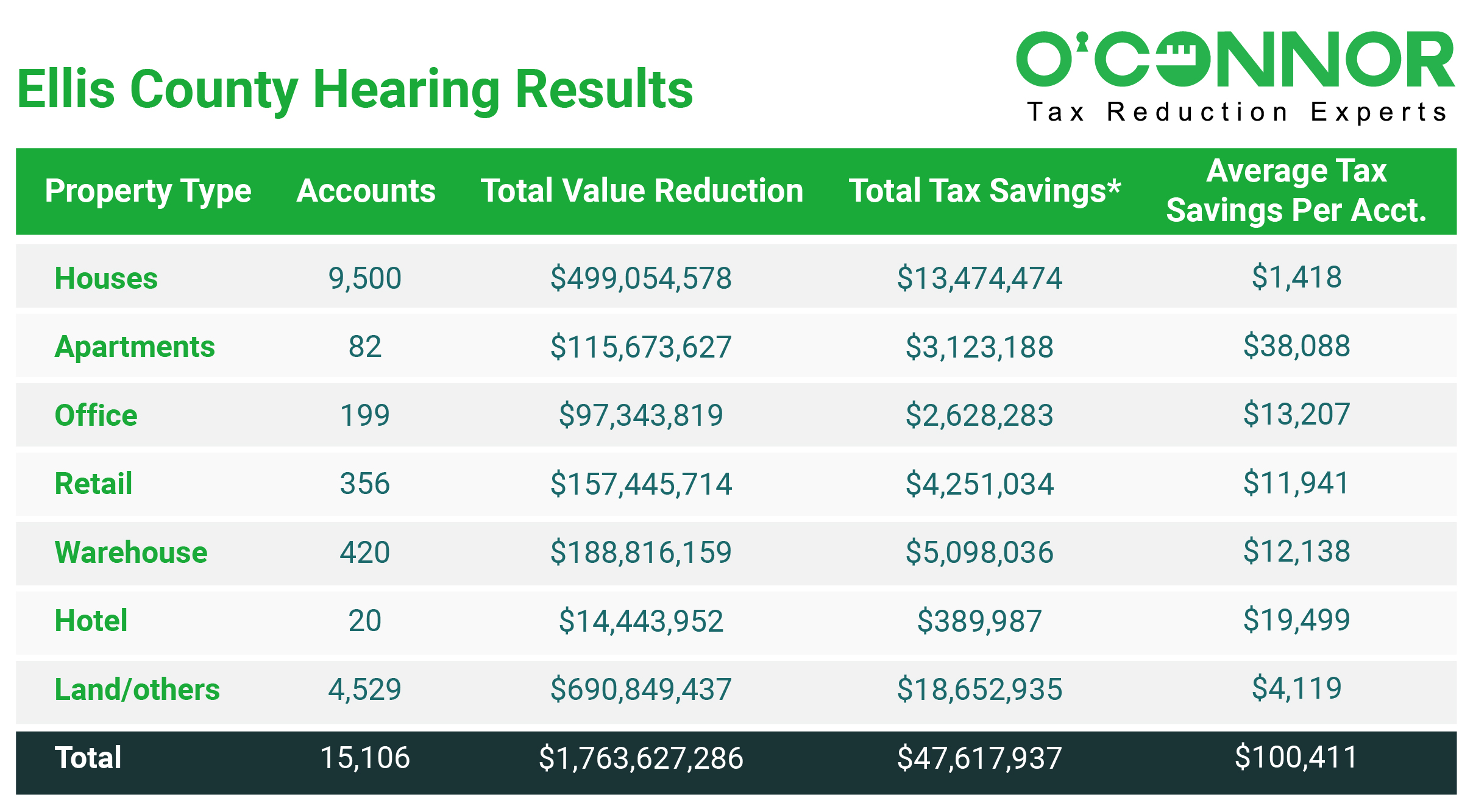

Property tax protests concluded at the end of September 2023 have delivered savings exceeding $47.6 million to successful appellants among property owners in Ellis County. The annual duty of assessing the market value of both real and personal property in Ellis County is overseen by the Ellis Appraisal District. Irrespective of whether the valuation increases or remains the same, property owners retain the right to contest these valuations each year. O’Connor has compiled this data through an analysis of the preliminary and current tax records supplied by the Ellis Appraisal District.

