Like any other area in the orbit of the Dallas-Fort Worth metroplex, Wise County has both an independent lifestyle and one that is influenced by its neighbors. Closer to Fort Worth than Dallas, Wise County has a more rural aesthetic compared to swanky suburbs like Denton or Collin counties. Known for bountiful natural resources and expansive land, Wise County is a keystone area in the DFW sprawl. While not stereotypically suburban or exurban, Wise County is seeing a growing influx of commuters looking to escape crowding in the urban jungle. This has led to rising property taxes and values for both homes and businesses.

Property taxes are usually the largest single expense a Texas taxpayer will see. While Texans have long relied on exemptions to keep property values in check, property tax appeals are becoming another popular option. Once only a technique for the rich, these protests are now being used for every property type. Now that both informal and formal appeals have been finished, we can examine just how effective they were in 2025 in reversing rising taxes.

Combined Appeals Help to Rebound from Rising highs

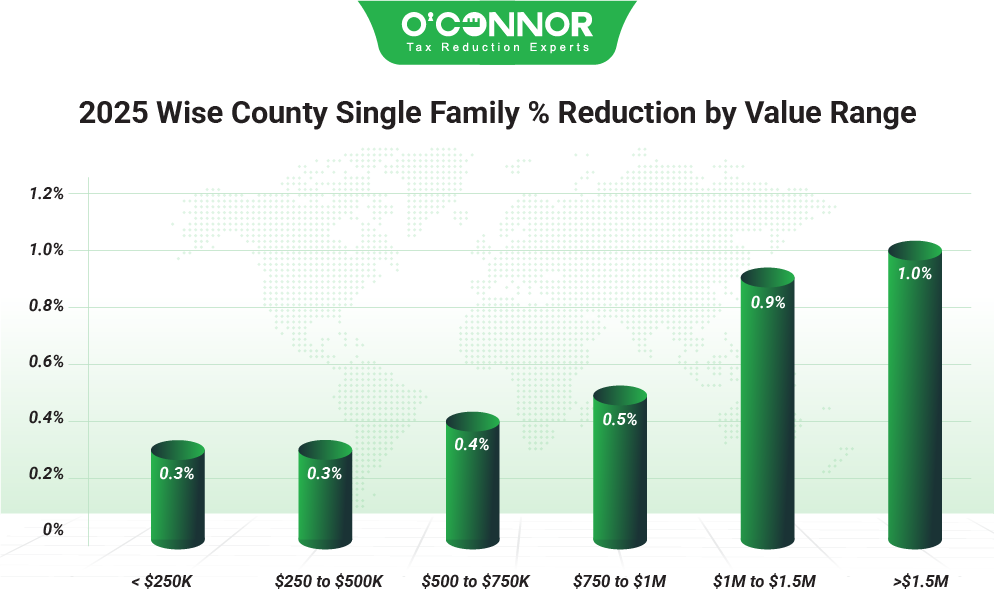

In 2025, the Wise County Appraisal District (Wise CAD) increased residential property values dramatically, raising the total assessed value by 6.5% to $6.97 billion. Homes of all prices and sizes experienced this upswing. Combined appeals were able to drive values back in places, eventually reaching a reduction of 0.4%, bringing the total down to $6.94 billion. Falling 0.3%, homes worth between $250,000 and $500,000 were in the No. 1 spot with $3.33 billion. Homes assessed from $500,000 to $750,000 were reduced by 0.4% to $1.79 billion. Modest homes worth under $250,000 were able to earn a cut of 0.3%, falling to $849.94 million. Generally, the more expensive the home, the greater the reduction. O’Connor was able to get homeowners stronger returns, netting an overall reduction of 1.3%.

