Harris County Home Owners Face Excess Property Taxes of $1.365 billion

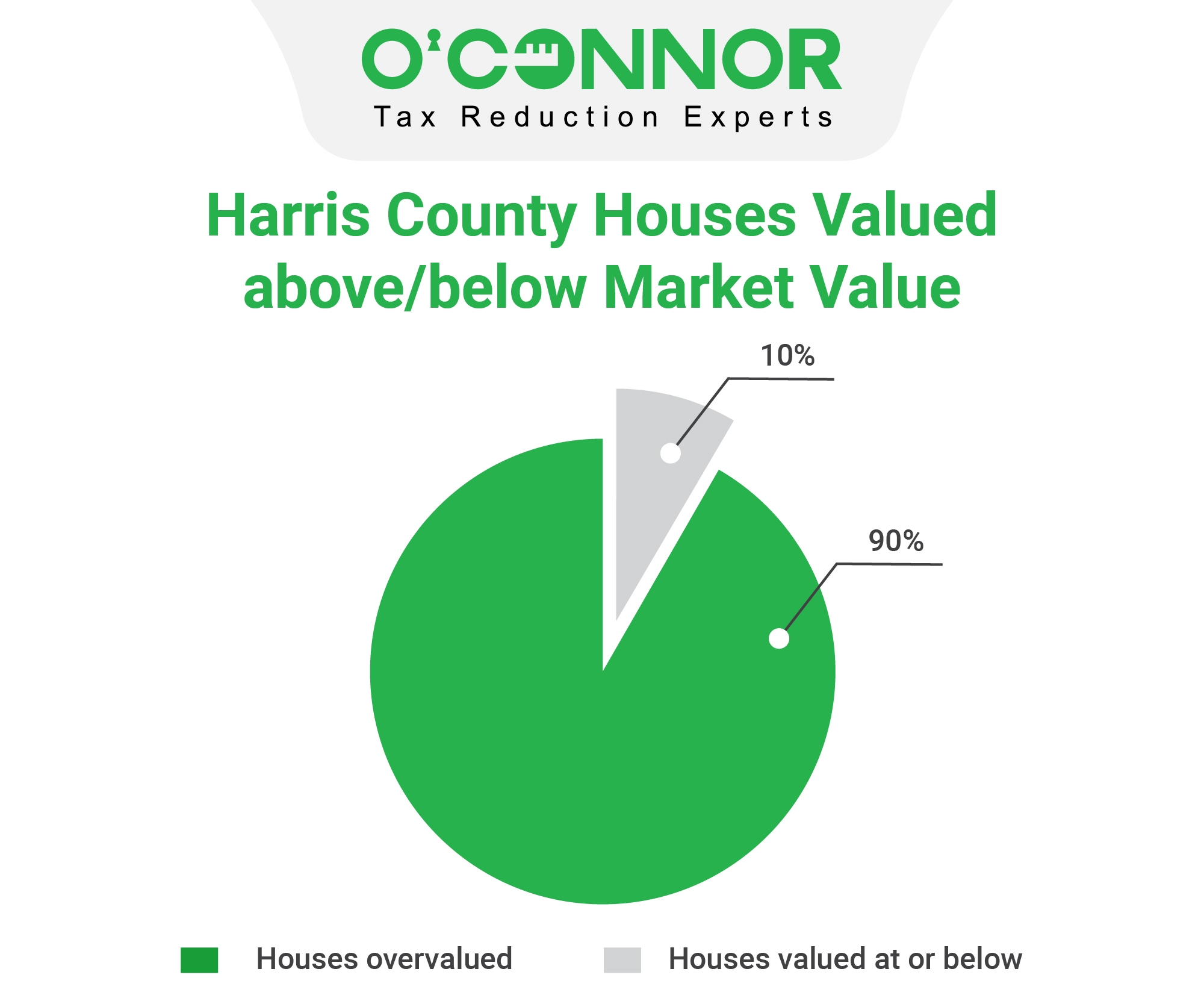

Harris County home owners are being taxed based on 116.2% of the value of their property, based on an analysis by O’Connor. Over 90% of Harris County home owners received notices of assessed value that exceed the market value of the property. Before considering protests of the 2023 value, the excess assessment will generate excess property taxes of $1,365,000,000 for Harris County home owners according to O’Connor.

90% of Harris County houses are valued in excess of the January 2023 market value based on a study of over 50,000 Harris County single-family sales from January 2022 to March 2023. Home sale prices were adjusted for market conditions since values spiked upward in 2023 and then decline to just above the January 2022 level in 2023. The comprehensive study includes houses, lots, condos, townhomes, duplexes, triplexes, fourplexes, etc.

