The McLennan Central Appraisal District (CAD) has released its proposed property tax assessment values for 2025. Both high-value commercial and residential properties are facing significant increases. While the overall rise in residential property values is 3.5%, this figure masks much steeper hikes for certain property owners. Particularly owners of luxury homes, new construction, and properties with larger square footage, which all saw notably higher assessments. This may reflect a strategic move by the appraisal district to raise revenue without heavily impacting lower or middle-income homeowners.

Commercial properties followed a similar pattern. With an average increase of 6.9%—nearly double the residential rate—high-value commercial real estate bore the brunt of the reassessment. This suggests that luxury real estate values rose faster than the general market.

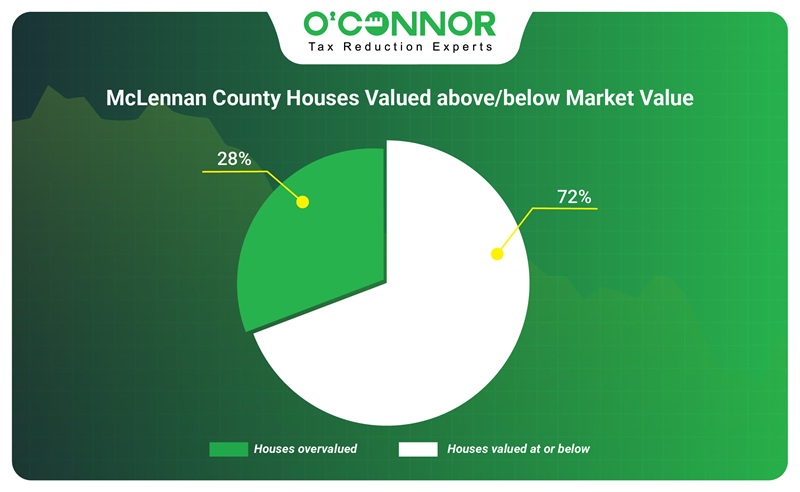

During the 2025 reassessment in McLennan County, around 28% of homes were found to be overvalued, while 72% were assessed at or below market value. This is encouraging news for the majority of homeowners. However, those with overvalued properties may face disproportionately high tax bills and are at risk of being unfairly taxed.

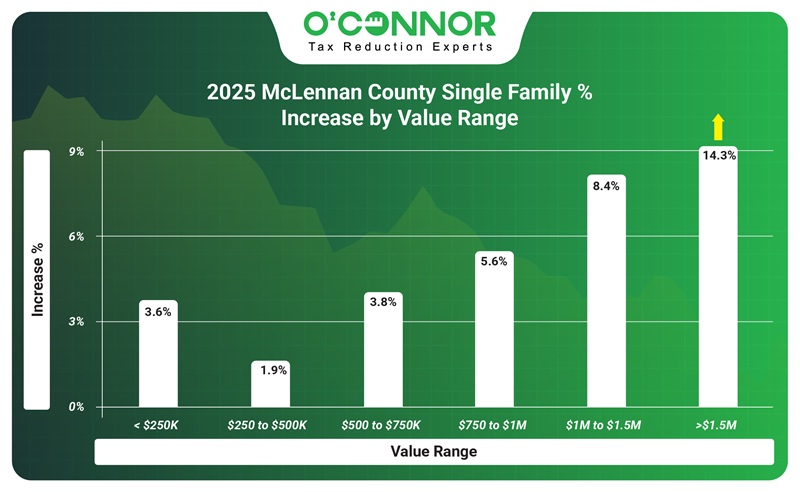

Luxury Value Homes Increase by 14.3%

According to the McLennan CAD, in 2025, the most significant value increases were observed in residences with higher or luxury values. For instance, homes valued at $1.5 million or more increased in value by 14.3%, growing from $612 million to $699 million. In contrast, lower-value homes that range between $250,000 to $500,000 grew by 1.9%, rising from $10.5 billion to $11 billion. The graph illustrates that higher-value homes were likely reassessed more aggressively than lower-value homes.