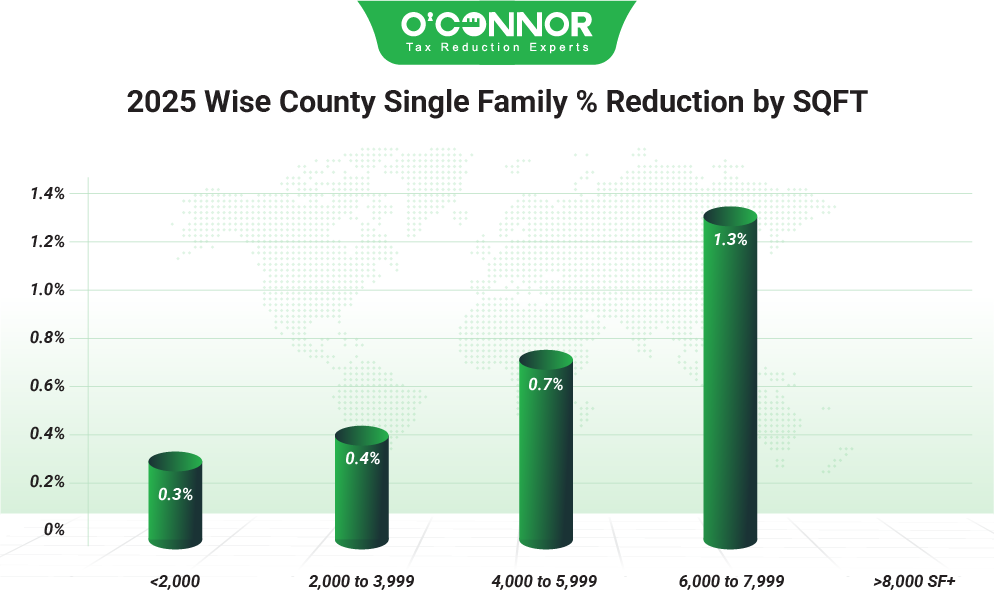

While stacked with residential value, there are very few mansions in Wise County, with most homes being of modest sizes. Residences between 2,000 and 3,999 square feet were the most valuable, with a total of $3.60 billion following a cut of 0.4%. Homes under $250,000 experienced a reduction of 0.3%, falling to $2.92 billion. The largest reductions were 0.7% and 1.3%. These were for homes measuring 4,000 to 5,999 square feet, and those assessed at 6,000 to 7,000 square feet respectively. True luxury homes received no reductions of note.

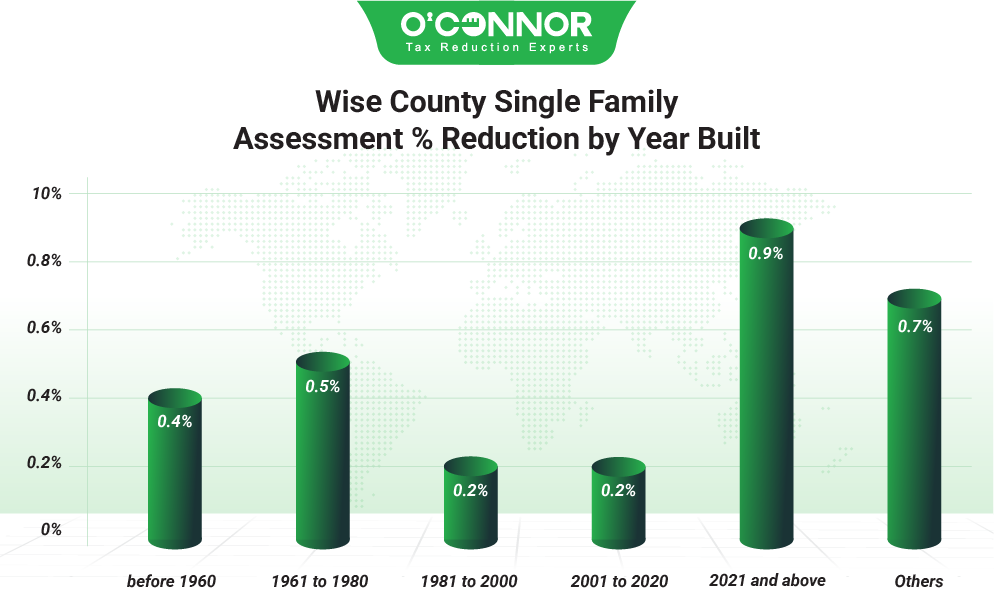

A good indication of how much Wise County is growing is to look at the major recency bias in home construction. The most valuable timeframe for construction is the boom period from 2001 to 2020, which produced $2.82 billion in value after a reduction of 0.2%. Homes from 1981 to 2000 got a cut of 0.2%, totaling $1.48 billion. New construction jumped up by 28.3%, totaling $1.34 billion. This was eventually lowered by 0.9% to $1.33 billion. All other homes combined account for only 18% of the total value.

