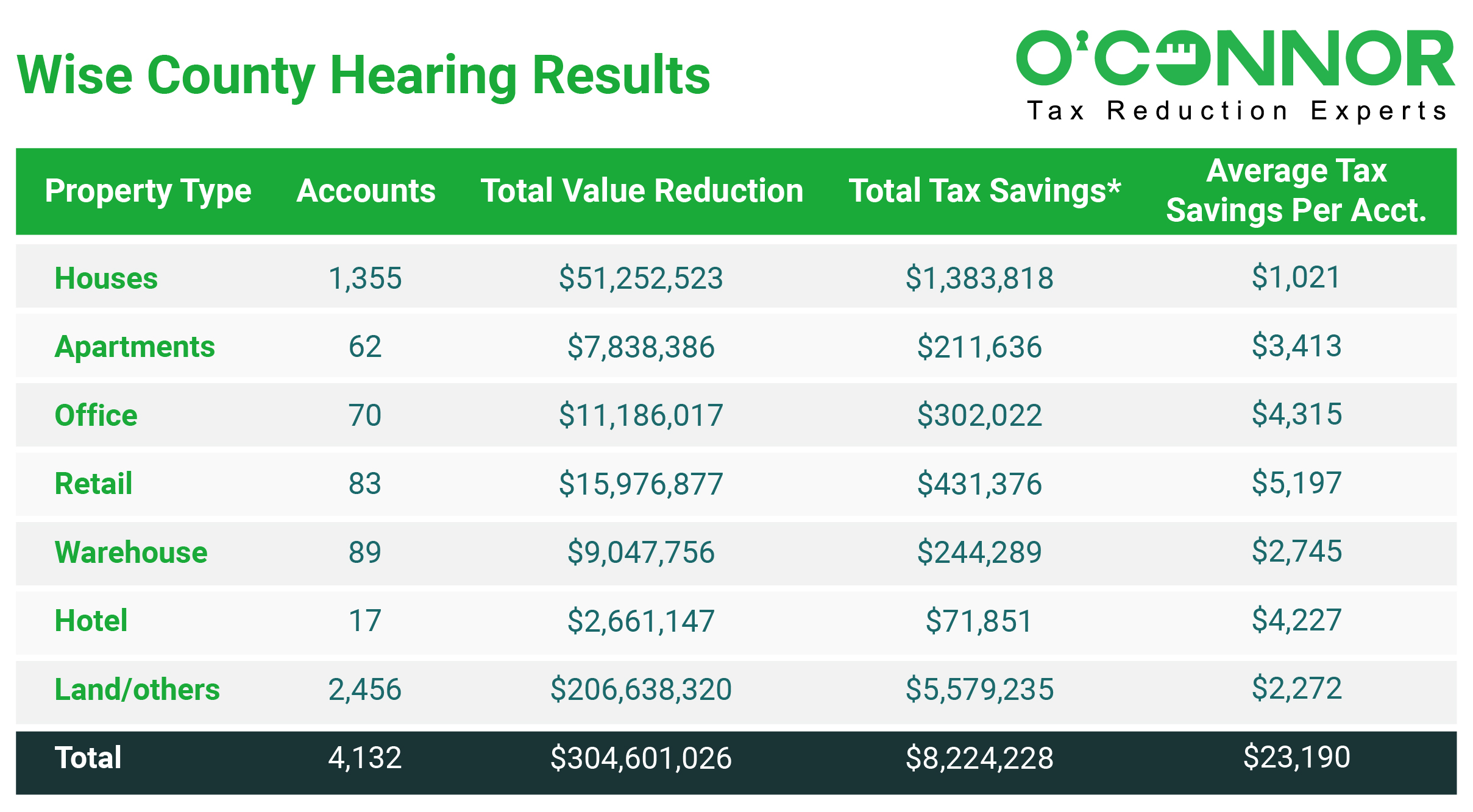

Fresh data from September 2023 reveals that Wise County property owners, taking on property tax disputes, have pocketed a remarkable $8.22 million in savings for the year 2023.

In Wise County, property owners have the legal authority to challenge county assessment values, as the Wise County Appraisal District consistently provides annual market values for real estate and business personal property. This right remains unchanged, whether property values have risen or fallen. O’Connor, through a meticulous analysis of Wise County Appraisal District’s past and current tax records, sheds light on the substantial advantages that property owners can gain by engaging in annual assessment appeals.