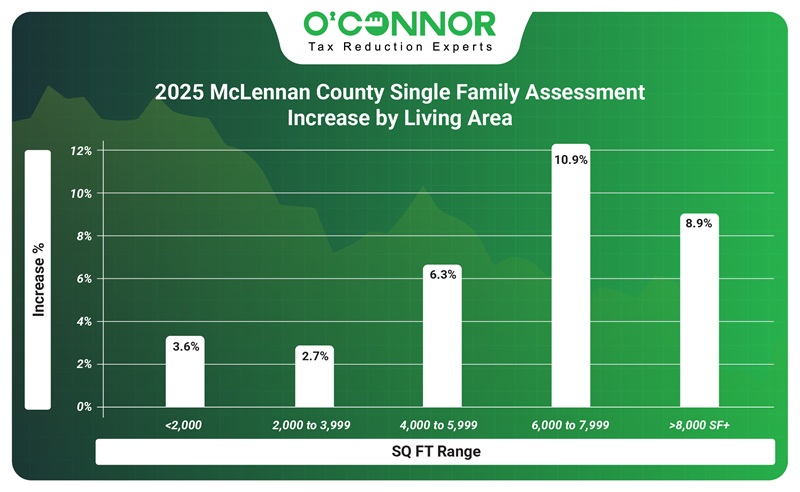

In McLennan County, property values per square foot generally rose with home size, with the largest homes seeing the steepest increases. Homes between 2,000 and 3,999 square feet experienced the smallest gain at 2.7%, while those between 6,000 and 7,999 square feet saw a significant 10.9% increase. Homes over 8,000 square feet also rose sharply, with their total assessed value climbing from $160 million to $174 million—an 8.9% increase.

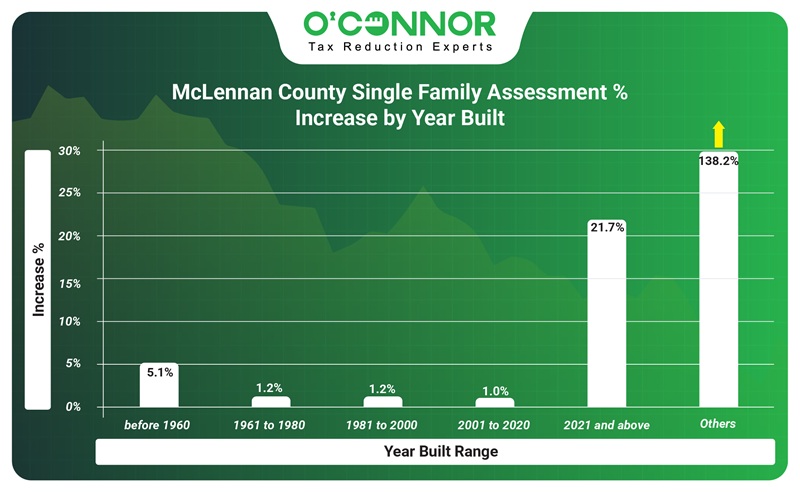

According to McLennan CAD, most homes saw minimal increases in assessed value based on their year of construction, except for newly built and undated homes, which experienced significantly higher increases. The lowest value increase was seen in houses built between 2001 to 2020 by 1.0%. Funny enough, houses built in 2021 and later rose in value by 21.7%, which was the highest in value with a construction date assigned. Contemporary homes that were built in 2021 and later grew in market value from $1.5 billion in 2024 to $2 billion in 2025. Homes without an assigned construction date significantly increased by 138.2% in 2025. This could undermine fair property assessments and raise concerns about how values are being calculated without key information like a home’s age.

28% of Homeowners Face Unfair Value Assessments in 2025

Based on 2024 house sales prices and the 2025 reassessment of property values, McLennan County overestimated 28% of county residences in 2025. This suggests that 28% of homeowners may face inflated tax bills because their properties were assessed above market value, carrying a larger share of the tax burden. Meanwhile, 72% of the homes were assessed below their market value. While the majority of homeowners benefited from conservative assessments, a significant minority may be unjustly penalized unless they take action to challenge those inflated valuations.