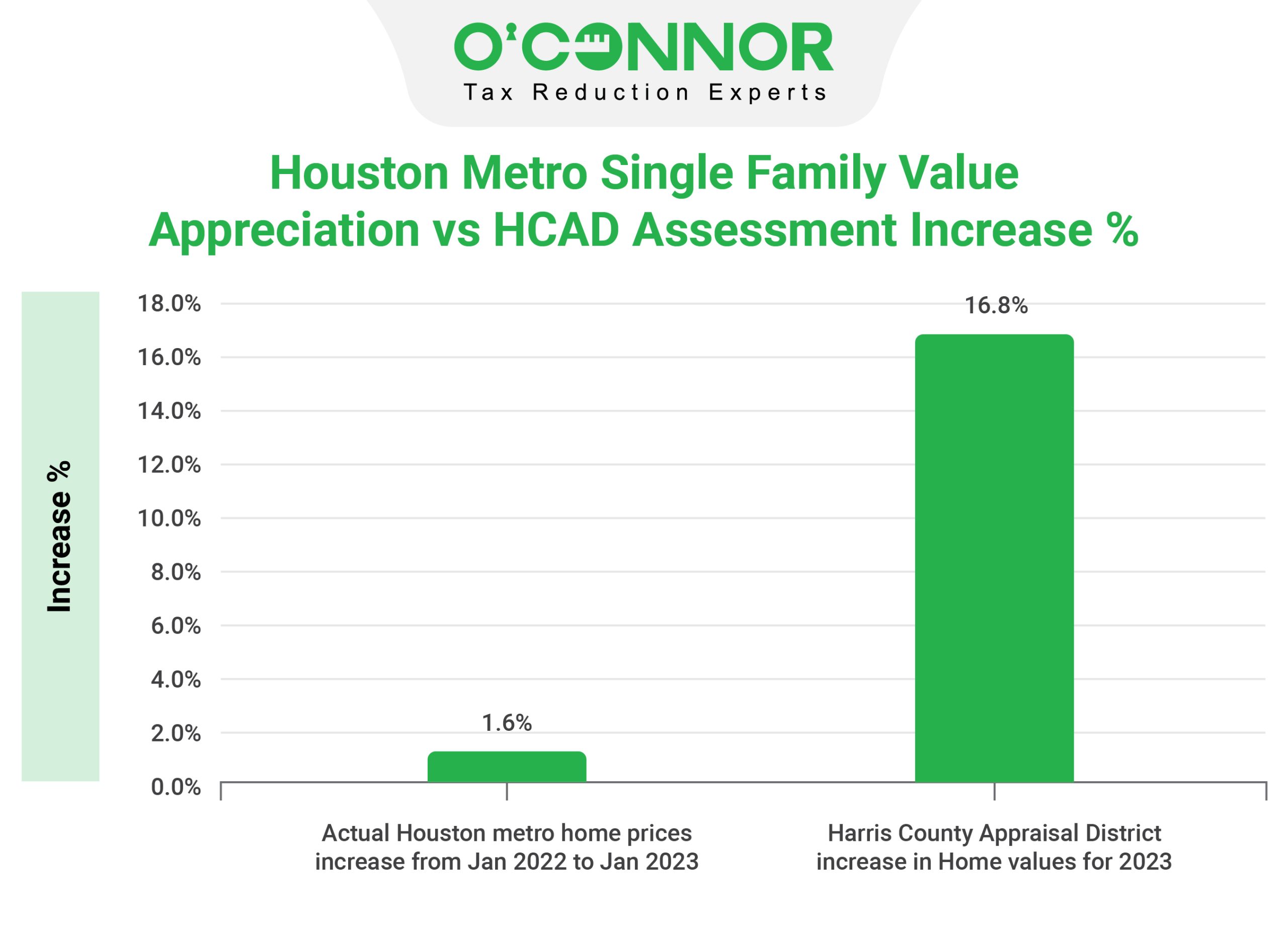

Home Prices Increase by 1.6% but Tax Assessments increase by 16.8%

Change in Home Value versus Tax Assessment

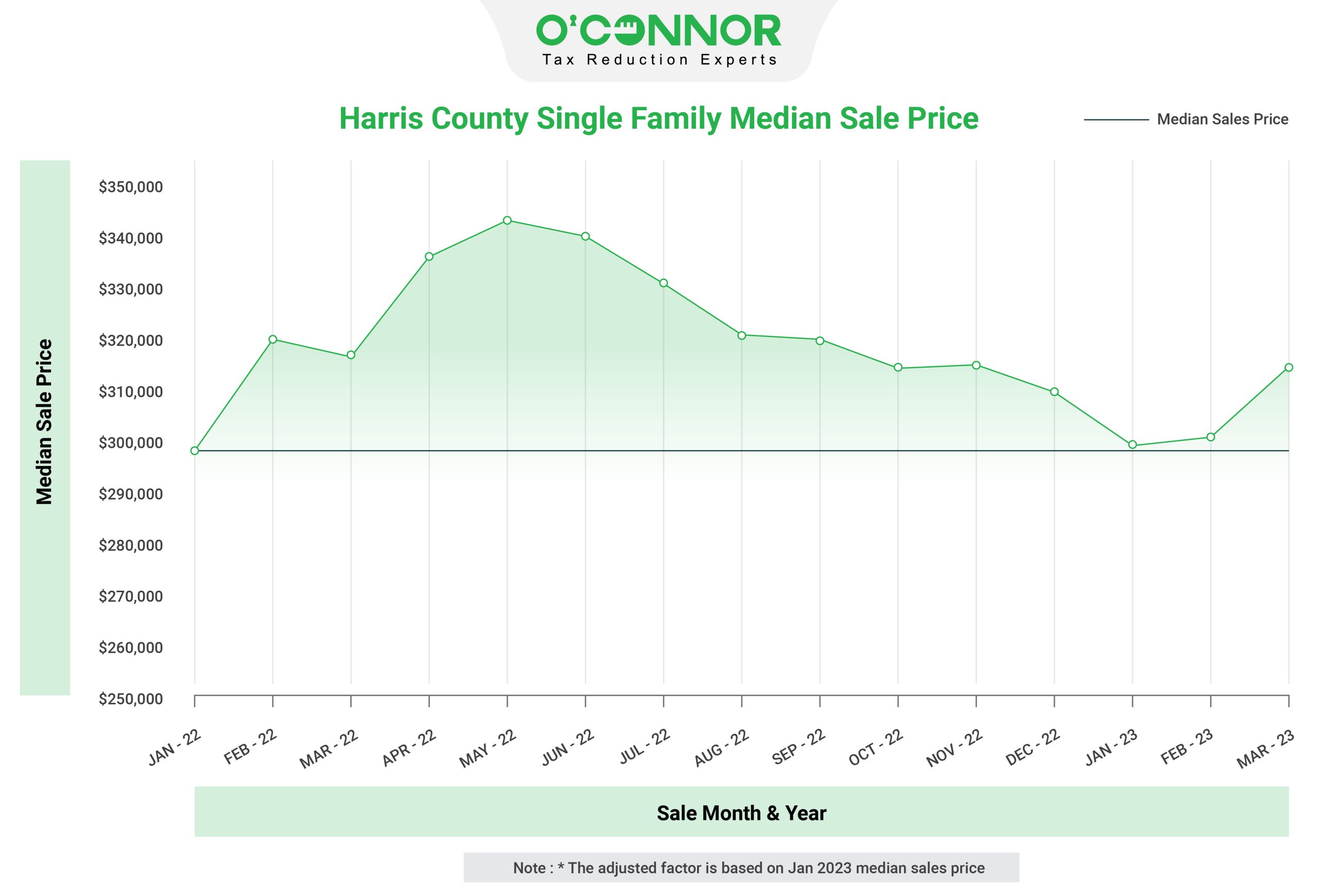

Home prices rose 1.6% during January 2022 to January 2023 while tax assessments increased by 16.8%. Yes, tax assessments are up about ten times as much as values rose. O’Connor conducted an analysis of 52,377 home and condo sales in Harris County for January 2022 through March 2023. The median home price was $289,000 in January 2022 and fell to $275,000 in January 2023, a 5% decline. Harris County Appraisal District reports tax assessments for county homes rose by 16.8% during the same period.

How Could this Happen?

Property tax assessments should be based on property value as of January 1 of the tax year (1/1/2023 in this case). Home values were erratic in 2022. Harris County home prices soared 14% in the first four months of 2022 before declining 11% during the next eight months. Harris County home prices peaked in May / June, and it appears the 2023 assessments were based on sales prices in May / June instead of January 2023.

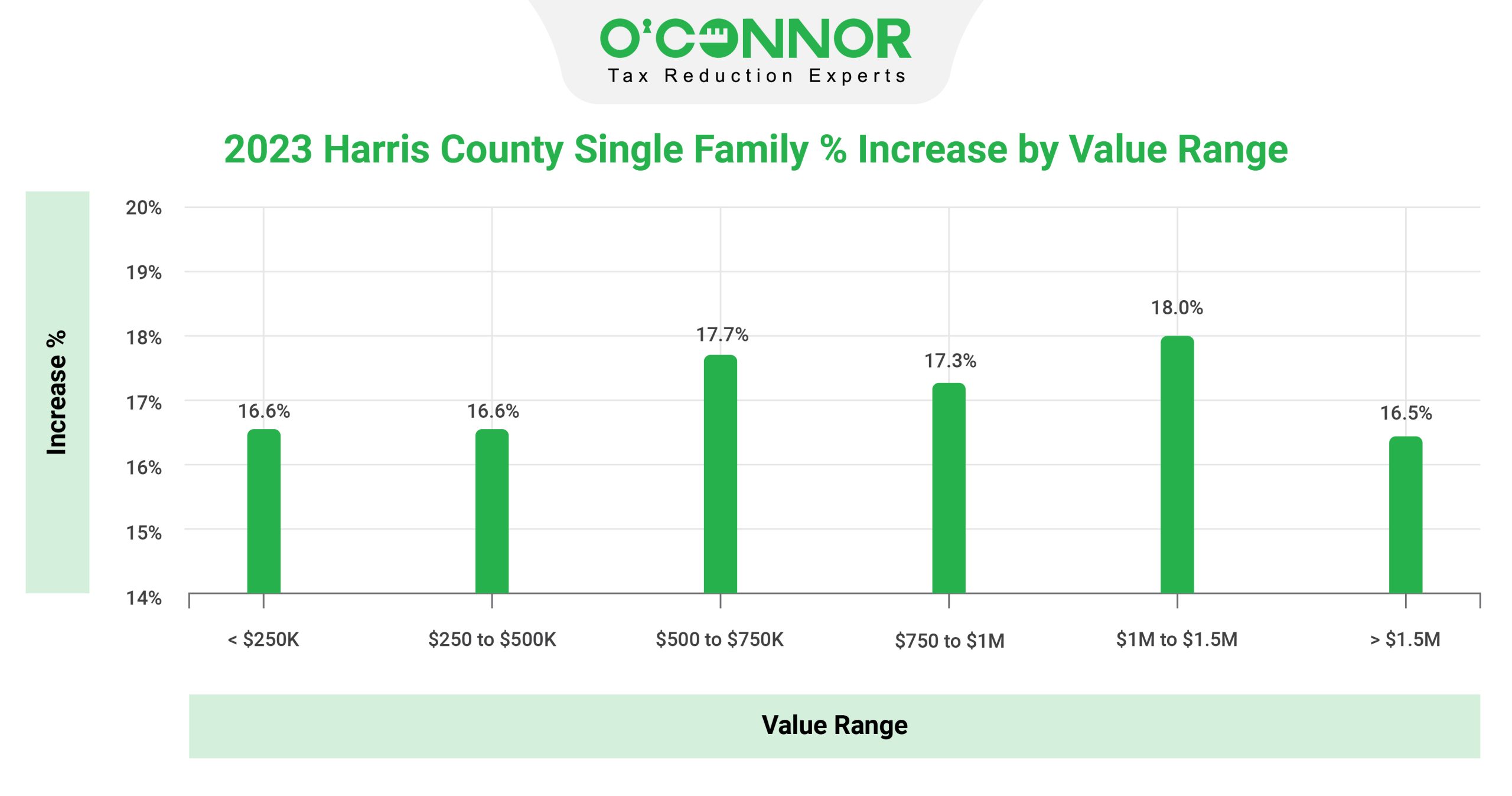

Harris County Assessed Values for Homes Increased by 16 to 18% for All Value Ranges