Beforehand, O’Connor anticipated that Wise County property tax protests would lead to a total savings of $8.29 million in property taxes by 2023. This projection was based on data from previous years available on the Wise County Property Tax Trends website. It’s evident that the actual savings for Wise County property taxes have not surpassed the initial expectations, however they are remarkably close.

After September 2023, the newly adjusted savings for Wise County residential property owners through property tax challenges amount to nearly $1.3 million. In response to the 2023 tax appeals, the Wise County Appraisal District has lowered valuations for 1,355 properties. With the total assessment reductions reaching $37,825, the average property tax savings per property comes to $1,021, based on a 2.7% tax rate, without factoring in homestead exemptions.

Recent September 2023 statistics reveal that Wise County apartment complex owners, initially valued at $73 million, successfully resolved their assessment challenges, resulting in a lowered valuation of $65 million. This reduction in valuation translates to a substantial $7.8 million decrease in tax assessments. Apartment owners in Wise County can now anticipate total property tax savings of $211,636, factoring in a 2.7% tax rate. Based on appeals completed for 62 apartment complex property owners, the updated average for Wise County showcases a 10.7% reduction from the original valuation, amounting to approximately $3,413 in property tax savings per apartment property resolved in 2023.

Based on the most recent 2023 data available, Wise County has seen a significant number of resolved hearings for its land and other property types, totaling 2,456 cases. These proceedings have led to an outstanding reduction in the initial valuation, which started at $710 million and now stands at $504 million. Notably, this property type achieved the most substantial percentage reduction among all commercial property types in 2023, at an impressive 29.1%. With a 2.7% tax rate in consideration, these commercial property owners have collectively benefited from $5.5 million in tax savings, resulting in an average of $2,272 in savings per tax parcel.

In 2023, hearings concluded with notable reductions, granting considerable property tax savings to 17 hotels. On average, each hotel saved $156,538 in final taxes. The hotels began with a total value of $49 million and, after a $2.6 million reduction, now have a current assessed value of $46.9 million. These savings apply to a 5.4% tax rate for the year with reductions.

Wise County witnessed a successful resolution of 70 office building tax protests this year, leading to property tax savings of $302,022 for the property owners. The initial valuation of $67.5 million decreased to $56.3 million, resulting in an $11.1 million reduction in tax assessments. On average, each commercial office saved $4,315 in property taxes, based on a 2.7% tax rate. The reduction percentage for resolved office tax disputes stands at 16.6%.

Per the most recent data available in September 2023, individuals who own properties in Wise County have successfully concluded their tax appeal submissions for the year 2023. As a result, the assessed value of 4,132 properties has been trimmed from $1.53 billion to $1.23 billion. On average, this translates to a significant reduction of 19.82%. Property owners who elected to contest their taxes have realized an average savings of $23,190 per property, encompassing both residential and commercial structures.

The following three apartments in Wise County received the highest 2023 property tax assessment reductions:

- The owner of the Crestview Place apartment complex in Decatur, Texas has successfully reduced their property tax assessment from $14.5 million to $13.1 million. This represents a significant decrease of $1.4 million or 10%. Based on a tax rate of 2.7%, this adjustment will result in a reduction of the property owner’s tax payments by $39,936. The complex is located at 950 W Thompson St.

- Rodriguez Fernando & Wendy Alvardo, owners of a Wise County apartment building, had their first property tax assessment reduced by $577, from $1,359,078 to $1,358,501. They will save $36,679 in 2023 as a result of the reduction.

- The apartment property owned by El Camino Real LLC witnessed a substantial reduction of $514,800 in their initial property tax assessment, decreasing from $889,200 to $374,400. This reduction equates to a remarkable $13,899 in savings for the year 2023. Notably, this apartment building achieved an impressive 57% reduction.

While the Wise County Appraisal District operates with a modest team of just 19 employees, they bear the significant responsibility of crafting property assessments for the entire expanse of Wise County. As exemplified by the cases outlined earlier, engaging in the property tax process can yield substantial savings. Importantly, there is no minimum property value prerequisite, and this opportunity is accessible to all Texas property owners, whether residential or commercial.

The study’s data is compiled through a comparison of Wise County’s initial 2023 tax year appraisal values with the final amended 2023 tax assessments. It’s important to note that properties appealed without any assessment reduction are not considered in this report.