Coryell Central Appraisal District

Local Appraisal District

More property owners choose O’Connor than any other tax consultant in Texas because:

- O’Connor’s proactive approach is fully aligned with the best interests of property owners. We cover all fees and costs, no matter the appeal level. Unlike many competitors who require property owners to pay for binding arbitration deposits or costs associated with judicial appeals—such as legal fees, expert witness charges, and court costs—we never ask you to cover any of the expenses related to your property tax protest.

- O’Connor has built strong relationships with the staff at Coryell Central Appraisal District (CAD) over the years, gaining a deep understanding of the information required to successfully win your property tax appeal.

- With extensive experience in Texas property tax protests, O’Connor uses relevant data specifically tailored to the appraisal district’s approach to adjusting sales.

- O’Connor brings the expertise needed to compile uneven appraisal data and sales information that meet the guidelines established by the Coryell Appraisal Review Board (ARB) and Coryell CAD.

Coryell Central Appraisal District

Local Appraisal District

Coryell Central Appraisal District’s (CAD) formal and informal 2024 hearing results are displayed below:

- Through Coryell CAD, property owners saved $1.5 million in overall tax savings in 2024. In 2024, Coryell County property owners protested the taxable value of 2,170 accounts.

- In Coryell County, 65% of the informal protests and 46% of the ARB protests were successful with achieving a reduction in property taxes.

- Through informal protests at Coryell CAD and formal protests through the ARB, homeowners were able to save $740,000 and $30,000, respectively.

- In 2020, 5% of Coryell County properties were disputed, but that number increased to 6% in 2024.

Save With O’Connor

1,148

Average HCAD Tax Savings

Average Property Tax Savings from Protesting (Informal + Formal)

Residential Property

343

Commercial Property

1,966

Disclaimer: O’Connor is a property tax consultant and is not affiliated with any appraisal district. Data for graphs provided by Texas comptroller.

Single Family

Commercial / Other

Total

Disclaimer: O’Connor is a property tax consultant and is not affiliated with any appraisal district. Data for graphs provided by Texas comptroller.

Single Family

Commercial / Other

Total

2024 County Appraisal District Statistics

Select

Year

-

County:

Coryell -

Street Address:

705 E. Main St. Gatesville, TX 76528 -

Mailing Address:

705 E. Main St. Gatesville, TX 76528 -

Phone:

254-865-6593

Major Cities:

Copperas Cove, Gatesville, McGregor, Oglesby, Evant.

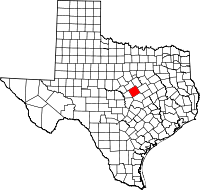

Coryell County totals 1,057 square miles, with a population of about 83,093 in 2020. Adjacent counties include Bosque, McLennan, Bell, Lampasas, and Hamilton. The total market value of real and personal property in Coryell County in 2023 was $8.42 billion. Coryell County 2023 property taxes were estimated to total $65.10 million based on an effective tax rate of 2.1%, including homestead exemptions. Coryell County property owners protested the appraised value of 1,270 houses and 1,710 commercial and BPP properties. Coryell County Appraisal Review Board appeals were successful for 61% of property owners. Property tax protests in Coryell County resulted in savings of $19.80 million in 2023, or $663.09 per account protested. The 2023 budget for the Coryell Central Appraisal District was $1.16 million, including 11 employees.

Coryell Property Tax Values