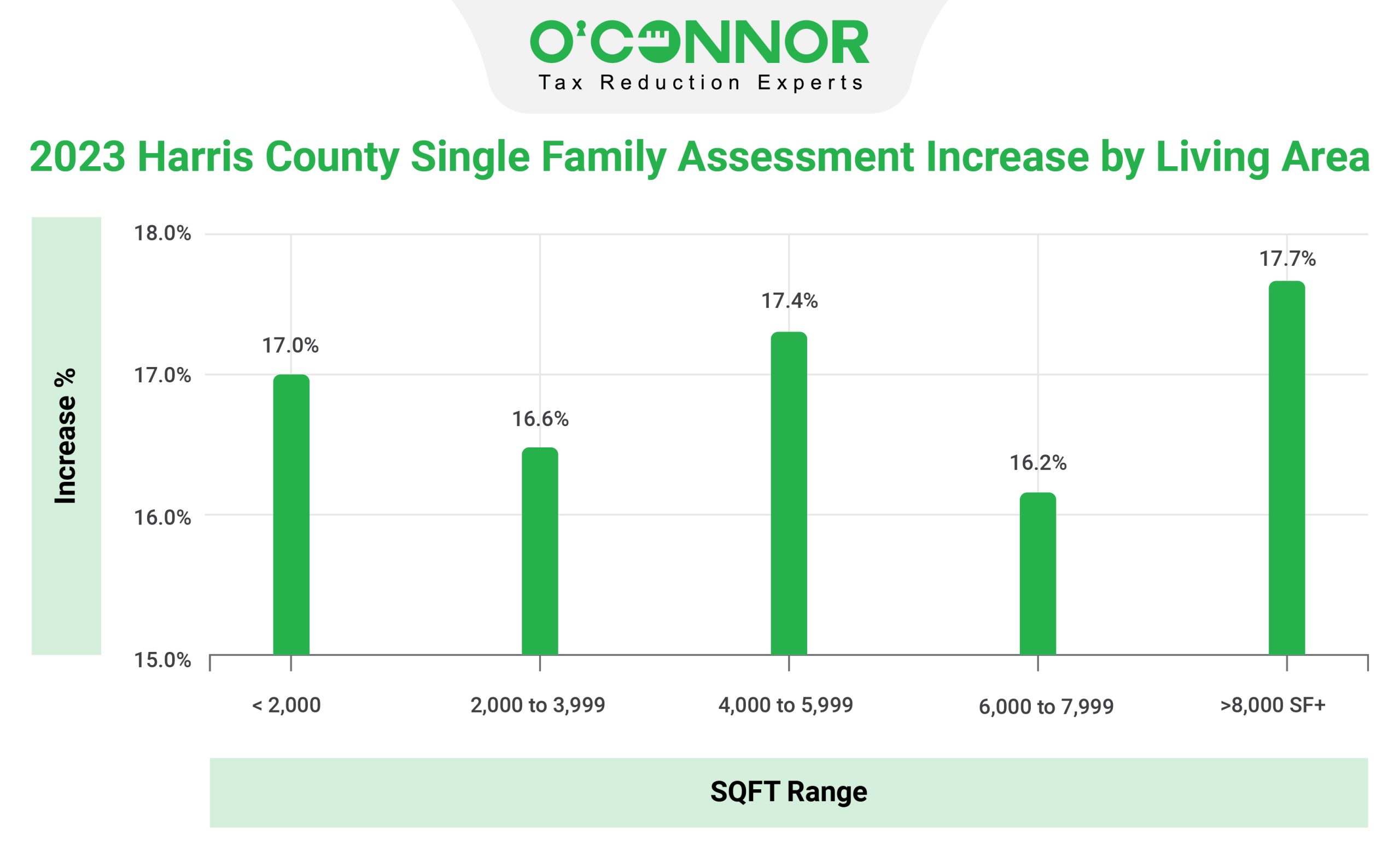

Harris County Single Family 2023 Assessment Increase by Living Area

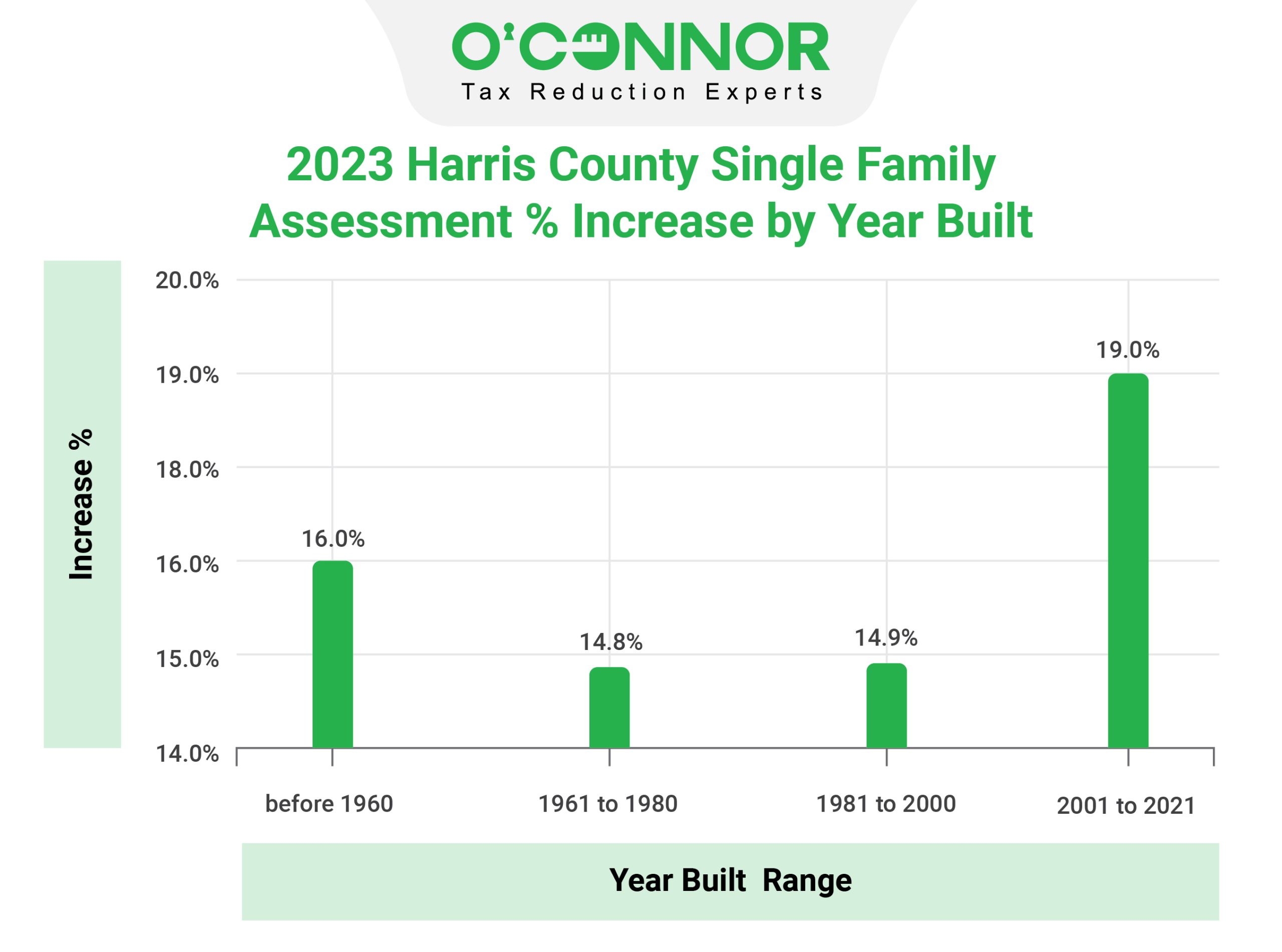

Harris County Single Family Assessment % Increase by Year Built

Homes built before 1960 and after 2000 saw the largest increases in property tax assessments in Harris County.