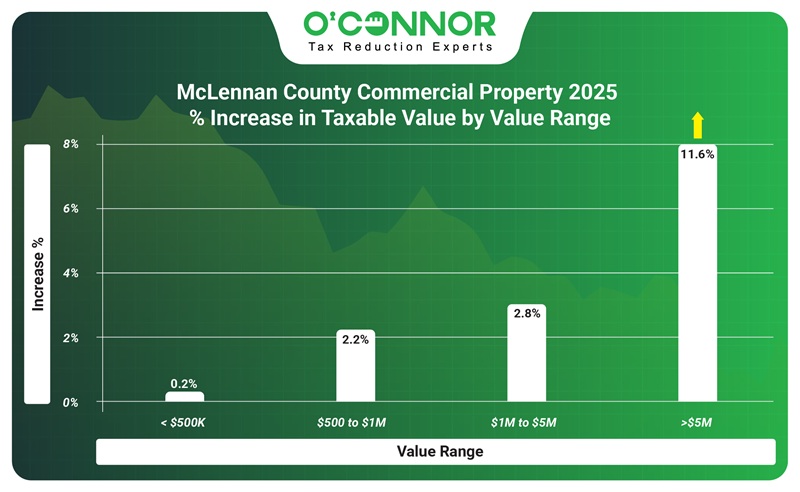

High-End Commercial Property Owners Face High Increases

An analysis of commercial property tax assessments in McLennan County by value range shows that valuable or high-end property increased the greatest in value. Properties valued at $500,000 or less experienced the lowest increase of 0.2%, growing less than $1 billion from 2024 to 2025 in market value. In comparison, commercial property worth $5 million or more experienced an increase of 11.6% with a 2025 notice market value of $7 billion.

For the 2025 tax year, McLennan CAD raised the market values across all categories of commercial properties. The largest increases in value were seen in hotels with 24.4% and apartments with 18.7%. The jump in assessed values may indicate that these properties were previously undervalued, and the appraisal district is now aligning them more closely with current market trends. Land faced the lowest value increase in assessment by 0.8%.

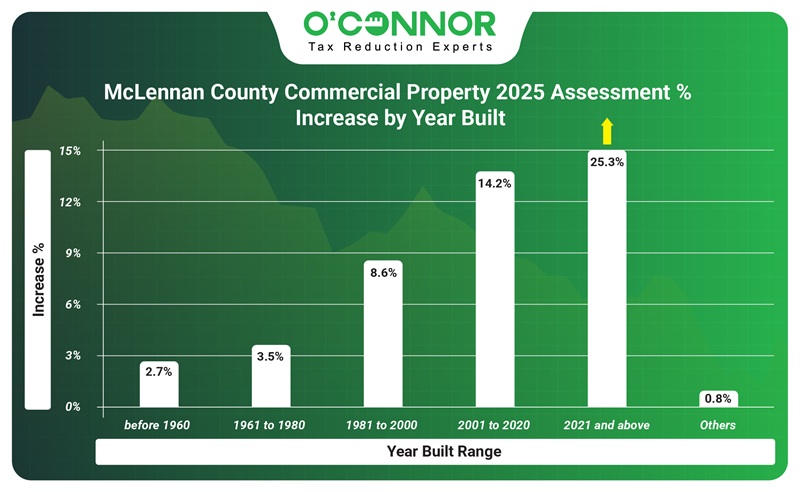

McLennan CAD’s commercial property assessments for 2025 have increased across all construction years, with a particular emphasis on recently constructed properties. The highest increase in value was seen in commercial property built in 2021 and later with 25.3%, rising greatly from $546 million to $684 million. In contrast, property built before 1960 saw a modest increase of 2.7%. This disparity highlights a market shift favoring newer commercial developments, possibly due to modern amenities, energy efficiency, better locations, or higher investment interest.