Commercial Properties Shed $25.55 Million in Taxable Value

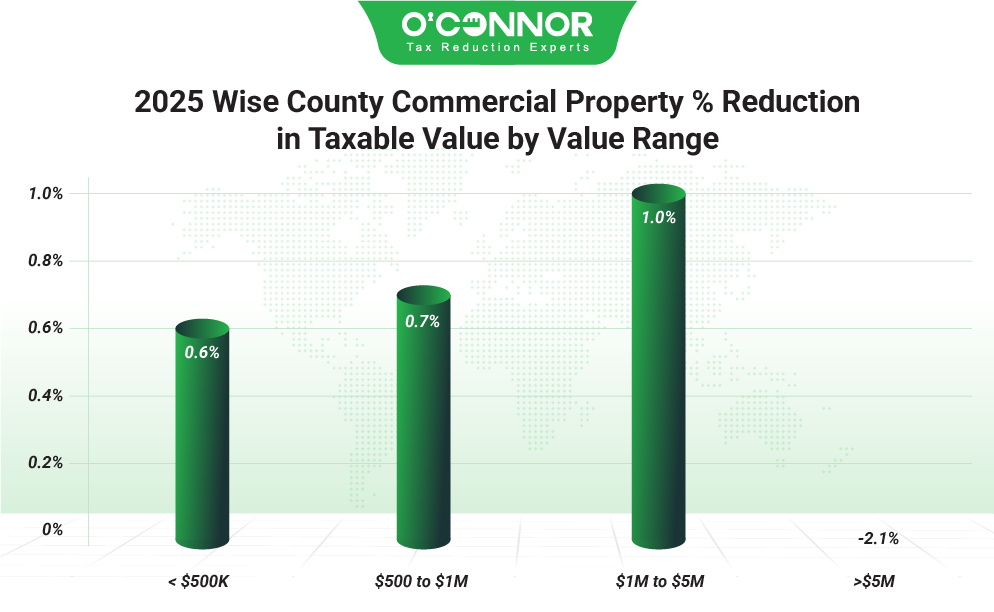

Wise CAD hit business owners with similar value increases to homeowners, assessing an increase of 6.5%, which meant a final tally of $5 billion. Organized resistance through appeals managed a reduction of 0.4%, bringing the total down to $4.98 billion. Wise County was unusual, in that businesses worth over $5 million were the least valuable when combined. Usually, these properties can hog up to 50% of a county’s value. However, those in Wise only reached $669.94 million with no reduction. Businesses worth between $1 million and $5 million saw a reduction of 1%, achieving a total of $1.77 billion. Commercial real estate assessed at $500,000 to $1 million totaled $1.19 billion, while those under $500,000 reached $1.36 billion. These were cut by 0.7% and .06% respectively. We at O’Connor partnered with our clients to earn an overall reduction of 12.4%, including 24.9% for businesses worth between $500,000 and $1 million.

