Parmer County Appraisal District

Local Appraisal District

O’Connor is the leading company representative for the Parmer County Appraisal District property owners because:

- Enrolling in O’Connor’s Property Tax Protection Program™ takes just 2–3 minutes online.

- As part of our Property Tax Protection Program™, O’Connor provides personalized, concierge-style site visits to better serve our clients.

- We work on a contingency fee basis—you pay nothing unless we successfully reduce your property taxes. There are no upfront costs, enrollment fees, or hidden charges, even if your case goes to arbitration or judicial appeal.

- With years of experience, we’ve developed a comprehensive database of sales and unequal appraisal data tailored to the formats required by the Parmer County Appraisal District (CAD) and Parmer County Appraisal Review Board (ARB).

Parmer County Appraisal District

Local Appraisal District

Parmer County Appraisal District’s (CAD) formal and informal hearing results are displayed below:

- In Parmer County, property owners saved $410,000 in tax savings through informal hearings with the CAD and saved $20,000 in tax savings through formal hearings with the Appraisal Review Board (ARB). In 2023, Parmer County property owners protested the taxable value of 190 accounts.

- In Parmer County, just 1% of property tax appeals submitted to the Appraisal Review Board (ARB) were successful, while 11% of informal protests resulted in a favorable outcome.

- Through informal protests with the CAD, homeowners saved $30,000 in property taxes and commercial property owners saved $380,000 through formal protests.

- By 2023, 2% of properties in Parmer County had been protested, doubling from 1% in 2019.

Save With O’Connor

1,148

Average HCAD Tax Savings

Average Property Tax Savings from Protesting (Informal + Formal)

Residential Property

343

Commercial Property

1,966

Disclaimer: O’Connor is a property tax consultant and is not affiliated with any appraisal district. Data for graphs provided by Texas comptroller.

Single Family

Commercial / Other

Total

Disclaimer: O’Connor is a property tax consultant and is not affiliated with any appraisal district. Data for graphs provided by Texas comptroller.

Single Family

Commercial / Other

Total

2024 County Appraisal District Statistics

Select

Year

-

County:

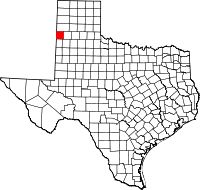

Parmer -

Street Address:

305 3rd St. Bovina, TX 79009-9999 -

Mailing Address:

P.O. Box 56 Bovina, TX 79009-0056 -

Phone:

806-251-1405

Major Cities:

Friona, Farwell, Bovina, Lazbuddie

Anderson County Texas totals 8 square miles, with a 2020 population of about 7,076. Adjacent counties include Henderson, Houston, Freestone, Cherokee, and Leon County. The total market value of real property and personal property in Anderson County in 2020 was $4,900,000,000. Anderson County 2020 property taxes are estimated to total $58,600,000 million based on an effective tax rate of 2.4% including homestead exemptions. Anderson County property owners protested the noticed value for 214 houses and 1,100 commercial and BPP properties. Anderson County Appraisal Review Board appeals were successful for 17.05% of the owners. Property owner property tax protests in Anderson County results in savings of $16,062,679 million in 2020, or $12,355 per account protested. The 2020 budget for Anderson was $1,200,000 including 13 employees.

Parmer Property Tax Values