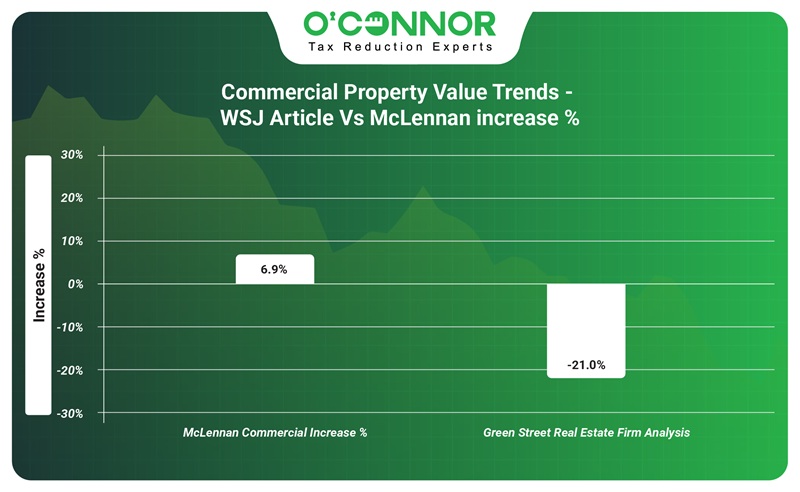

The Growing Disconnect Between Property Values and Market Data

The 2025 commercial property tax reassessment by McLennan CAD stands in sharp contrast to findings from Wall Street firm Green Street Real Estate Advisors. While Green Street reports a 21% decline in commercial property values since their 2022 peak, McLennan CAD indicates a 6.9% increase in those same values over the past year. This divergence highlights a significant discrepancy between local tax assessments and broader market trends.

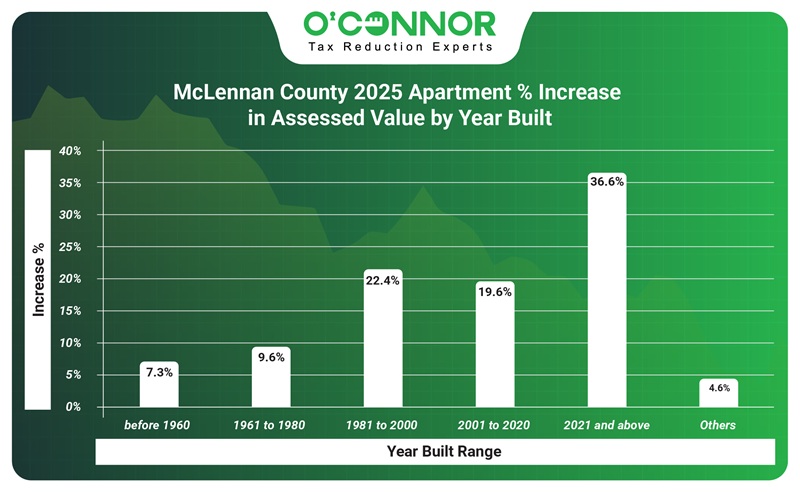

New Apartment Buildings Fall Victim to High Increases

The data reveals no consistent pattern between the age of apartment buildings and the rate of increase in 2025 property tax assessments in McLennan County. Despite the mixed trend, noticeably, newer apartment buildings are experiencing high value increases. In particular, apartments built in 2021 and later experienced an increase of 36.6%, growing from $109 million in 2024 to $148 million in 2025. Older apartments built before 1960 saw an increase of 7.3%.