Residential property owners in Ellis County initially had a total noticed value of $3.3 billion. By September 2023, this value had decreased by $499 million to a noticed value of $2.8 billion. As a result of the concluded 2023 property tax appeals, these homeowners are projected to save approximately $13 million. This translates to an average tax savings of $1,418, based on a tax rate of 2.7%, and an average assessment decrease of $52,532. It’s important to note that these calculations do not take into account homestead exemptions. For the 2023 tax appeals that have been resolved, the Ellis Appraisal District has reduced valuations for 9,500 residential properties.

After concluding the hearings for 82 complexes in 2023, it has been determined that the average tax decrease for commercial apartment complexes in Ellis County will be 11.7%. This reduction will result in property tax savings of $38,088 for each property that had a successful appeal in the 2023 tax year. As of now, the resolved apartment accounts for 2023 started with a total value of $987 million, which has been revised to $871 million, leading to a significant $115 million reduction in tax assessments. Calculated based on a tax rate of 2.7%, the collective property tax savings for apartment buildings for the year amount to $3.1 million.

Among all the commercial property types appealed this tax year, the most substantial percentage assessment decrease was observed for land and other commercial properties, with a reduction of 36.7%. By the end of September 2023, a total of 4,529 tax appeals were successfully challenged and resolved. Taking into account the initial valuation of $1.8 billion, which was ultimately lowered to $1 billion, property owners collectively saved $690 million in property taxes. Based on a 2.7% tax rate, this equates to approximately $4,119 per tax unit in Ellis County.

Ellis County’s hotel owners effectively lowered their assessed value from $77 million to $63 million, resulting in a significant decrease in tax assessments of $14.4 million. As a result, they were able to save $389,987 in taxes per property based on the tax rate of 2.7%. The property tax hearings for 20 hotels that were resolved by September 2023 revealed an average savings of $19,499 in property taxes for each successful appeal. Overall, there was an 18.6% decrease in protests that resulted in a reduction in hotel or property taxes for this year.

As of the end of September 2023, office building real estate saw the second most substantial percentage assessment decrease among Ellis County commercial property tax appeals, with a reduction of 34.7%. A total of 199 office building tax appeals were successfully resolved for this tax year in Ellis County, resulting in property tax savings totaling $2.6 million for the property owners. The initial valuation of $280 million was reduced to $183 million, leading to a significant $97 million tax assessment decrease. Based on a 2.7% tax rate, the average amount saved on property taxes for the year came to $489,165.

The property tax appeals submitted by Ellis County property owners in 2023 resulted in reductions for 15,106 properties. The initial assessed value of these properties decreased from $8 billion to $6 billion, representing an average drop of 21.83% as of September 2023. This reduction covers both residential and commercial accounts, and the average tax savings per appealed property amount to $3,152.25.

Ellis County apartments with the largest 2023 property tax assessment reduction include the following:

- The owner of the Lakeside Villa apartment complex, constructed in 2020, located in Midlothian, Texas, at 2991 Lakeside Dr., successfully reduced their property tax assessments from $29.8 million to $23.3 million, achieving a substantial 21% reduction, which amounts to $6.5 million. With a tax rate of 2.7%, this assessment decrease results in a reduction in property taxes by $176,605.

- Thanks to a significant reduction in their original property tax assessment, from $20 million down to $15.5 million, the owner of Brent Tree Townhomes in Waxahachie, Texas, will realize impressive savings of $123,629 in 2023. This apartment complex received a substantial 22% property tax reduction.

- The owner of the two-story, 200-unit apartment complex, which was built in 1986 and is located at 2200 Brown St. in Waxahachie, Texas, achieved a successful reduction in apartment property taxes by 14%. This led to substantial savings of $116,429. The initial property tax assessment for 2023, which was $30.3 million, was successfully lowered to $26 million, resulting in a significant drop of $4.3 million for the Bridgepoint apartments.

A team of experts from the Ellis Appraisal District appraise homes in Ellis County. The instances mentioned above do, however, highlight the significant savings made in 2023 for property owners in Ellis County. These property tax savings from the owner’s property tax appeal procedure demonstrate the value property owners stand to gain by exercising their right to appeal.

In Ellis County, it’s common for property owners to achieve significant victories in their property tax challenges in a typical year. As a result, property owners are encouraged to regularly assess and contest their annual property tax assessments.