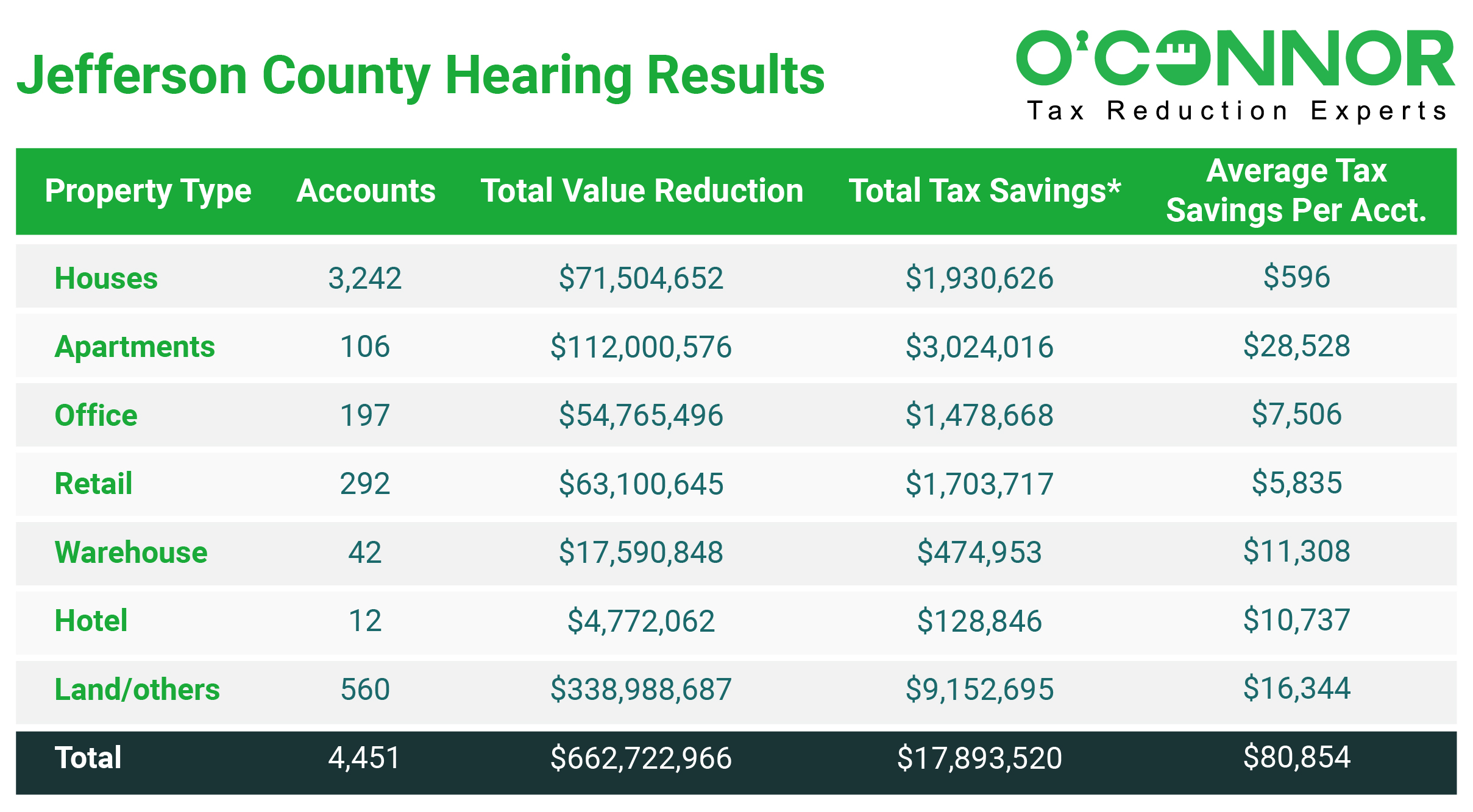

As of the conclusion of September 2023, Jefferson County property tax appeals have successfully saved local property owners approximately $17.8 million.

Thanks to the Jefferson Central Appraisal District’s provision of the latest tax records, O’Connor effectively collated this data and conducted a comprehensive analysis. The district is responsible for establishing the annual market values of real estate and personal property in Jefferson County. Property owners maintain the right to contest these values each year, irrespective of whether they have risen or fallen.