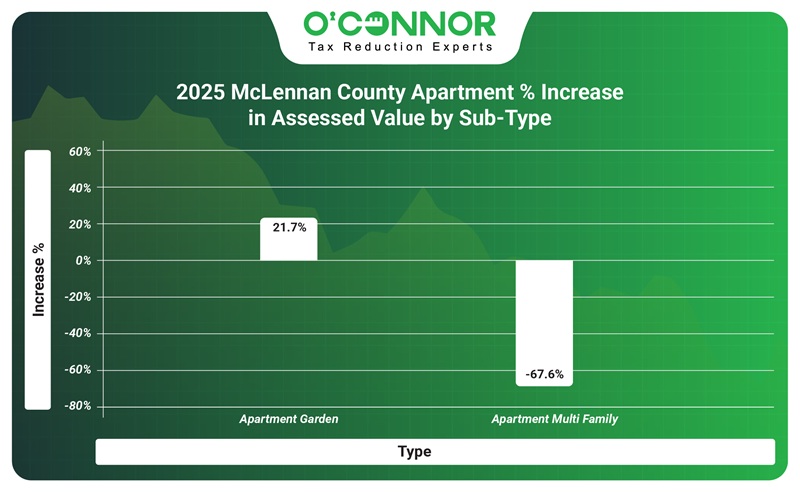

Apartment owners in McLennan County experienced a substantial property tax hike in 2025, with the CAD increasing the overall taxable value of apartment buildings by 18.7%. Despite the high increase, one apartment subtype faced a decline in 2025. Multifamily apartments experienced a decline of 67.6%, dropping from $59 million in 2024 to $19 million in 2025. On the other hand, garden apartments increased in value by 21.4%, growing from $2 billion to $2.2 billion in the past year. This contrast reflects changing tenant preferences, shifts in development trends, or differences in location, amenities, or management.

Modern Office Buildings Face a Striking 48% Value Increase

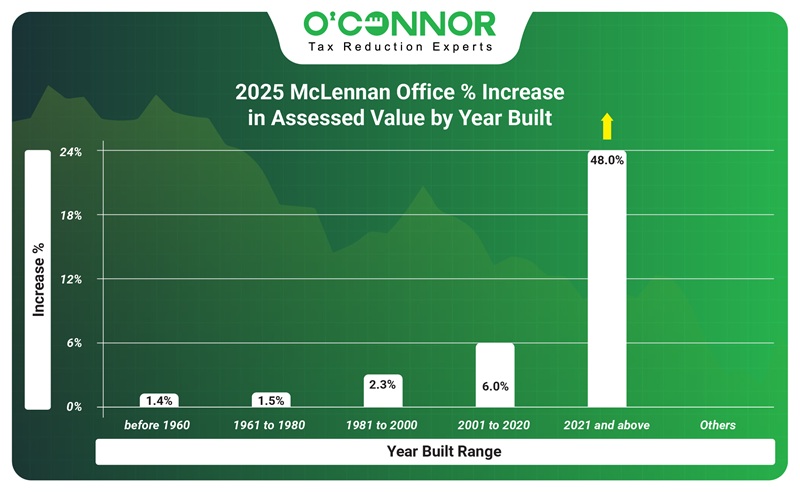

According to McLennan CAD reports, property tax assessments for 2025 office buildings have increased tremendously for modern or new offices. The greatest value increase was seen in newly constructed office buildings in 2021 and later by 48%, growing in value from $63 million to $93 million in the past year. Older offices experienced very little increases. For example, offices built before 1960 increased in value only by 1.4%. This data paints a picture of the growing inequality in property valuations within the same asset class, driven largely by age, condition, and likely location.

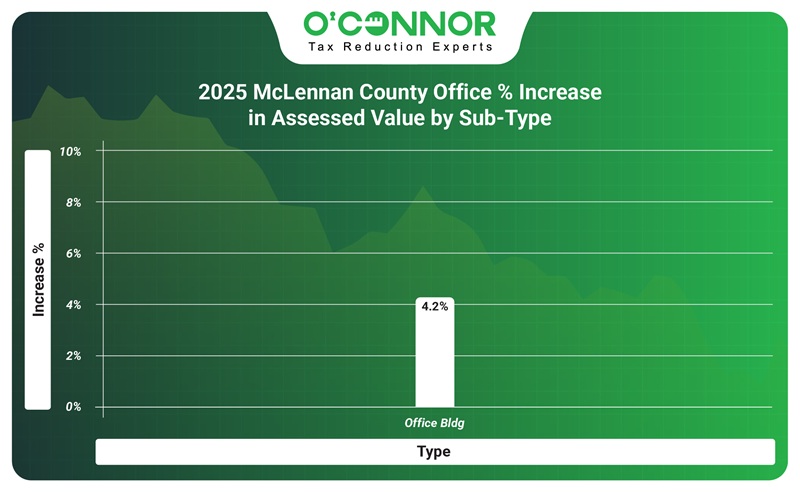

In McLennan County, only one office subtype was reported for property tax assessments in 2025. Standard office buildings increased by 4.2%, rising from $2.2 billion to $2.3 billion.

