Property owners in Midland County have achieved notable success in disputing their assessed property values during the 2023 tax year, resulting in reclaims exceeding $27.7 million. The annual responsibility of determining the market value of all real estate and personal property within the county falls upon the Midland Central Appraisal District. By leveraging the most recent tax rolls, as furnished by the Midland Central Appraisal District, O’Connor has effectively translated these data into insightful comparisons.

Contrary to O’Connor’s initial expectations, the 2023 property tax savings resulting from protests in Midland County fell short of the anticipated $62 million. This projection was established through an analysis of historical data on property tax savings, sourced from the Midland County Property Tax Trends website.

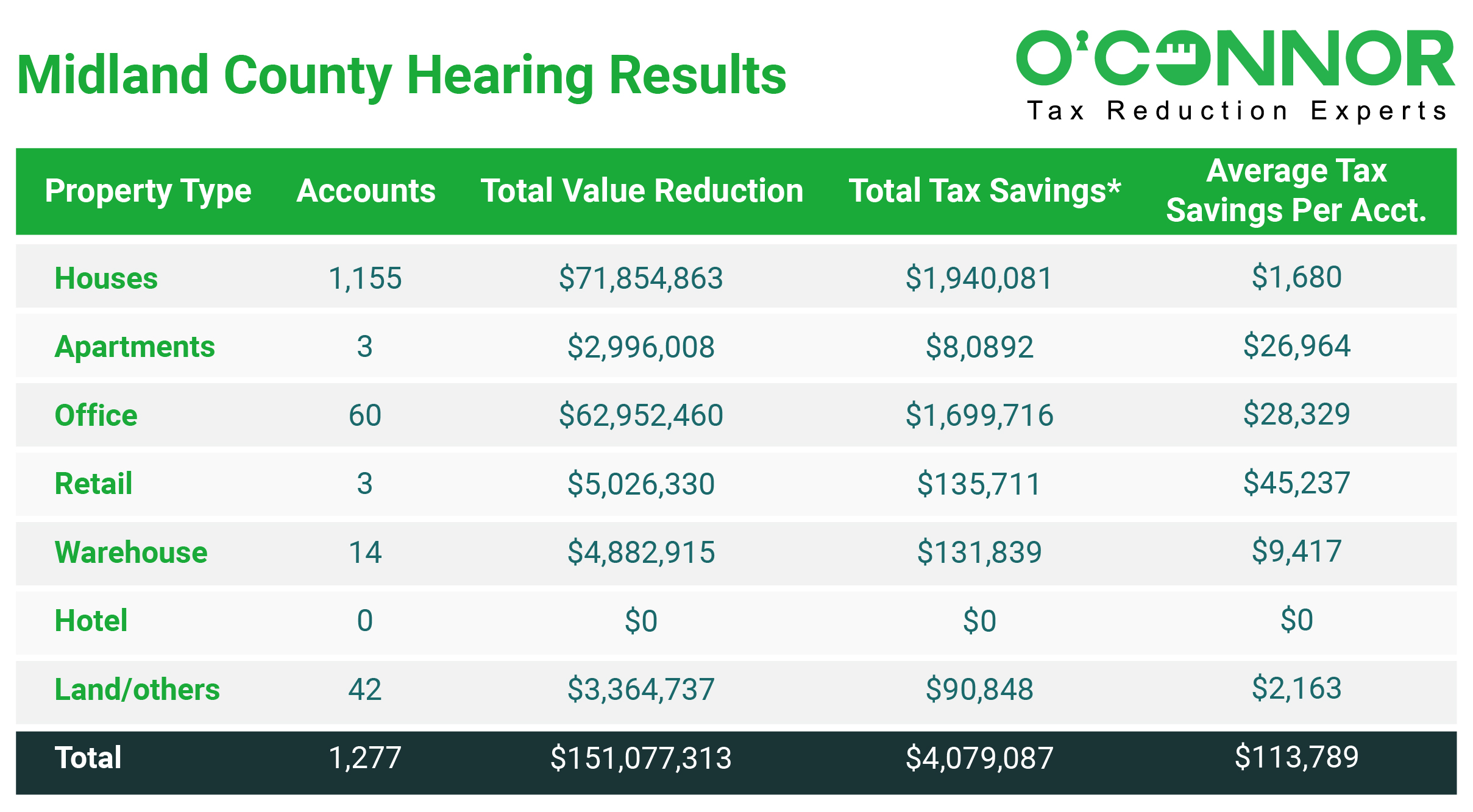

Per the Midland Central Appraisal District, there have been 1,155 tax protests for residential properties, with hearings resulting in assessment reductions. The median assessment decrease was $62,212, leading to a cumulative property tax savings of $1,680, calculated at a 2.7% tax rate, without considering any possible homestead exemptions. These successfully completed property tax challenges allowed homeowners to collectively save nearly $1.9 million.

The tax appeals that have achieved success for apartment buildings in 2023 have triggered a decrease in the initial property valuation, moving it from $38 million down to $35 million. Consequently, this has led to a reduction in tax assessments totaling $2.9 million. Owners of commercial apartment buildings are projected to collectively realize approximately $80.8 million in property tax savings, based on the average tax rate of 2.7%. The challenges to property taxes for apartment complexes in Midland County have resulted in a 7.9% decrease, equating to total savings of $26,964 per appeal. These figures reflect the outcomes of the three apartment hearings conducted in 2023.

In Midland County for the year 2023, commercial property tax assessments have seen a substantial decline, with the second-highest percentage reduction reaching 36.5%. This reduction specifically applies to land and miscellaneous properties, encompassing a total of 42 resolved tax protests. The initial property value of $9.2 million has been successfully lowered to $5.8 million, which translates to an estimated tax savings of approximately $3.3 million for the property owners. This reduction in assessments corresponds to a 2.7% tax rate, resulting in savings of about $2,163 per tax parcel.

