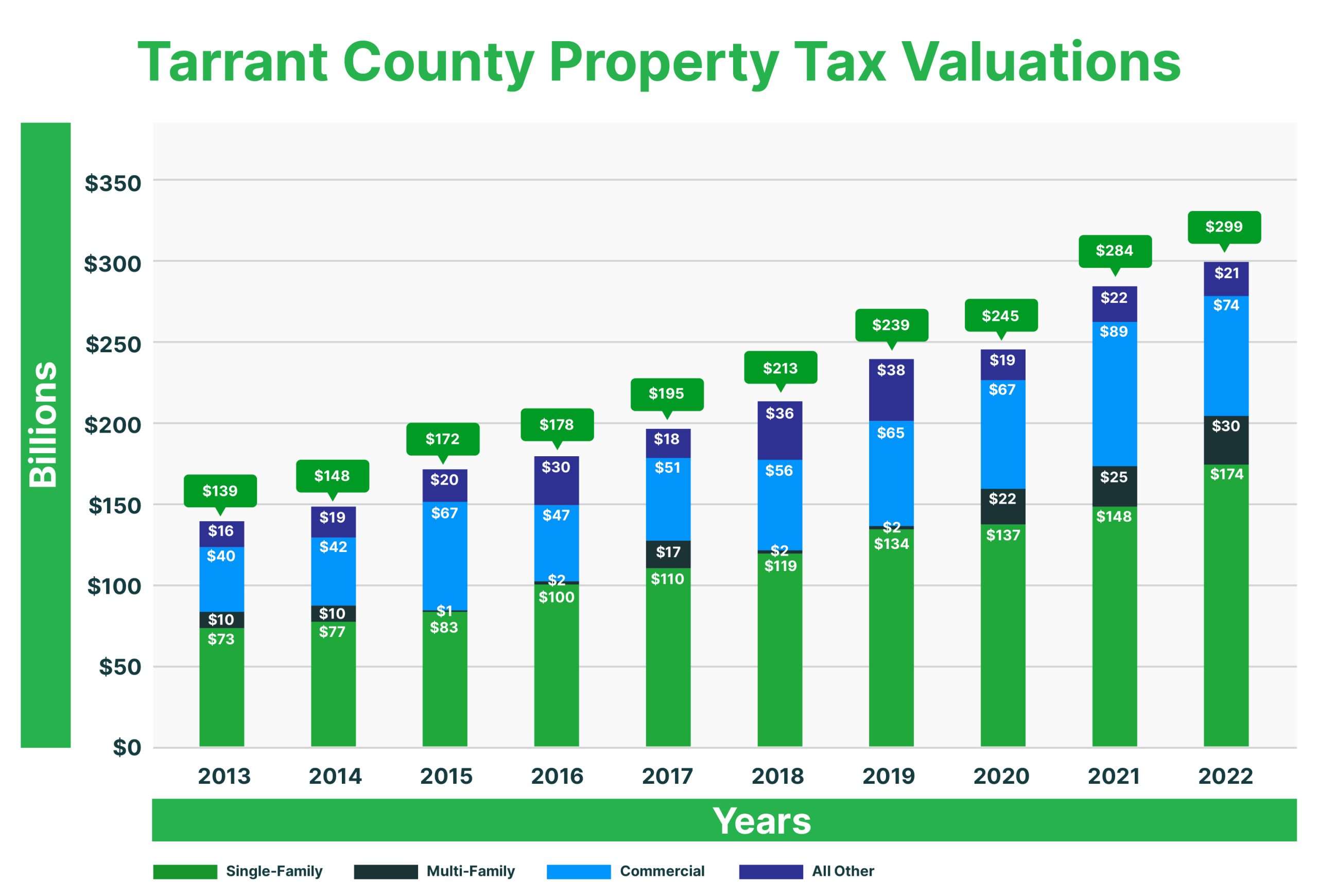

Based on recent data analysis, the Tarrant Appraisal District in Tarrant County witnessed robust growth in property values, soaring by an impressive 115% from 2013 to 2022. Specifically, Tarrant County’s property values surged from $139 billion in 2013 to an impressive $299 billion in 2022. This substantial growth outpaced the statewide average growth rate of 135%. Furthermore, the aggregate value of all properties appraised by Texas appraisal districts experienced significant expansion, climbing from $2.253 trillion in 2013 to a notable $5.296 trillion in 2022.

Tarrant Appraisal District

The Tarrant Appraisal District, a government organization, holds the responsibility of assessing the market value of every property within Tarrant County, with evaluations conducted at least once every three years. Oversight of this process falls under the purview of the board of directors, who are tasked with appointing the chief appraiser.

Tarrant County Property Value per Acre

Tarrant County has 902 square miles and 577,280 acres. That’s 640 acres per square mile. This indicates that Tarrant County is smaller than the average size county which has a total area of 1,058 square miles. The Tarrant Appraisal District established a total value of $299 billion for 2022. The value per acre is $491,963. The statewide value is $30,808 per acre.

