0625

Major Cities:

Hereford

Anderson County Texas totals 8 square miles, with a 2020 population of about 7,076. Adjacent counties include Henderson, Houston, Freestone, Cherokee, and Leon County. The total market value of real property and personal property in Anderson County in 2020 was $4,900,000,000. Anderson County 2020 property taxes are estimated to total $58,600,000 million based on an effective tax rate of 2.4% including homestead exemptions. Anderson County property owners protested the noticed value for 214 houses and 1,100 commercial and BPP properties. Anderson County Appraisal Review Board appeals were successful for 17.05% of the owners. Property owner property tax protests in Anderson County results in savings of $16,062,679 million in 2020, or $12,355 per account protested. The 2020 budget for Anderson was $1,200,000 including 13 employees.

Deaf Smith Property Tax Values