Harris County Property Tax Assessments for Commercial Soar as Values Tumble

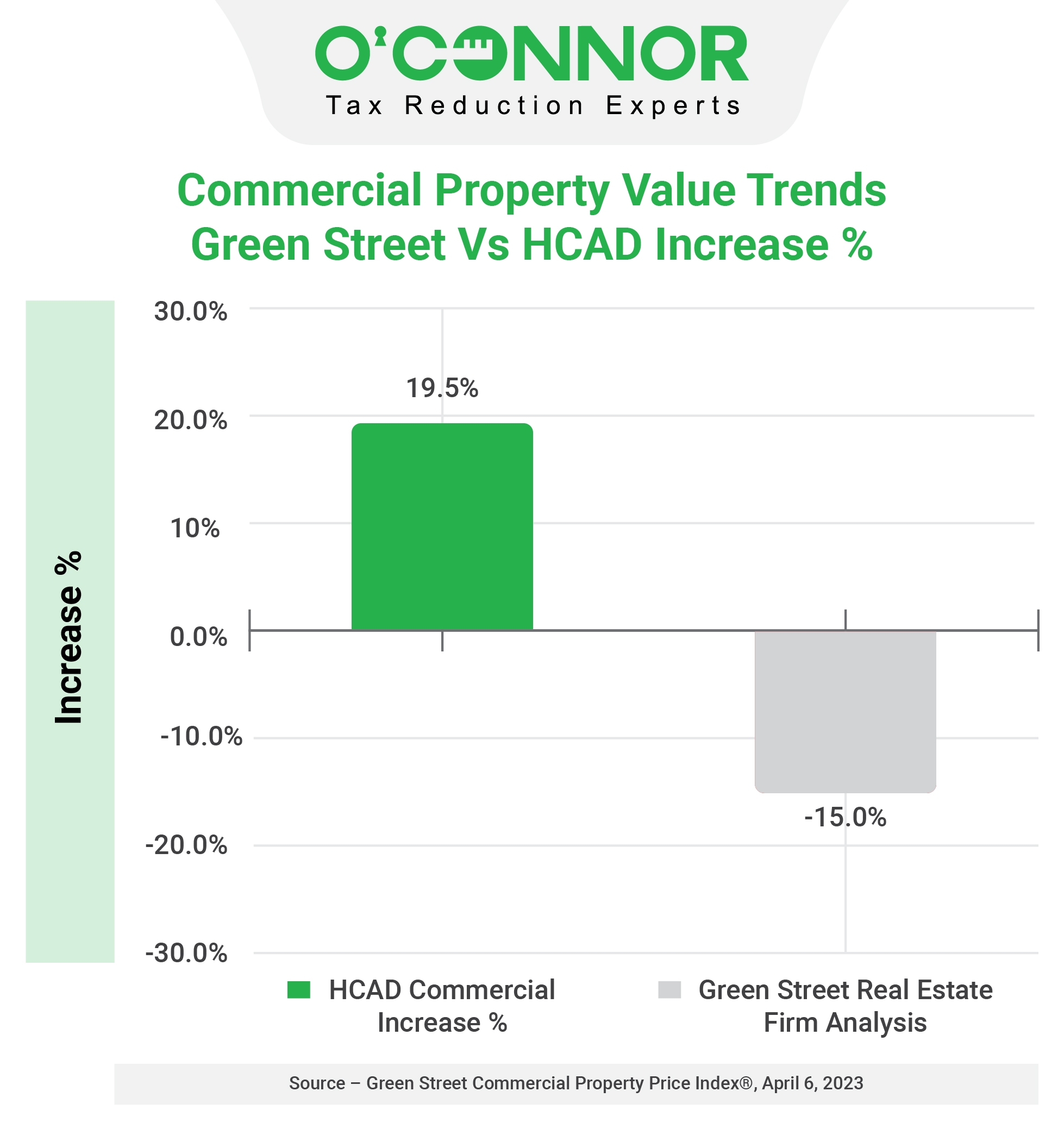

Harris County commercial property assessments rose by 20% but commercial values declined by 15 to 25%, depending on property type. This yields a spread of 35 to 45% differential between commercial property values and Harris County property tax assessments. The decline in value is based on the Green Street Commercial Property Price Index®, published April 6, 2023, and discussions with owners and brokers in Harris County.

Rising interest rates have hit the entire commercial real estate sector hard. Higher mortgage costs eat into landlords’ earnings and make it harder to refinance expiring loans. Rising yields on bonds and other securities also make real estate look less profitable in comparison, making buyers more reluctant to pay high prices and pushing down property values. Real-estate analytics firm Green Street recently estimated that U.S. property values are down 15% since March 2022.

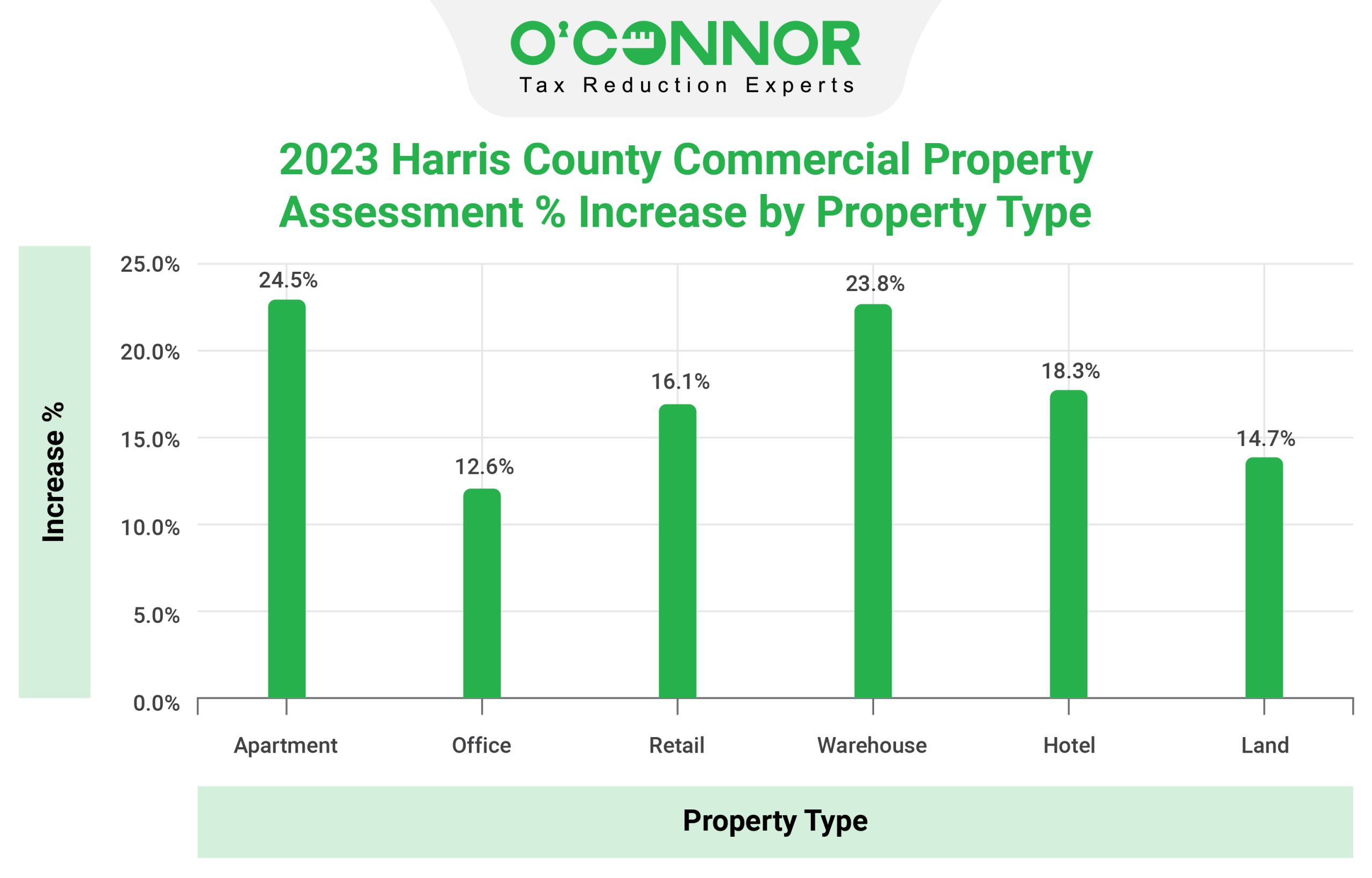

Harris County Commercial Property 2023 Assessment % Increase by Property Type

Property tax assessments soared by 13 to 24% depending on property type. All types of commercial property incurred substantial increases, averaging about 20% overall. Apartments and warehouses incurred the highest levels of tax assessment increases in Harris County in 2023.

