Per the recently released data, property owners in Lubbock County can anticipate more than $34 million in property tax savings for the 2023 tax year.

Regardless of the fluctuations in property values during the year, the Lubbock Central Appraisal District regularly disseminates market values for both real estate and personal property accounts. Each year, property owners have the chance to challenge these assessments. O’Connor has gathered this data from the earliest and most recent property tax information provided by the Lubbock Central Appraisal District.

Prior to the latest 2023 tax values, O’Connor had estimated that property tax protests in Lubbock County would result in approximately $11 million in tax savings. The analysis of data found in the Lubbock County Property Tax Trends report, which relied on the most recent available data from 2021, supported this estimate. However, upon a thorough evaluation of the final 2023 values, it is evident that property owners saved even more through appeals, surpassing the initial projections.

An updated estimate reveals that homeowners are expected to save $7 million in property taxes for the year 2023. Official statistics from the Lubbock Central Appraisal District indicate that a total of 8,688 houses have experienced reductions in their values due to tax disputes in 2023. With a tax rate of 2.7%, the average assessment reduction currently amounts to $31,694. As a result, homes are set to enjoy an average reduction in property taxes of $856. Please note that any homestead exemptions are not taken into account in this study.

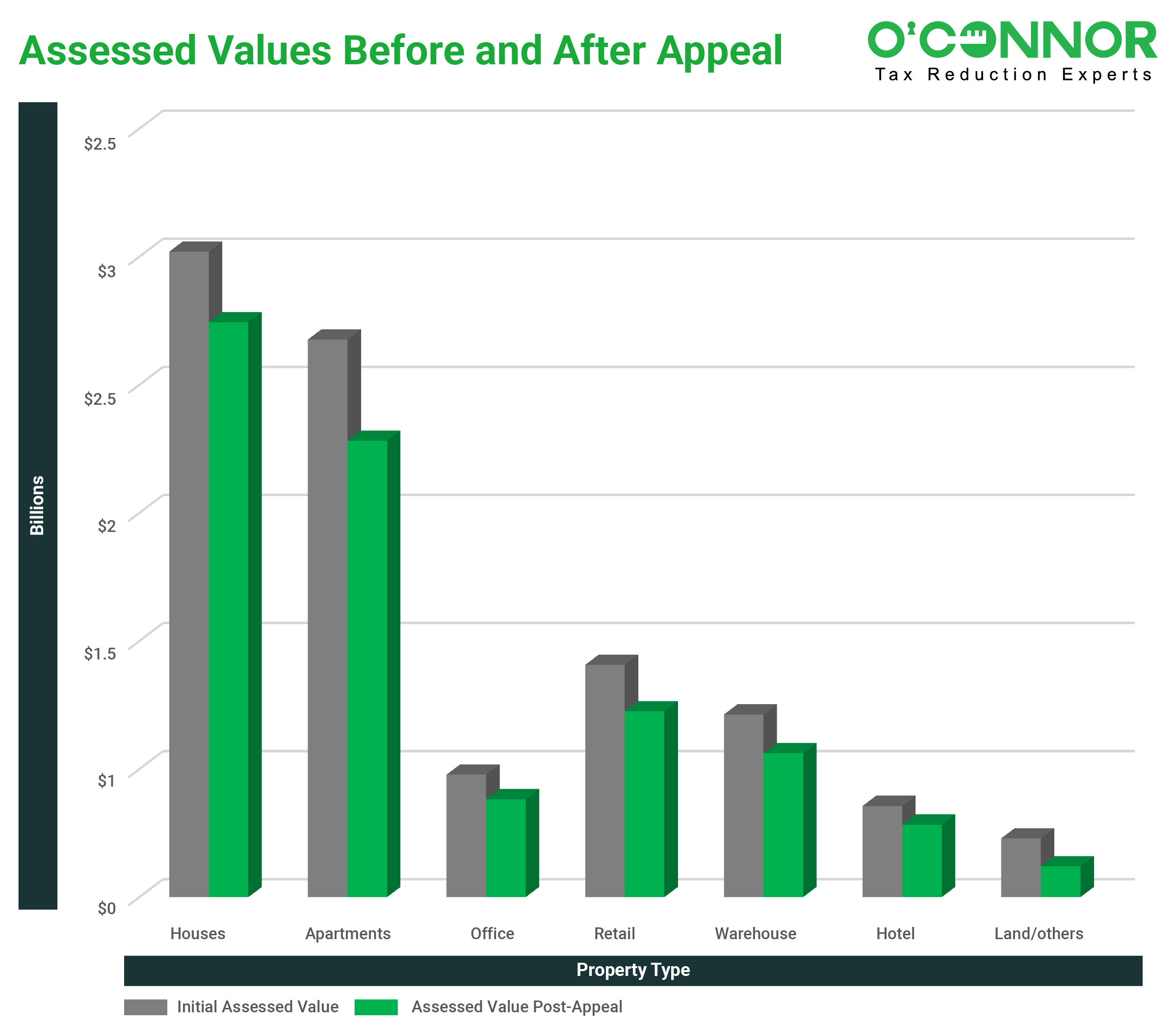

Based on previous evaluations, apartments emerged as the most cost-effective type of commercial real estate by the end of September 2023, in relation to real estate taxes and tax disputes. In contrast to their initial worth of $2.1 billion, the final tax objections for 2023 were resolved at $1.7 billion, resulting in a $395 million decline in tax assessments. As a result of their protests, apartment owners managed to avoid $10.6 million in property taxes this year, taking into account a tax rate of 2.7%. These owner appeals led to an 18.2% reduction in taxes for apartment complexes in Lubbock County in 2023. On average, each apartment complex appeal saved $34,629 in property taxes. A total of 308 hearings were conducted for apartments during the 2023 property tax year, resulting in savings.

Based on the 2023 finalized valuations, 2,753 accounts for land and other commercial properties have been successfully resolved. The current notice value stands at $120 million, which is a substantial $109 million lower than the initial value of $229 million. With a tax rate of 2.7% for the current property tax year, owners of land and other assets can expect to realize a total of $2.9 million in tax savings. This equates to an average of $1,069 per tax parcel, calculated based on the tax values after the hearings. Notably, there was a significant 47.5% reduction in property tax, making land and other properties the category with the highest percentage of commercial property tax savings in Lubbock County.

Based on the most accurate projections for 2023, the assessed values of the hotels that filed protests have declined from $355 million to $283 million. With a tax rate of 2.7%, this translates to a tax savings of $1.9 million and a total reduction of $72 million in tax assessments. This analysis covers 54 hotels, with an average reduction in property taxes per resolved hotel property of $36,310 in 2023. The final percentage reduction in hotel property taxes, based on concluded objections that resulted in a reduction, stands at 20.4% as of the end of September 2023.