As of the current year, 2023, a total of 60 office building owners in Midland County have effectively resolved their tax appeals, leading to collective property tax savings of $1.6 million. This substantial reduction in tax assessment, equating to $62.9 million, was achieved by lowering the initial property valuation from $403 million to $341 million. On average, property owners experienced a tax reduction of $28,329, calculated based on a 2.7% tax rate. It’s noteworthy that the successful tax appeals for office properties resulted in a 15.6% decrease in the assessed amount.

At the close of September 2023, property owners in Midland County had concluded their objections to property tax assessments. During this process, assessments for a diverse range of 1,277 properties were successfully reduced. The initial assessed value, which originally stood at $964 million, experienced a substantial decrease, reaching $812 million, with an average reduction of approximately 15.67%.

The following complexes will have the biggest reduction in their 2023 property tax assessments:

- Owners of the Ventura at Tradewinds apartment building saw a $42,706 decrease in their yearly property tax. The $34.7 million original 2023 property tax assessment was decreased by $1.5 million to $33 million. The complex may be found in Midland, Texas at 1811 Tradewinds Blvd.

- The property owner has recently reduced the tax assessment of the building from $1.5 million to $200 million. This property is situated at 415 W Scharbauer Dr. in Midland, Texas. This adjustment reflects a substantial decrease of $1.3 million. As a result, there will be a notable reduction of $35,588 in property taxes, based on a tax rate of 2.7%.

- The proprietors of 2929 W. Kansas Avenue have successfully lowered their property tax assessment from $1.8 million to $1.7 million, resulting in savings of $96,188. This adjustment has led to a reduction of $2,597 in real estate taxes, calculated based on an effective tax rate of 2.7%.

The Midland Central Appraisal District currently maintains a workforce of 28 personnel tasked with appraising property values throughout the county. As illustrated earlier, there are compelling examples of substantial property tax reductions attainable through the property tax appeal process. It is prudent for property owners to conduct a thorough review of their annual property tax assessments and contemplate the annual submission of an appeal. On average, Midland County consistently witnesses a success rate ranging from 55 to 95% in property tax appeals every year.