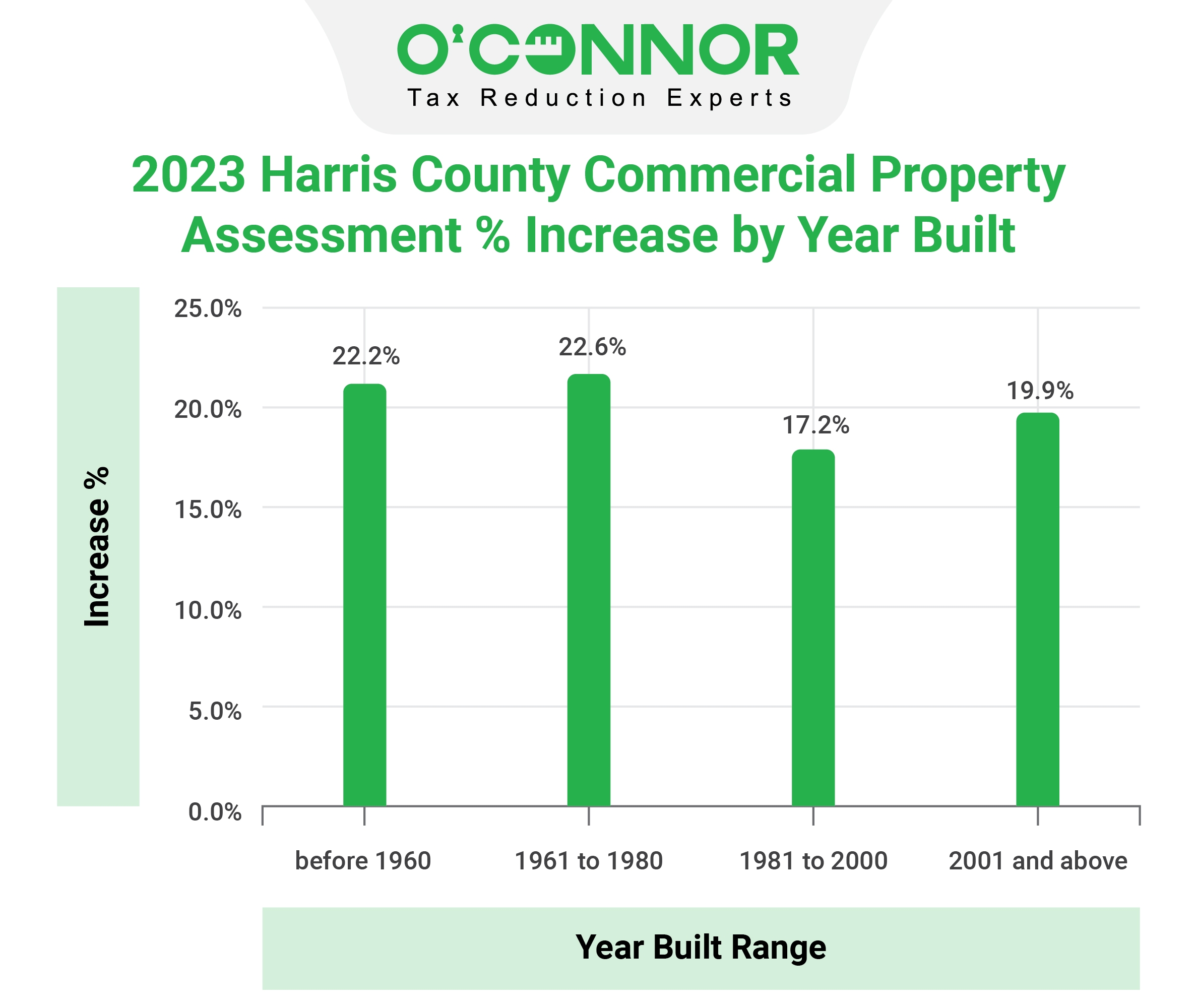

Harris County Commercial Property 2023 Assessment % Increase by Year Built

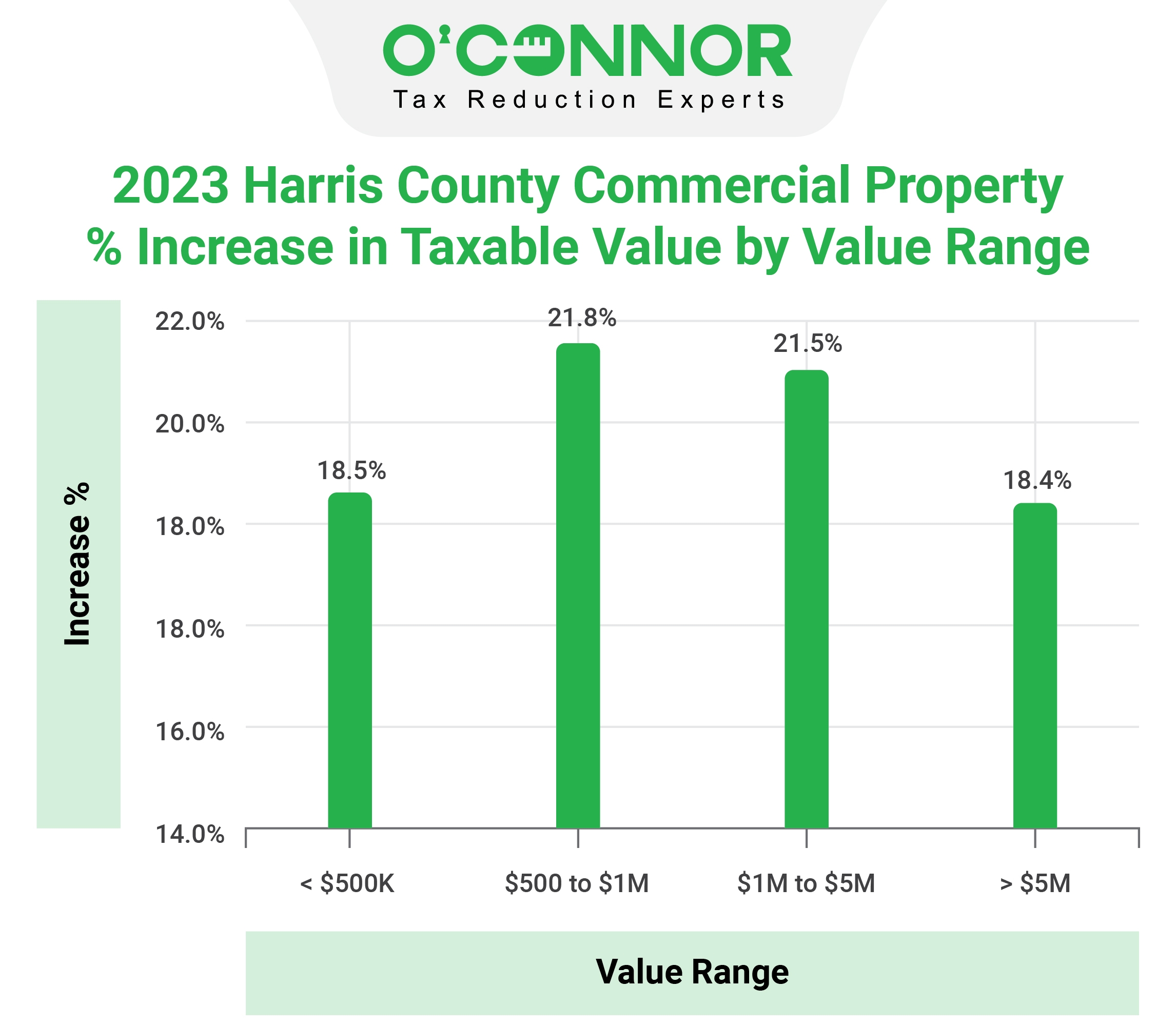

Harris County Commercial Property 2023 % Increase in Taxable Value by Value Range

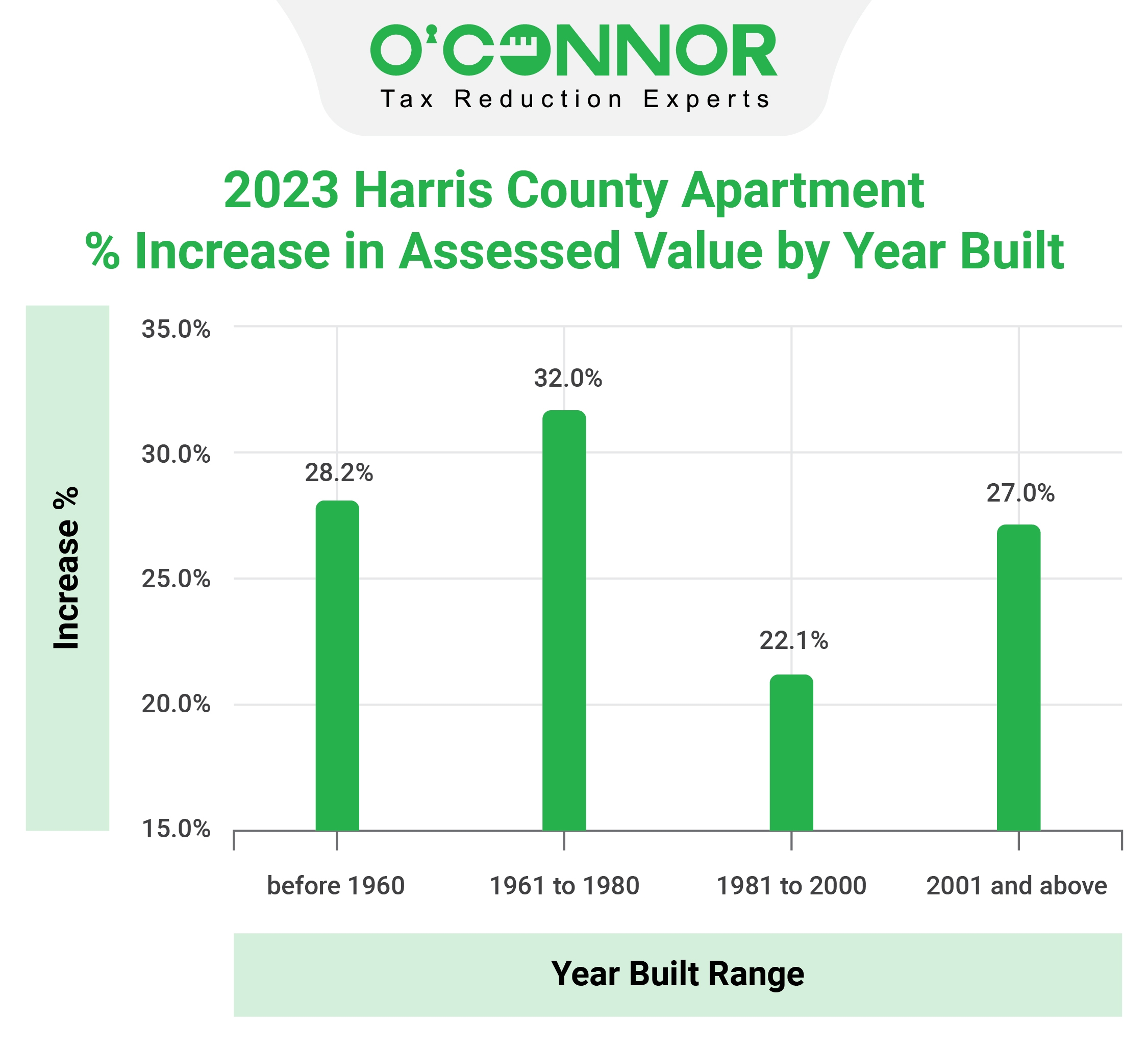

Harris County 2023 Apartment % Increase in Assessed Value by Year Built

Apartments of all vintages again saw staggering increases in assessed value while market values tumbled due to higher cap rates and operating expenses (insurance, labor and property taxes).