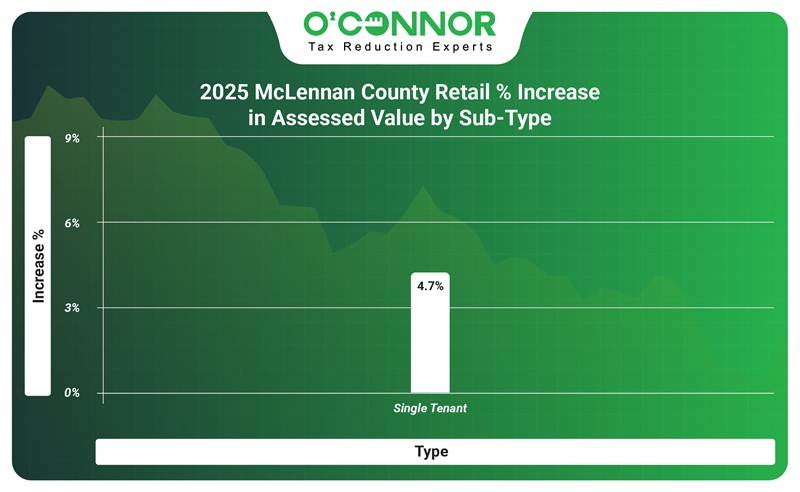

Retail Property Value Averaged 4.7% Increase

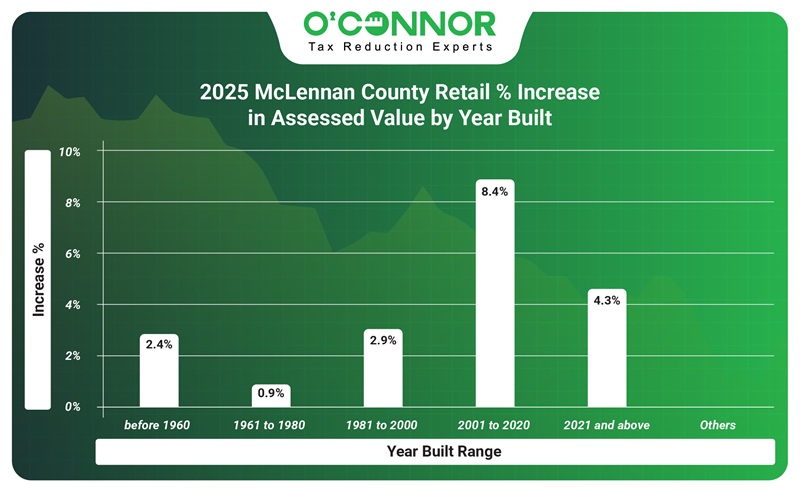

Property tax assessments for retail buildings in McLennan County increased for all years-built categories. Retail properties constructed between 1961 and 1980 saw a slight growth of 0.9%, while those built between 2001 and 2020 experienced a bigger increase of 8.4%. The market value between 2024 and 2025 grew from $1.2 billion to $1.3 billion.

There was only one retail subtype reported by McLennan CAD and that property assessment value increased by 4.7%.