After analyzing the property tax savings data reported in recent years on Jefferson County Property Tax Trends, O’Connor predicts that the cumulative property tax savings for 2023, resulting from Jefferson County property tax appeals, is estimated to be approximately $43 million.

In 2023, Jefferson County homeowners collectively realized $1.9 million in property tax savings. This significant reduction in taxes can be attributed to the hearings within the Jefferson County Appraisal District, which reported a total of 3,242 residential valuations lowered as a result of tax protests that year. The average assessment decrease, calculated after applying a 2.7% tax rate and accounting for homestead exemptions, amounted to $22,056 per homeowner, resulting in an average property tax reduction of $596.

The initial amount of tax complaints filed by commercial apartment complex owners, which was valued at $625 million, was successfully reduced to $537 million. As a result, a total of $71 million in tax assessments were saved this year. Taking into account the tax rate of 2.7%, apartment owners were able to save a grand total of $3 million in property taxes for the year. Jefferson County experienced a high number of tax protests specifically from apartment owners, ranking second in quantity. On average, these protests resulted in a reduction of 17.9% and a corresponding average property tax savings of $28,528 per apartment. These figures are based on the outcomes of 106 apartment tax protests that took place in 2023.

The Jefferson County commercial property type land/others achieved the highest combined savings in terms of reduced value and property tax. The savings from reduced value amount to $338 million, while the tax savings reach a total of $9 million thus far. On the other hand, the land and other properties in Jefferson County experienced the second smallest percentage assessment reduction, with only a 10.9% decrease. The initial value of $3 billion decreased to $2.7 billion. Considering a tax rate of 2.7%, each tax parcel saved a total of $16,344.

The assessed valuations for hotels in Jefferson County were successfully reduced from $91 million to $87 million, leading to a substantial $4.7 million reduction in tax assessments. At a 2.7% tax rate, this translated to an average tax savings of $128,846. These results stem from 12 hotel property tax hearings conducted for the 2023 tax year, with each hotel, whose hearings resulted in reductions, experiencing an average property tax savings of $10,737. For appeals that resulted in reductions, the average percentage decrease for hotel tax and property tax appeals this year is 5.2% year-to-date.

In the current year, Jefferson County successfully addressed 197 tax appeals related to office buildings, resulting in a collective property tax savings of $1.4 million for their owners. The initial valuation of $283 million has been reduced to $228 million, leading to a substantial $54.7 million reduction in tax assessments. Considering a 2.7% tax rate, property owners saved an average of $7,506 on their taxes. The successful appeals for office properties yielded an impressive 19.3% decrease in property assessments.

All 2023 tax filing appeals for Jefferson County have been resolved by property owners, leading to reductions for 4,451 properties. This has reduced the initial assessed value from $5.2 billion to $4.6 billion, resulting in an average decrease of 13%.

The following apartments will see the highest reduction in their 2023 property tax assessments:

- The owner of Promenade Apartments, situated at 6030 N Major Dr in Beaumont, Texas, has effectively reduced their property tax assessment from $32.5 million to $21.6 million. This significant adjustment, amounting to a $10.8 million reduction, leads to a corresponding decrease of $292,285 in property taxes, based on a 2.7% tax rate.

- The owner of the apartment complex situated at 3315 Highway 69 in Nederland, TX, will realize a $256,980 savings in 2023 by successfully reducing their original property tax assessment from $15.3 million to $5.8 million, representing an impressive $9.5 million reduction.

- The proprietors of Willow Lakes apartments achieved a property tax reduction of $222,154. The initial 2023 property tax assessment, set at $51.2 million, was successfully reduced by $8.2 million, resulting in a final valuation of $15.5 million. This property, situated at 2555 95th St in Port Arthur, TX, was constructed in 2010.

The Jefferson Central Appraisal District conducts annual appraisals of real estate in Jefferson County, employing a staff of 242 individuals. The substantial property tax reductions resulting from the appeal process have been detailed in the preceding cases. Property owners are advised to diligently review their yearly property tax assessments and submit appeals on an annual basis. In a typical year, the success rate for property tax appeals in Jefferson County ranges from 40% to 60%.