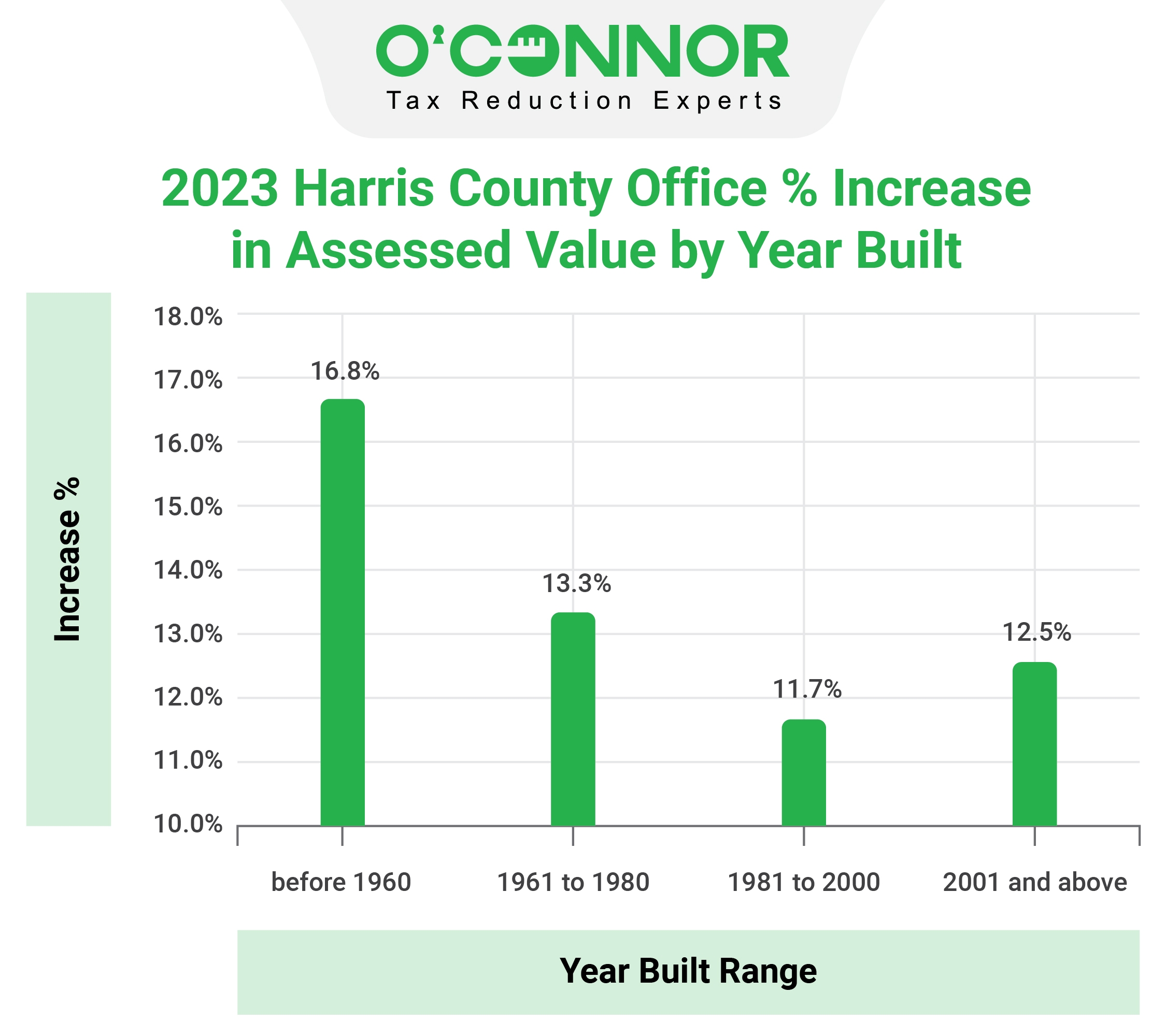

Harris County 2023 Office % Increase in Assessed Value by Year Built

Office buildings built prior to 1960 incurred the largest tax assessment increase in 2023 in Harris County.

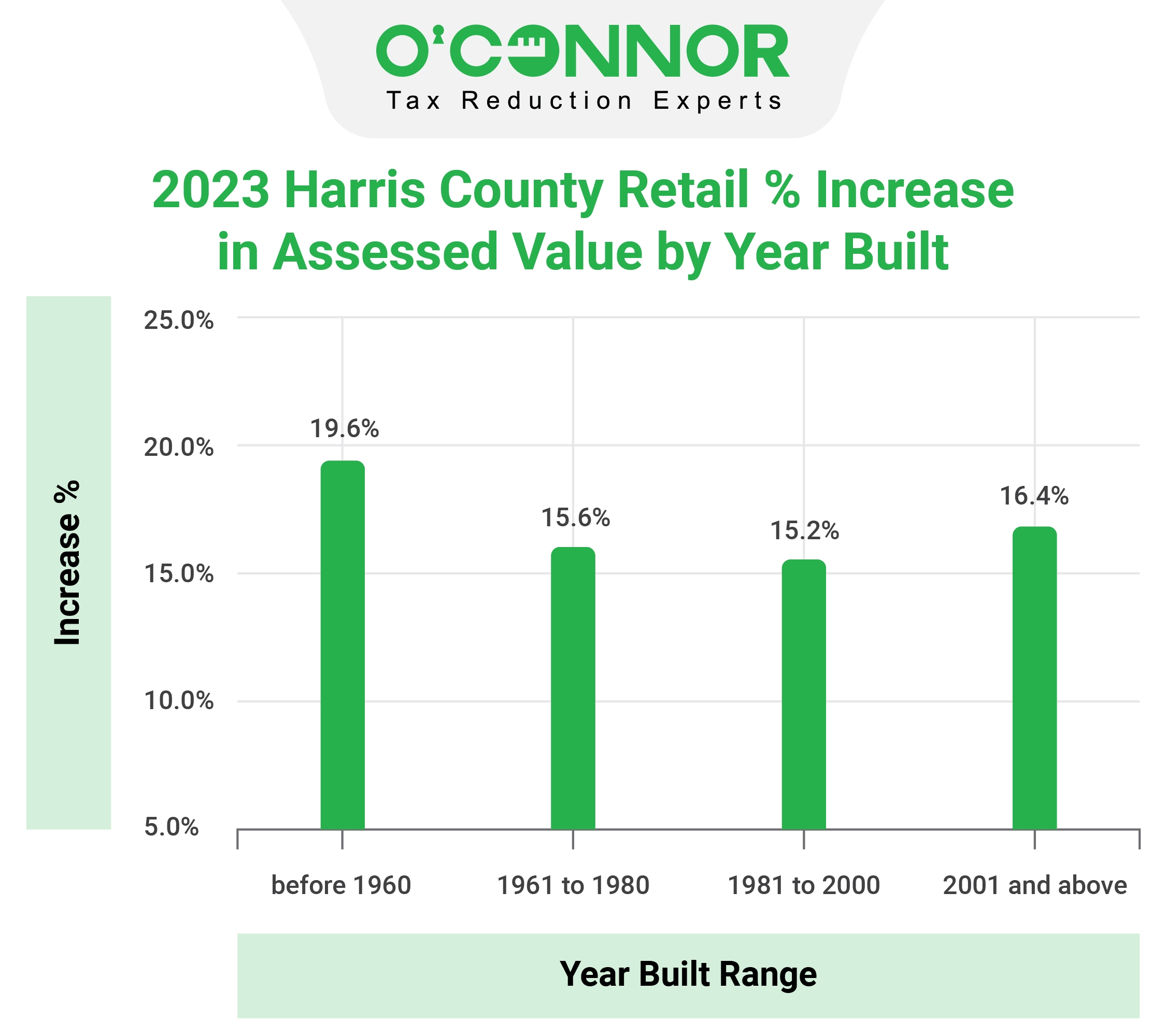

Harris County 2023 Retail % Increase in Assessed Value by Year Built

Retail property tax assessments rose consistently and considerably for all age brackets.