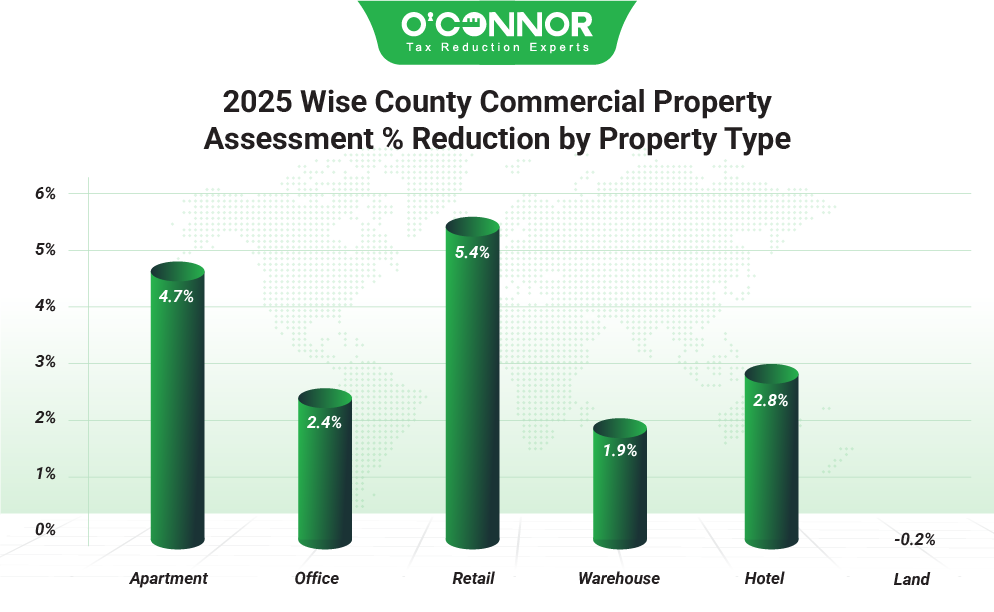

Like many counties that are rural in origin, Wise’s top commercial property is raw land at $4.10 billion. This did not receive any type of reduction, which hampers lowering the overall total. Warehouses were the No. 1 developed property type, dropping 1.9% to $269.95 million. Offices were right behind with $256.29 million, following a cut of 2.4%. Retail landed a strong reduction of 5.4%, securing a final tally of $133.97 million. Dropping 4.7%, apartments achieved a total of $155.52 million.

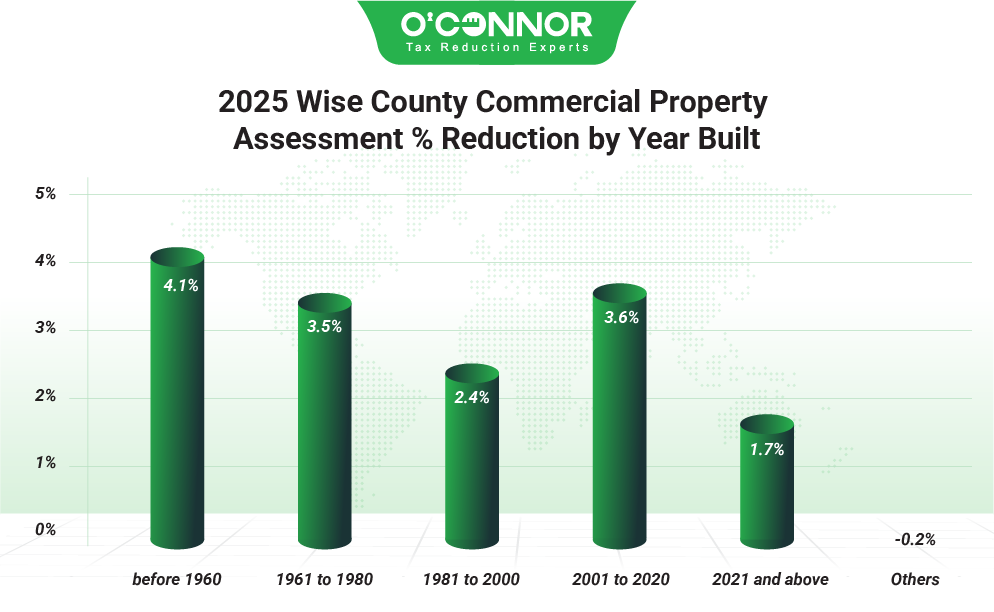

Commercial property did not lean as heavily on recent construction as homes, though the huge value of raw land can certainly throw off averages. Like homes, the period from 2001 to 2020 provided the most value outside of raw land, reaching $452.87 million after being lowered by 3.6% by appeals. Business real estate from 1981 to 2000 was next with a reduction of 2.4% and a total of $253.21 million. New construction reached $85.01 million after being cut down by 1.7%. This had previously climbed 56.5%. The two oldest property types saw some of the best reductions in the county.