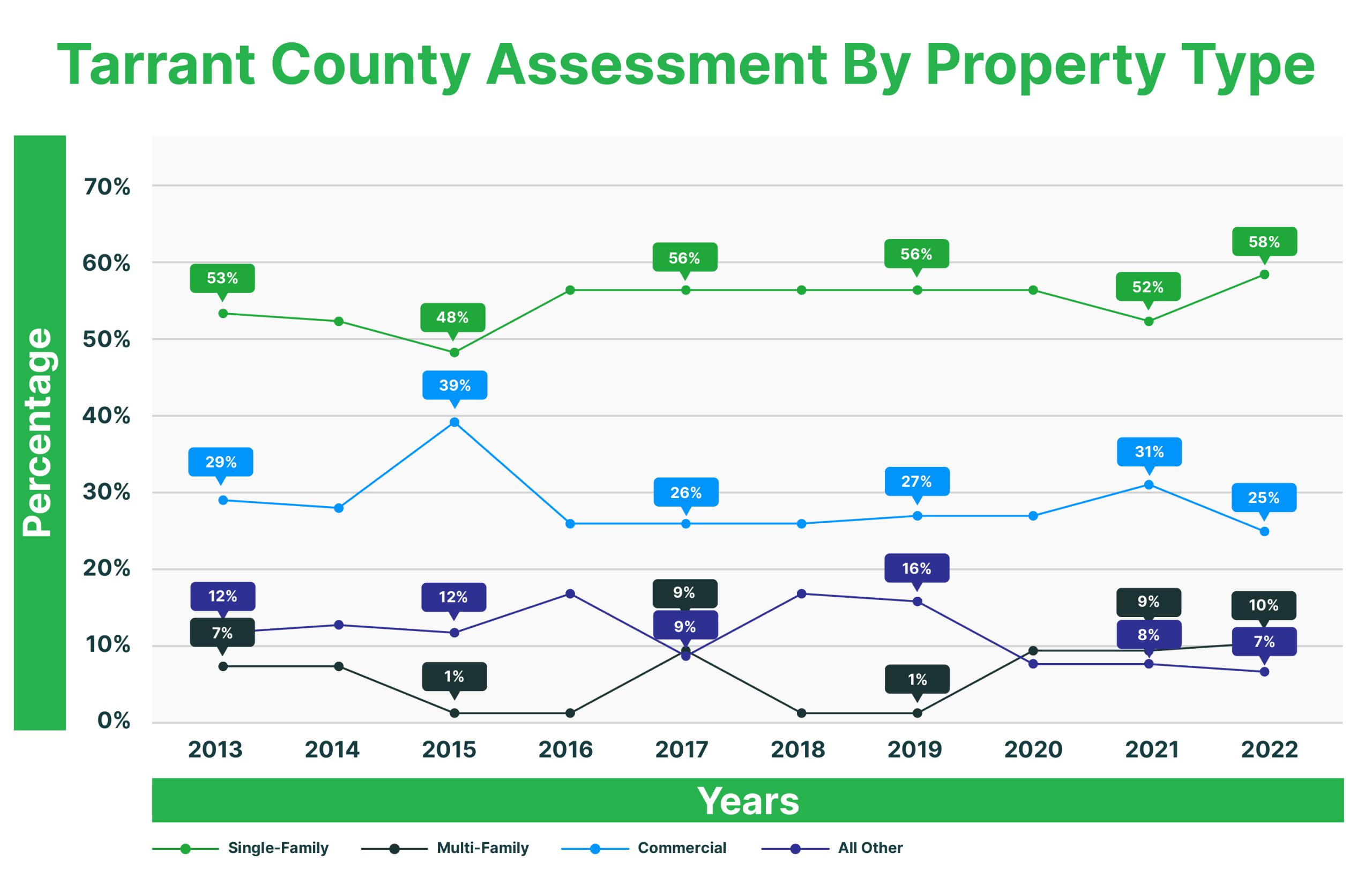

Tarrant County Houses ~ 58% of Total Value

Single-family home values in the Tarrant Appraisal District account for 58% of Tarrant County’s total market value. This percentage is higher than the statewide average, which is projected to be around 46% in 2022. The percentage of value attributable to homes increased from 53% to 58% between 2014 and 2022, above the statewide percentages of 41% to 46% of value resulting from residential property.

Apartments, Commercial, Business Personal Property and Industrial / Other ~ 58%

The Tarrant Appraisal District has announced statistics regarding the allocation of property taxes in Tarrant County for the year 2022. According to their statistics, single-family houses accounted for 58% of the overall tax valuation, while apartments made up 10%, commercial buildings accounted for 25%, and industrial and other assets made up 7%.

Tarrant County Property Value $138.7 BB per 1 Million Population

Property values have increased from $73 billion per million people in 2013 to $138.7 billion per million population now. This is a far quicker rise than the population and CPI increases, reaching 90% in only 8 years. For the state, the market value per million people is $176 billion.