As of September 2023, numerous objections to office building assessments have been successful, resulting in a 20% reduction in assessments for these properties. During the same period, the final valuations for office buildings in Lubbock County led to significant savings of $2.5 million across a total of 446 office properties. This ultimately resulted in a decrease in the overall valuation from $477 million to $382 million, leading to a substantial tax reduction of $95 million. Considering a tax rate of 2.7%, the finalized property tax amount for 2023 is $5,791.

Starting with an initial assessed value of $7.3 billion, this figure later decreased to $6 billion, reflecting an average reduction of 17%. As of the end of September 2023, the combined tax savings for properties that underwent objections, encompassing both residential and commercial segments, totaled $2,587. The favorable outcomes of property tax protests in Lubbock County translated to reduced property taxes for a total of 13,363 property owners.

The following apartments reflect these with the greatest reductions in their 2023 property tax assessments:

- The Republic at Lubbock apartments are located at 3824 Erskine Street in Lubbock, Texas. It is anticipated that they will benefit from substantial tax reductions totaling $452,069 for the 2023 tax year. Initially, the property tax assessment for this establishment was set at $47.7 million. However, it was significantly revised down to $31 million, marking a substantial difference of $16 million. As a result, the property taxes for this business facility were reduced by a noteworthy 35%.

- The One at Lubbock Apartment Homes, situated at 1002 Frankford Ave in Lubbock, Texas, experienced a significant decline in its property tax assessment in 2023. The assessment decreased by $10.6 million since its initial calculation. The value of the property dropped from $28.7 million to $18 million. Consequently, the property taxes decreased by $288,094, calculated using a tax rate of 2.7%.

- The initial property tax evaluation for the apartments located at 1819 Glenna Goodacre Blvd in Lubbock, Texas was set at $41.4 million in 2023. However, this evaluation was later revised and reduced by $10.4 million, resulting in the current total value for their 2023 property tax assessment being $31 million. In 2016, the construction of a 217-unit apartment complex named Park East was completed.

Previous cases serve as compelling examples, highlighting the potential for substantial property tax savings achievable through the property tax protest process. The finalized reductions in 2023 property tax assessments were determined by contrasting the initial values provided by the Lubbock Central Appraisal District with the latest tax assessments for the year. The Lubbock Central Appraisal District employs over 39.5 individuals responsible for evaluating all properties within Lubbock County. It’s important to note that the average reduction is skewed upwards since properties that have been protested but not reduced are not factored into this dataset.

The annual success rate for property tax protests in Lubbock County typically falls within the range of 65% to 75%. Property owners increase their likelihood of securing tax reductions by contesting their assessments each year.