Apartment Owners That Used O’Connor Quadrupled Their Savings

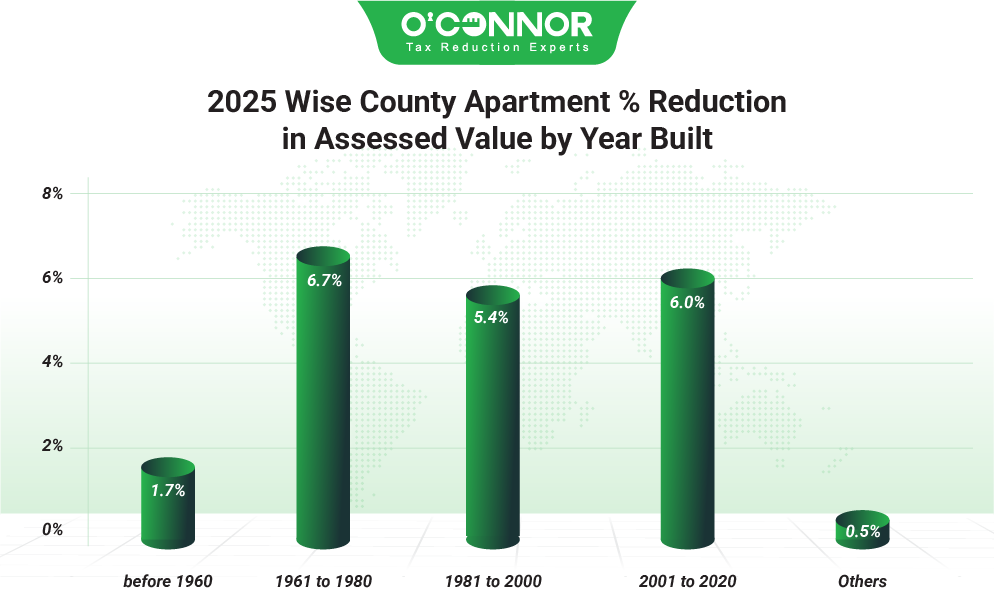

Apartments are usually the most valuable of commercial properties in most major counties, but due to Wise’s rural nature, they are a relatively small aspect of the whole. Totaling $163.13 after an initial increase of 27.9%, apartments saw the largest value spike in the county. This was later protested down by 4.7%, reaching a new total of $155.52. The recency bias observed for homes was just as strong for this multifamily housing, with $74.40 million in value coming from the period of 2001 to 2020. New construction reached a final total of $33.53 million. These figures were the result of cuts of 5.4% and 6% respectively. Those built from 1981 to 2000 contributed $33.50 following a reduction of 5.4%. We at O’Connor were able to bring in a massive decrease of 19.4% for our clients, over four times the county number.