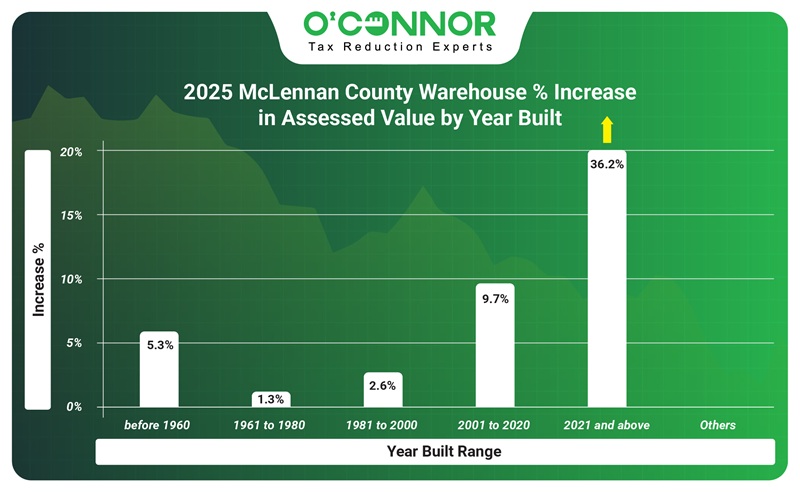

Recently Built Warehouses Take the Hardest Hit

All warehouse property owners in McLennan County witnessed property tax increases, but owners of buildings built in 2021 and later face the greatest strain in 2025. Properties built since 2021 are seeing steeper increases, which implies a possible focus by the appraisal district on newer, likely higher-value or more modernized structures. Warehouses built in 2021 and later increased in value by 36.2%, growing from $203 million to $277 million. In comparison, warehouses built between 1961 and 1980 increased by 1.3%.

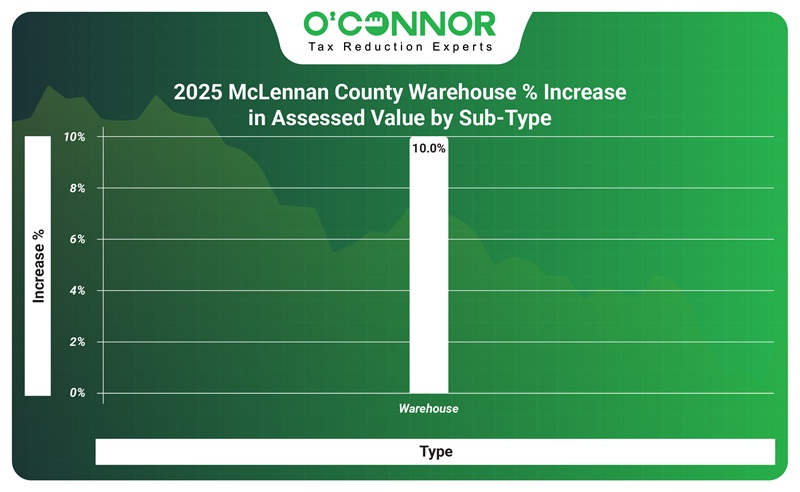

McLennan CAD assessed the market value of only one warehouse subtype in 2025. Standard warehouses increased by 10% in assessment value. The total market value grew from $1.5 billion in 2024 to $1.7 billion in 2025.

McLennan CAD’s 2025 Property Revaluation Takeaways

The 2025 property reassessment in McLennan County reveals a clear pattern: high-value residential and commercial properties are experiencing the most significant tax increases. While the average residential value rose by 3.5%, owners of luxury homes, larger properties, and new construction saw much steeper hikes.

This was mirrored in the commercial sector, where high-value properties faced increases averaging 6.9%. These trends may indicate that the appraisal district may be shifting the tax burden toward higher-end properties. The commercial real estate market appears to be favoring newer assets, possibly due to changing workplace expectations, sustainability standards, or investor preferences.

Although 72% of homes were assessed at or below market value—a reassuring figure for most—28% were overvalued, potentially subjecting those property owners to unfair and inflated tax obligations.

Consistent Property Appeals Are Your Best Defense Against Rising Taxes

Property owners in McLennan County, Texas have the opportunity to successfully appeal their property tax assessments. Whether the property is residential or commercial, the appeals process provides a chance to present evidence that supports a lower valuation. Filing an appeal independently can cause stress and be time-consuming due to its complexity. Partnering with a property tax consulting firm like O’Connor can be highly effective, as the majority of protests result in a reduction. For over 50 years, O’Connor has helped property owners minimize their tax burdens through strategic, cost-effective solutions.