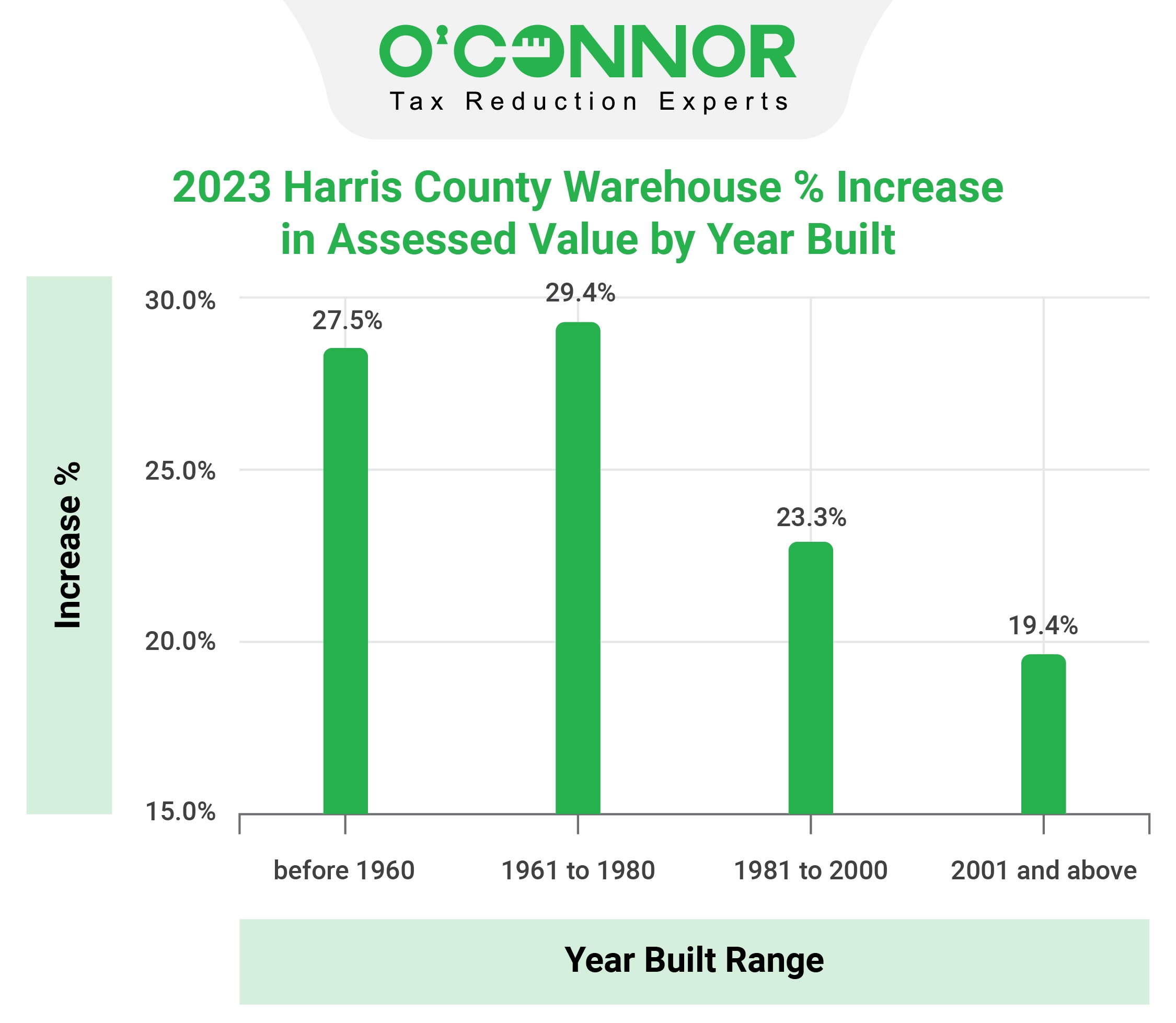

Harris County 2023 Warehouse % Increase in Assessed Value by Year Built

Warehouses built prior to 1980 had the largest increases in property tax assessments in Harris County.

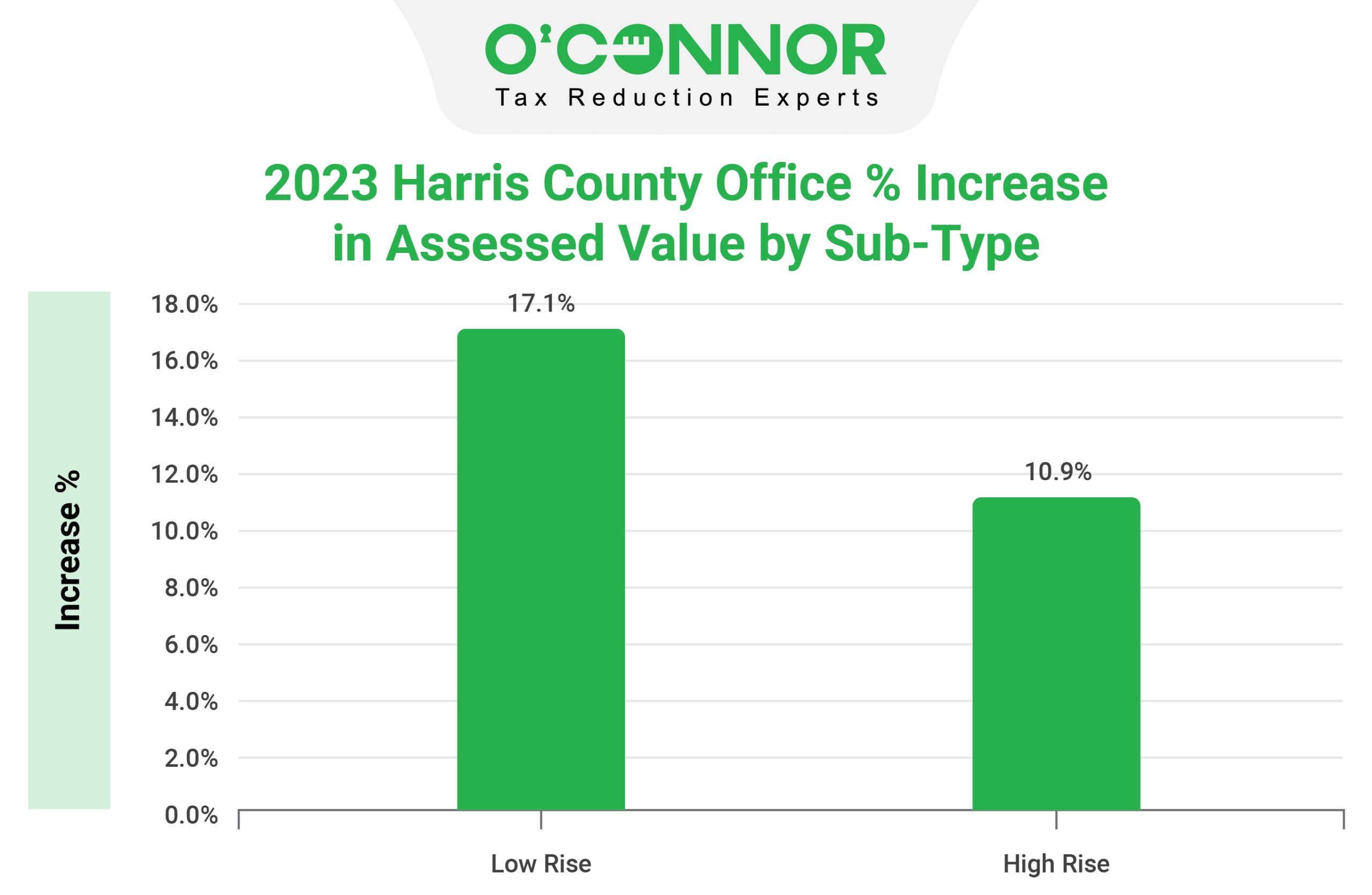

Harris County 2023 Office % Increase in Assessed Value by Sub-Type

Low-rise office buildings had property tax assessments of 17% versus 11% for high-rise office.

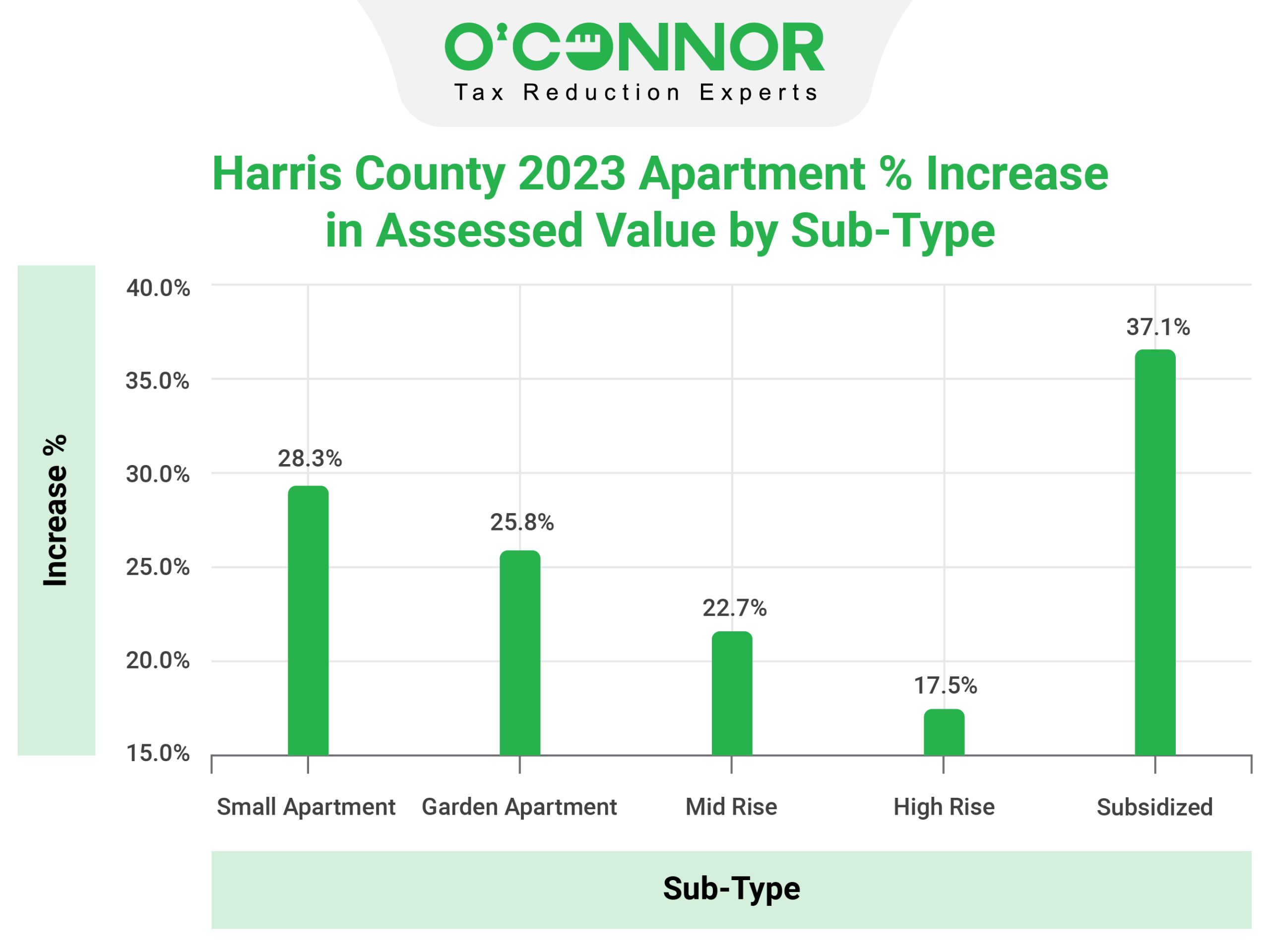

Harris County 2023 Apartment % Increase in Assessed Value by Sub-Type

Subsidized apartments had property tax assessment increases of 37% versus 17% for high-rise apartments in Harris County.