Offices Slice off $6 Million Thanks to Protests

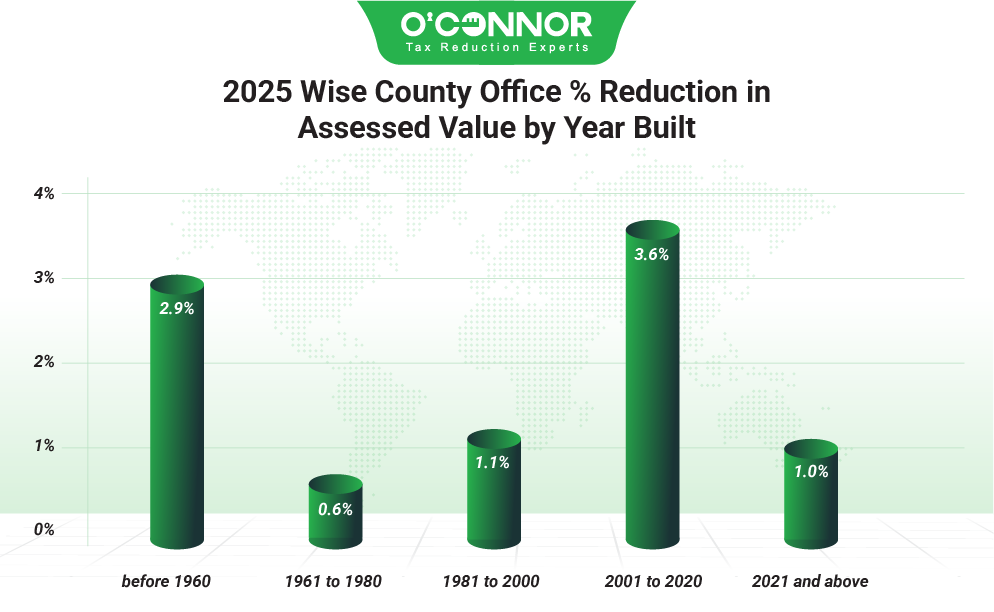

Offices lagged behind only raw land and warehouses when it came to value. Originally spiking by 15.7% to $262.47 million, offices were eventually protested down 2.4% to $256.29 million. 80% of all office value was constructed between 1981 and 2025. The largest category was once again the boom era of 2001 to 2020, which contributed $111.15 million after dropping 3.6%. Those from 1981 to 2000 were responsible for $82.54 million, which was the result of a reduction of 1.1%. New construction added $13.36 million, which came after a drop of 1%. When office owners joined O’Connor for their protest, they saw an improvement in their results, with a total reduction of 6.2%.

Warehouse Taxable Value Decreased by 1.9%

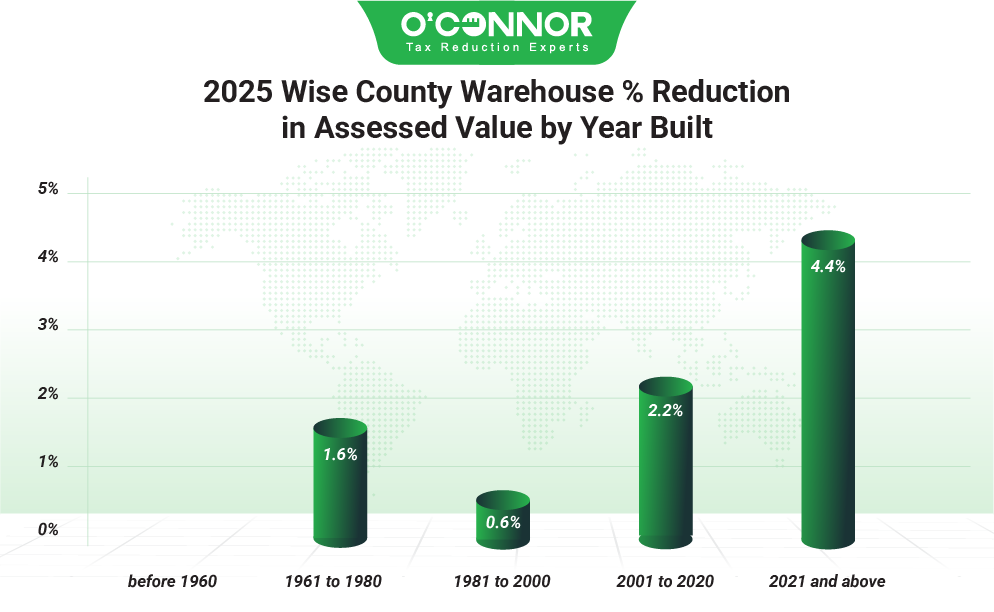

Warehouses are the No. 1 commercial property outside of raw land. Wise CAD initially handed out an increase of 12.6%, but this was countered with a battery of appeals that produced a reduction of 1.9%, which resulted in a final tally of $269.54 million. 85% of all value was constructed between 1981 and 2025, showing just how much the county has grown in the last few decades. $134.33 million came from 2001 to 2020 alone, which was thanks to a decrease of 2.2%. Those from 1981 to 2000 saw a reduction of 0.6% to $67.06 million. New construction managed to get a reduction of 4.4%, dropping to $26.81 million. Warehouses constructed from 1961 to 1980 still held value, reaching $36.70 million after being cut by 1.6%. O’Connor once again delivered for our clients, managing an overall decrease of 12.5%.

