FAQs for Application for a Place on Ballot for Publicly Elected Member of County Appraisal District

Senate Bill 2, passed in the second special session in 2023, provides that appraisal districts in Texas counties with a population of 75,000 or more shall elect 3 members to the county appraisal district. For example, public members for the Dallas Central Appraisal District and Fort Bend Central Appraisal District.

The initial election for these three board of director positions will be on May 4, 2024. (The next elections for these positions will be in general election in 2026.)

Applications shall be submitted to the County Judge (i.e. Lina Hidalgo in Harris County) starting Wednesday January 17, 2024, through February 16, 2024. Submit application to county judge in county where appraisal district is located.

How do I apply to be a candidate for a board of director position in my county?

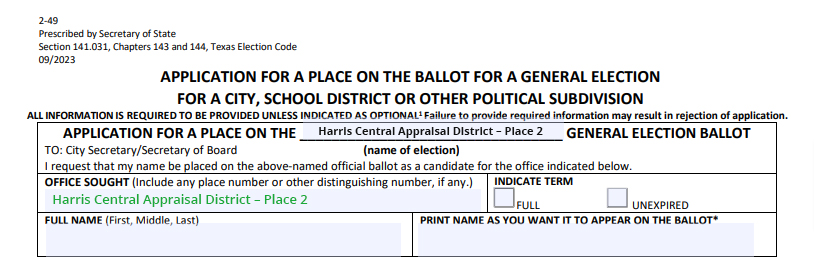

Complete Texas Secretary of State form 2-49 to apply for a position on the ballot.

Is there a cost or fee to file as a candidate for a place on the board of directors?

Filing fee: The filing fee is $200 in counties with population of 200,000 or less or $400 for counties with over 200,000. In lieu of the filing fee, you can collect “hard copy” signatures on a petition (500 in most counties). Electronic signatures are not valid. The filing fee or petition must be delivered with the application.

What are the requirements to run as a candidate?

Requirement: Must be a resident of the county where the appraisal district is located for 2 or more years immediately preceding the date the candidate takes office.

Are there any exclusions or reasons I may not be able to serve on the board of directors?

Exclusions:

- Employees of tax entities served by the appraisal district, unless they have an elected position with the same tax entity.

- Individuals with a substantial interest in a party to a contract with 1) the appraisal district or 2) taxing unit served by the appraisal district.

- Individuals related within the second degree of consanguinity (blood) to an individual who is engaged in the business of appraisal property for compensation in proceeding under this title in the appraisal district.

- Individuals who own property with taxes delinquent for 60+ days.

- A member of appraisal district board of directors for all or part of 5 terms (with narrow exceptions)

- Individuals who have engaged in the business of appraising property for compensation for use in proceedings under this title

- Individuals in the business of representing property owners for compensation in proceedings under this title in the appraisal district within the last 3 years

- Individuals who have been an employee of the appraisal district within the last 3 years.

What are the responsibilities of members of the appraisal district board of directors?

Requirements for publicly elected appraisal district board of directors – the members of the appraisal district board of directors have three primary responsibilities:

1.Two of three of the publicly elected appraisal district board of directors must approve appraisal review board members for the following year.

2.Approve the appraisal district budget.

3.Hire the chief appraiser.

Publicly elected members of the appraisal district board of directors are the only ones who can approve the appraisal review board for the following year.

Some appraisal review boards are perceived to be strongly biased based on surveys of property owners and tax consultants. Publicly elected board members would be able to balance the scales for the appraisal review board if it has members who exhibit strong bias repeatedly.

Most appraisal district boards meet 6 to 12 times annually. Meetings are typically a few hours to most of a day based on the appraisal district.

This is not an opportunity for financial riches but is an opportunity to make a meaningful contribution to assuring property owners receive impartial treatment at the appraisal district appraisal review board.

Where can I find additional information?

Election Advisory No 2023-24

Secretary of state form – 2-49 – application

Secretary of state form – 2-51 – petition in lieu of filing fee