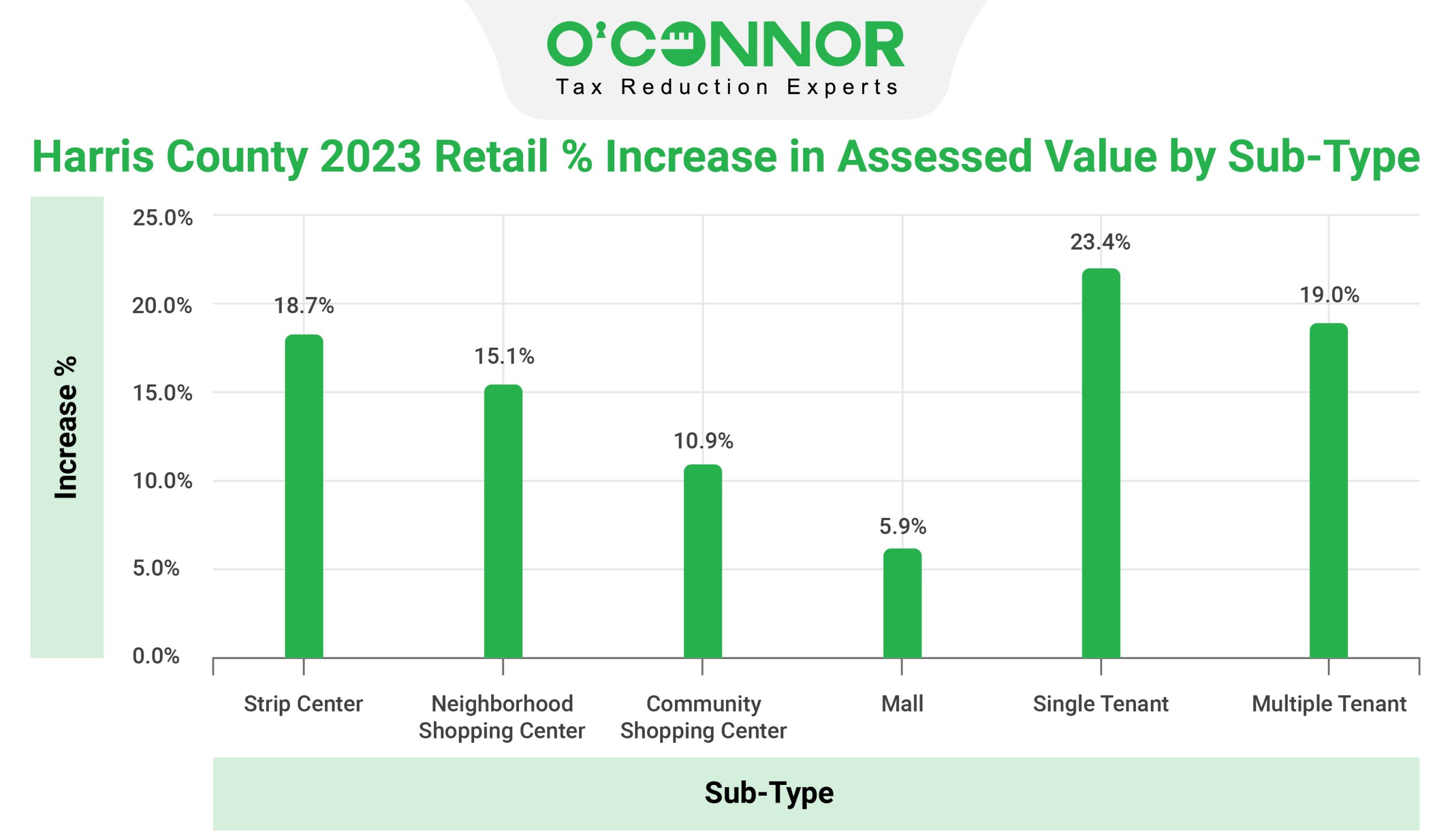

Harris County 2023 Retail % Increase in Assessed Value by Sub-Type

Single-tenant retail were socked with 23% increases in assessed value while tax assessments for malls in Harris County rose by 6%.

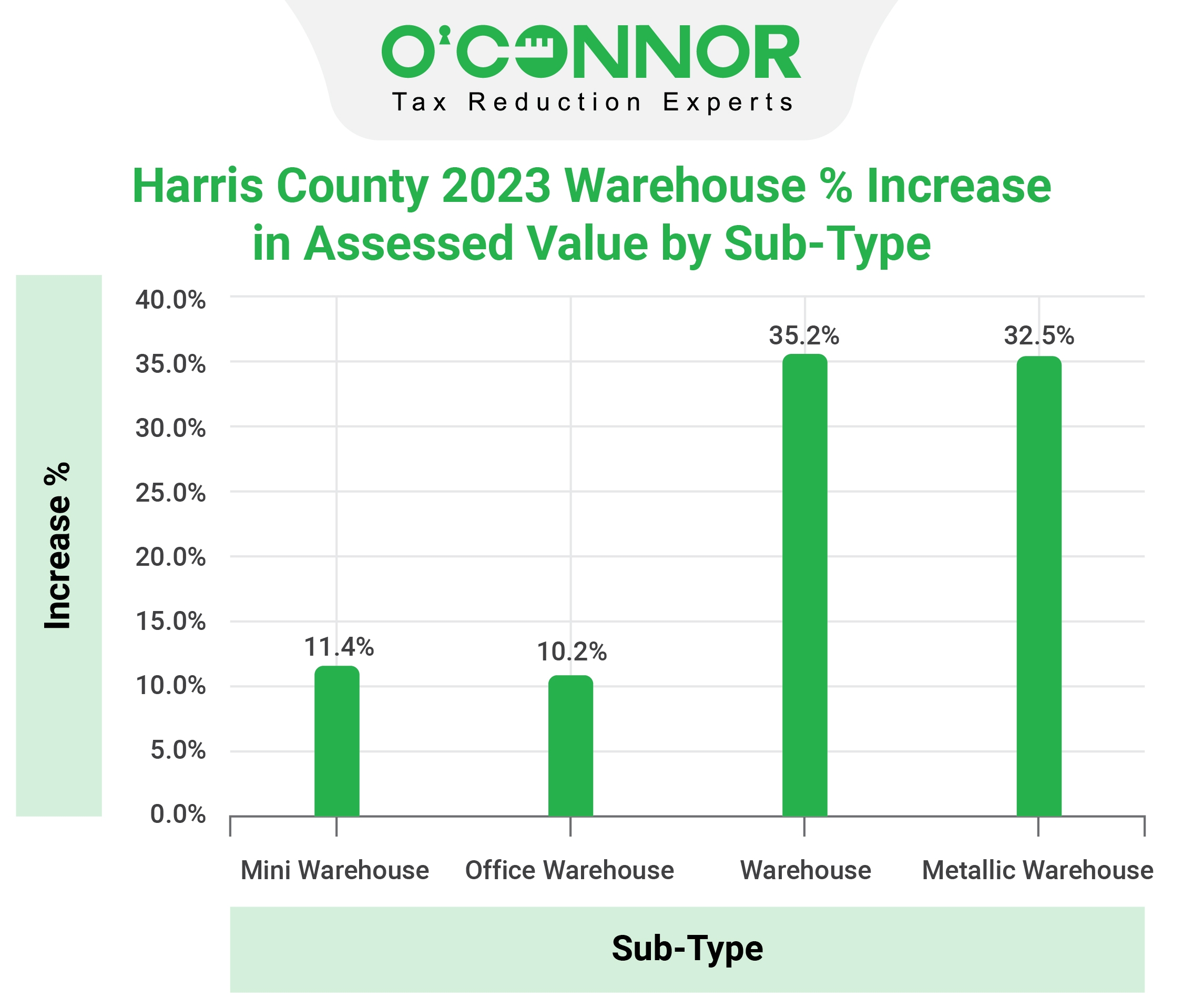

Harris County 2023 Warehouse % Increase in Assessed Value by Sub-Type

Masonry warehouse property tax assessments rose by an eye-popping 35% while values for office warehouse buildings in Harris County rose by 10%.

The deadline to file a property tax protest is May 15th. Record levels of property tax protests are expected to follow the massive increases in property tax assessment in Harris County.