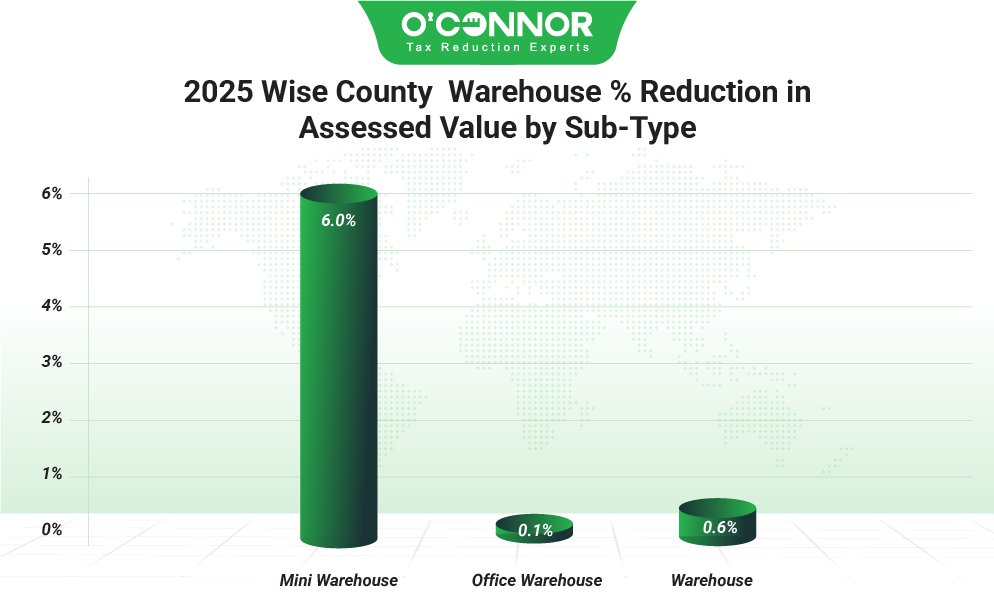

Wise CAD divided warehouses into a few different categories to aid in evaluation. Generic warehouses were the largest category with $185.44 million, receiving a reduction of 0.6%. Mini warehouses were in the No. 2 position with $61.80 million, while office warehouses managed to land $61.80 million. These saw reductions of 0.1% and 6% respectively.

Wise County Primed for Greater Appeals

In a common theme for rural counties surrounding metro areas, Wise County saw little participation in the tax appeal process. In 2023, roughly 5% of all properties were protested. This pales to the likes of Fort Bend or Galveston counties, which routinely see rates of 30% or more. While it is common to see high-dollar counties challenge at astronomical rates, taxpayers should not be complacent in other counties. Many areas can quickly see their values skyrocket, especially as DFW continues to grow, and counties like Denton and Collin become unaffordable for both new and old owners. Protests also keep Wise CAD honest, meaning they will have to be careful with the tax bills for all properties, not just those that protest. The best aspect of protesting taxable value is that there is no risk involved. Values can never be increased by protests, so even a failed effort will not harm a taxpayer.

We at O’Connor did well for our Wise County clients, beating the county average in virtually all categories. This should demonstrate why it is so important to have experts by your side when it comes to appeals. Informal appeals can be seen as simple, but formal hearings and especially judicial appeals need a professional touch. With over 185,000 clients across the nation in 2024, we at O’Connor have been fighting appraisal districts from Texas to Illinois. However, our true passion is fighting for our clients in Texas, our home state. Being based in Texas, we know how appraisal districts work and how best to represent our clients when it comes to protests of all kinds. There is no fee to join O’Connor, and you will only be charged if we can lower your taxes. Even better, we will protest your taxes for you annually, compounding each victory into greater savings.