Property Value Grows Faster Than Population

The significant difference between the 115% growth in property values recorded by the Tarrant Appraisal District in 2022 and the 9% population growth rate is notable. Over the period from 2013 to 2022, there was a remarkable increase in real estate values nationwide. However, the real estate market has entered a reset phase. This reset has been primarily driven by higher interest rates, which have diminished the affordability of homes and consequently devalued commercial properties.

Transition Period to Slower Property Value Growth

As of October 2023, the housing market in Dallas and Texas appears to be experiencing fluctuations. While there has been a slight decline in the number of house sales in 2023, the average sales price remains akin to last year. This can be attributed to the fact that many homeowners currently hold mortgages with low-interest rates, typically at 3.5% or below. Consequently, the pool of sellers has dwindled, as securing a new mortgage at the current average rate of around 7% would be substantially higher than their existing rates.

Erratic Reassessment in 2024

It’s possible that Texas appraisal districts could raise house values considerably once again. However, the data from home sales, encompassing both volume and prices, offers little comfort. In truth, even if sales prices stay relatively consistent across a metropolitan area, they can vary greatly. Certain areas might see increases, while others witness declines, and some stay the same. It seems likely that the 2024 reassessments will produce mixed outcomes, with some assessments going up and others possibly going down.

Dallas County Home Price Sale Trends

Home prices in the Dallas area have remained fairly steady compared to the previous year. In September, the average home sale price was approximately $350,000. However, in October, there was a slight decrease in the median home price, which fell by 1.57% to $344,500.

Commercial Property Values Down Due to Higher Interest Rates

The valuation of commercial properties is closely tied to interest rates, particularly the 10-year Treasury rate. As interest rates increase, capitalization rates also rise, leading to reduced market prices. Although commercial mortgage rates were low before COVID and during the pandemic until 2021, the following increase in rates in 2022 and 2023 has caused a significant decline in commercial property sales and mortgage activity.

The increase in interest rates has completely stopped activity in the commercial property capital markets, as buyers and sellers struggle with different expectations regarding the prices at which they are willing to sell or acquire. Currently, buyers are requiring much greater capitalization rates to obtain sufficient investment returns. This is causing sales prices to decrease due to the resulting downward pressure. As a result, property owners are choosing to wait and observe the situation instead of selling until they are forced to do so. They expect both interest rates and market conditions to become stable.

Tarrant County Property Value in Comparison

The countries listed below are ranking highest: 1) $788 BB for Harris, (2) $459 BB for Dallas, 3) $428 BB for Travis, 4) $299 BB for Tarrant, and 5) $270 BB for Bexar. The property values in Tarrant County were evaluated by the Tarrant Appraisal District, which ranked fourth, at $299 billion in 2022.

Are Tarrant Appraisal District (TAD) Property Values Reliable?

An enormous obstacle stands in the way of every Texas assessment district, including TAD. The valuation of 1,832,500 property tax parcels was evaluated by 122 appraisers at TAD in 2022. The bulk (122) of TAD’s appraisers focus on field-based data input for newly built properties, and the agency often reassesses property values. The significant issue that the appraisers have is maintaining records of land values, building condition and impairment data, and building data.

Tarrant County Owners Actively Protest Property Taxes

Property owners in Tarrant County exhibit a greater likelihood of initiating protests in comparison to other property owners in the entire state of Texas. Homeowners in Tarrant County raised objections to the valuation of 10.76% of cases in 2022, whereas the proportion statewide was 12.2%.

Property tax demonstrations in Tarrant County in 2022 led to a substantial reduction of over 564 billion dollars in property taxes. Moreover, informal, ARB, and judicial appeals combined to reduce the taxable value of property in Tarrant County by $23.71 billion as a result of these demonstrations.

A significant amount of the property tax savings resulting from property tax objections and judicial appeals are contributed by Texas. In 2022, the cumulative value reduction at the state level was $243 billion.

Homeowner Tips

It is recommended that homeowners confirm whether their principal place of residence meets the criteria for a homestead exemption. Property taxpayers in Tarrant County who appear in person at the informal appeal have a significant opportunity to secure a reduction in their property taxes. The forthcoming blog post concerning property taxes in Tarrant County will elaborate on protests, including their quantity, ultimate outcomes, and their connection to the state of Texas, among other details. To obtain our free assistance regarding homestead exemptions, kindly reach out to us at 713 290 9700. While we are unable to file homestead applications on your behalf, there is no charge when we provide answers to your questions.

Free Enrollment in Property Tax Protection Program™

Enrollment is free of any upfront costs. With the assistance of the Property Tax Protection Program™.

Enroll in three minutes for free via our website, by calling 713 290 9700, or, if you prefer, in person at any of our nine locations.

O’Connor will aggressively contest your property taxes on an annual basis; you will only be required to make a payment if those taxes are reduced that year.

Source: Appraisal district assessment and protest data from Texas Comptroller. Tax savings are estimated based on 2.7% tax rate and no exemptions or homestead caps. We are not a part of or associated with any appraisal district or government entity.